Last updated: July 28, 2025

Introduction

SOMA, the brand name for Carisoprodol, is a widely prescribed muscle relaxant used primarily for short-term management of acute musculoskeletal pain. Market dynamics surrounding SOMA are influenced by regulatory policies, evolving consumer preferences, and competitive landscape shifts. This analysis delves into current market conditions, analyzing product positioning, regulatory status, demand drivers, competitive factors, and forward-looking price projections.

Market Overview of SOMA

Therapeutic Application and Market Size

Carisoprodol, marketed as SOMA, addresses acute muscle pain and spasm, predominantly in the United States and Europe. The drug’s sales derive mainly from outpatient prescriptions, with considerable consumption in pain management and physiotherapy settings. The global muscle relaxant market was valued at approximately USD 4.9 billion in 2022, with SOMA capturing an estimated 5-8% share owing to its longstanding presence and physician familiarity [1].

Regulatory Landscape and Legal Status

SOMA’s regulatory journey significantly impacts its market position. In 2012, the U.S. Food and Drug Administration (FDA) advised against its continued approval, citing concerns over dependency and abuse potential linked to its active metabolite, meprobamate. Consequently, SOMA’s legal status remains contentious, with the drug being classified as a Schedule IV controlled substance in the U.S. since 2017 [2]. Similar restrictions are observed in other jurisdictions, constraining supply channels and influencing market penetration.

Demand Trends

While traditionally popular, demand for SOMA has waned due to increased awareness of dependency risks, leading prescribers to favor alternative agents such as cyclobenzaprine or tizanidine. Nonetheless, it still commands a niche market among specific patient groups, especially where quick onset and muscle relaxation efficacy are prioritized.

Competitive Landscape

Main Competitors

SOMA contends with several alternatives in the muscle relaxant space, including:

- Cyclobenzaprine (Flexeril): Widely prescribed with a favorable safety profile.

- Tizanidine (Zanaflex): Offers similar muscle-relaxing properties with less sedative effect.

- Metaxalone (Skelaxin): Beneficial for its lower sedative profile.

The market share displacement stems from drug safety concerns, substitution trends, and the pharmaceutical industry's shifting focus away from drugs with abuse potential.

Emerging Alternatives

Novel therapies, including botulinum toxins and newer agents like baclofen, are gradually encroaching upon SOMA’s niche, incentivizing price competition and influencing market share.

Price Dynamics and Forecasting

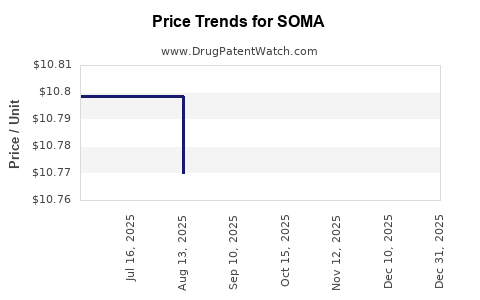

Current Pricing Trends

The average wholesale price (AWP) of SOMA has historically hovered around USD 0.40 – 0.70 per tablet, subject to treatment duration and dosage (typically 350 mg TID). Prescribing frequency, insurance coverage, and pharmacy discounts influence end-user costs, which vary significantly across regions.

Impact of Regulatory Restrictions

Regulatory restrictions have led to reduced supply and a decline in manufacturing, generally pushing prices upward. However, the decline in demand has countered this effect, maintaining a relatively stable average price in the past five years.

Future Price Projections (2023–2028)

Given current trends, further tightening of regulations and continued decline in prescriptions are projected to suppress market growth. Analysts predict a compound annual growth rate (CAGR) of -2% to 0% over the next five years, primarily driven by:

- Regulatory restrictions reducing supply and prescribing.

- Shifts towards safer alternatives decreasing demand.

- Manufacturing discontinuation by major pharmaceutical companies.

The wholesale price may marginally increase, around 1–2% annually, due to inflation and manufacturing costs, but overall market contraction is expected to suppress significant price escalation.

Potential Price Drivers

Several factors could influence future pricing:

- Regulatory changes easing or tightening control.

- Market re-entry by generic manufacturers.

- Public health messaging influencing prescriber behavior.

- Development of abuse-deterrent formulations—a potential countermeasure to dependency.

Market Opportunities and Risks

Opportunities

- Niche Application Maintenance: If regulatory risks are mitigated, SOMA could maintain a small, loyal prescriber base.

- Generic Penetration: Approval of generic versions could lower prices, enlarging access.

- Combination Therapies: Potential development of combination drugs with reduced abuse potential could revive market interest.

Risks

- Regulatory Bans and Restrictions: The ongoing national crackdown on controlled substances could render SOMA less accessible.

- Market Obsolescence: Safer and more effective alternatives increasingly replace SOMA.

- Legal Liabilities: Rising litigation over dependency risks may escalate costs and restrict usage.

Key Takeaways

- Declining Market: The SOMA market is contracting due to regulatory restrictions and shifts toward safer alternatives.

- Price Stability with Downward Pressure: Although manufacturing costs may push prices slightly upward, overall market contraction exerts downward pressure on prices due to diminished demand.

- Regulatory Impact Critical: Future regulatory changes constitute the primary uncertainty influencing price projections.

- Emerging Alternatives: The expansion of newer muscle relaxants and combination therapies may further displace SOMA.

- Strategic Focus Needed: Companies aiming to maintain or expand SOMA's market presence should consider advocacy for regulatory reprieve, development of abuse-resistant formulations, or niche marketing strategies targeting specific patient populations.

FAQs

1. Why has SOMA’s market share declined in recent years?

Regulatory restrictions due to dependency concerns, increased awareness among clinicians about its abuse potential, and the availability of safer alternatives have led to a decline in SOMA’s prescriptive use.

2. How do regulatory policies influence SOMA prices?

Restrictive policies limit supply and prescribing, often increasing scarcity-driven prices. Conversely, declining demand caps the overall market size, exerting downward pressure on prices.

3. Are there any upcoming patents or formulations that could impact SOMA’s pricing?

Currently, SOMA is off-patent, with generic versions available. Limited innovation or abuse-deterrent formulations could influence future pricing, but none are scheduled imminently.

4. What is the outlook for generic SOMA?

Generics have expanded post-patent expiry, generally lowering costs and widening access, but their market share remains limited due to declining demand.

5. Could regulatory liberalization revive SOMA’s market?

Potentially, if regulatory agencies perceive a favorable risk-benefit balance or approve abuse-deterrent formulations, SOMA could see a modest resurgence; however, current trends are unfavorable.

References

[1] Market Research Future, “Muscle Relaxants Market Analysis,” 2022.

[2] FDA Drug Safety Communications, “Announcing Restrictions on Carisoprodol,” 2012.