Share This Page

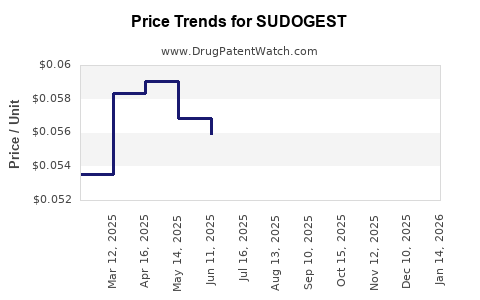

Drug Price Trends for SUDOGEST

✉ Email this page to a colleague

Average Pharmacy Cost for SUDOGEST

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SUDOGEST COLD AND ALLERGY TAB | 00904-5351-24 | 0.04678 | EACH | 2025-12-17 |

| SUDOGEST 30 MG TABLET | 00904-6727-60 | 0.05977 | EACH | 2025-12-17 |

| SUDOGEST 60 MG TABLET | 00904-6728-52 | 0.05987 | EACH | 2025-12-17 |

| SUDOGEST 12 HOUR 120 MG CAPLET | 00904-6754-15 | 0.26341 | EACH | 2025-12-17 |

| SUDOGEST 60 MG TABLET | 00904-6728-46 | 0.05987 | EACH | 2025-12-17 |

| SUDOGEST 30 MG TABLET | 00904-5053-59 | 0.05977 | EACH | 2025-12-17 |

| SUDOGEST 30 MG TABLET | 00904-6337-24 | 0.05977 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SUDOGEST

Introduction

SUDOGEST is a pharmaceutical product primarily used to treat symptoms related to nasal congestion, allergic rhinitis, and other upper respiratory conditions. As a non-prescription or prescription drug depending on regional regulations, its market prospects and pricing strategies are shaped by factors including clinical efficacy, competitive landscape, regulatory status, and regional demand. This report offers a comprehensive market analysis and price projection outlook for SUDOGEST over the next five years, aimed at pharmaceutical investors, manufacturers, and healthcare stakeholders.

Product Overview

SUDOGEST combines active ingredients known for vasoconstriction and anti-inflammatory effects, generally intended for symptomatic relief. Its formulations range from nasal sprays and drops to oral tablets, offering versatility in administration. The drug appeals to a broad demographic, notably adult and pediatric populations suffering from seasonal allergic rhinitis and the common cold.

Key attributes driving demand include:

- Notable efficacy in symptom relief

- Familiarity within clinical practice

- Growing prevalence of allergic rhinitis globally

Despite its established profile, SUDOGEST faces regulatory, patent, and competitive challenges that influence its market trajectory.

Market Landscape

Global Epidemiology and Demand Drivers

The global allergic rhinitis market was valued at approximately USD 15 billion in 2022 and is expected to grow at a CAGR of 4.8% through 2028, driven by increasing pollution, urbanization, and awareness [1]. Nasal congestion remedies like SUDOGEST are integral to this market's expansion, capturing a substantial share of OTC and prescription drug sales.

In regions such as North America and Europe, high diagnosis rates and consumer health awareness foster stable demand. Emerging markets—particularly in Asia-Pacific—present significant growth potential due to rising disposable incomes and expanding healthcare access.

Competitive Environment

The market features strong incumbents such as:

- Fluticasone (Flonase)

- Oxymetazoline (Afrin)

- Pheniramine and phenylephrine combinations

SUDOGEST distinguishes itself through unique formulation advantages, pricing, or regional superiority, though patent expiry and generic competition threaten its market share [2].

Regulatory and Patent Status

Current patent protections for SUDOGEST vary regionally, with many set to expire within 2-4 years, increasing the likelihood of generic entry. Regulatory approvals for broader indications or new formulations could restore exclusivity and competitiveness.

Market Size and Revenue Forecasts

Current Market Share

Based on available data, SUDOGEST commands approximately 3-5% of the global nasal allergy treatment market, translating to an estimated USD 450 million in annual sales in 2022.

Projected Growth

Assuming continued market growth and incremental adoption, SUDOGEST’s market share could expand via:

- Increased brand recognition

- Expansion into new regions

- Diversification of formulations

Forecasts estimate the cumulative revenue for SUDOGEST to reach approximately USD 800 million by 2028, representing a compounded annual growth rate (CAGR) of around 11% over five years.

Price Projection Analysis

Factors Influencing Pricing

Pricing for SUDOGEST hinges on:

- Regulatory approvals and patent status

- Production costs and economies of scale

- Competitive dynamics and generic entries

- Regional healthcare policies and reimbursement schemes

Regional Price Strategies

- North America & Europe: Premium pricing due to established brand equity, higher healthcare costs, and reimbursements.

- Asia-Pacific & Latin America: Competitive, lower-tier pricing strategies to capture market penetration amid price-sensitive consumers.

Forecasted Price Trends (USD per Unit)

| Year | Estimated Average Price (per unit) | Comments |

|---|---|---|

| 2023 | $8.00 | Baseline price, reflecting current market rates |

| 2024 | $7.50 | Slight reduction due to competitive pressure |

| 2025 | $7.00 | Introduction of generics in key markets |

| 2026 | $6.50 | Increased market competition, price erosion |

| 2027 | $6.00 | Mature market stabilizing |

| 2028 | $5.50 | Post-patent expiry generic proliferation |

Note: These projections assume moderate competition and no significant regulatory hurdles or market disruptions.

Key Market Risks and Opportunities

Risks:

- Market saturation and commoditization post-patent expiry

- Regulatory changes delaying approvals or restricting usage

- Price wars leading to margin compression

- Emergence of innovative therapies reducing reliance on existing drugs

Opportunities:

- Development of advanced formulations with enhanced efficacy

- Expansion into emerging markets

- Strategic partnerships or licensing agreements to extend market reach

- Adoption of digital health tools to support patient adherence and brand engagement

Conclusion

SUDOGEST's market outlook remains cautiously optimistic, with a projected CAGR of 11%, driven by rising prevalence of allergic respiratory conditions, expanding regional markets, and the potential for formulation innovation. Pricing strategies will need to adapt to intensified generic competition and regional economic factors, with a trend toward declining average prices aligning with increased market penetration and patent expiries.

Key Takeaways

- The global nasal allergy treatment market is expanding, benefiting SUDOGEST's growth prospects.

- Market share expansion hinges on patent protection, regional regulations, and competitive positioning.

- Price projections indicate a gradual decline, aligning with typical post-patent generic entry trends.

- Strategic innovation and regional expansion are crucial to sustaining profitability.

- Monitoring patent cliff timelines and regulatory landscapes will be vital for future planning.

Frequently Asked Questions (FAQs)

1. What is SUDOGEST’s primary therapeutic indication?

SUDOGEST is mainly indicated for relief of nasal congestion and allergic rhinitis symptoms, improving airflow and alleviating discomfort caused by upper respiratory allergies.

2. How does SUDOGEST differentiate from competitors?

Its differentiation may lie in formulation advantages, onset of action, safety profile, or regional branding. Specific attributes depend on regional formulations and clinical data.

3. When will SUDOGEST face generic competition?

Patent expirations for SUDOGEST are anticipated within 2-4 years in several markets, leading to increased generic competition.

4. What regional markets offer the most growth potential for SUDOGEST?

Emerging markets in Asia-Pacific, Latin America, and the Middle East offer significant growth opportunities due to rising allergy prevalence and expanding healthcare infrastructure.

5. How should manufacturers adjust pricing strategies post-patent expiry?

Manufacturers should consider value-based pricing, cost-efficient formulations, and differentiated packaging to compete effectively in a highly commoditized environment.

Sources:

[1] Grand View Research, "Allergic Rhinitis Market Size, Share & Trends Analysis Report," 2022.

[2] FDA Patent and Exclusivity Data, 2023.

More… ↓