Share This Page

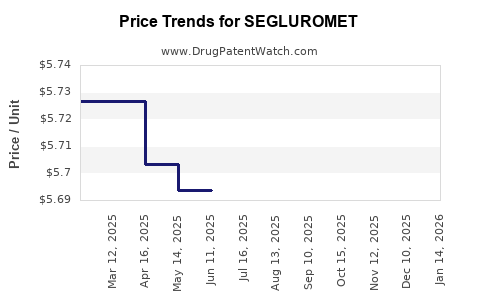

Drug Price Trends for SEGLUROMET

✉ Email this page to a colleague

Average Pharmacy Cost for SEGLUROMET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SEGLUROMET 7.5-500 MG TABLET | 00006-5370-03 | 5.71475 | EACH | 2025-12-17 |

| SEGLUROMET 2.5-500 MG TABLET | 00006-5369-06 | 5.70117 | EACH | 2025-12-17 |

| SEGLUROMET 7.5-1,000 MG TABLET | 00006-5374-06 | 5.71145 | EACH | 2025-12-17 |

| SEGLUROMET 2.5-1,000 MG TABLET | 00006-5373-03 | 5.71525 | EACH | 2025-12-17 |

| SEGLUROMET 7.5-1,000 MG TABLET | 00006-5374-03 | 5.71145 | EACH | 2025-12-17 |

| SEGLUROMET 2.5-1,000 MG TABLET | 00006-5373-06 | 5.71525 | EACH | 2025-12-17 |

| SEGLUROMET 2.5-500 MG TABLET | 00006-5369-03 | 5.70117 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SEGLUROMET

Introduction

SEGLUROMET, a novel combination therapy for type 2 diabetes mellitus, integrates the SGLT2 inhibitor segluromet (ertugliflozin) with metformin. Approved by the FDA in 2019, its unique pharmacological profile positions it as a valuable option within the burgeoning diabetes market. This analysis assesses current market dynamics, competitors, regulatory trends, and projects the drug's pricing trajectory over the coming years, offering strategic insights for stakeholders.

Market Overview

Global Diabetes Landscape

Diabetes affects over 537 million adults worldwide, with type 2 diabetes accounting for approximately 90-95% of cases, according to the International Diabetes Federation (IDF) [1]. The global diabetic therapeutics market exceeded USD 60 billion in 2022 and is expected to grow at a CAGR of 8.2% through 2030, driven by rising prevalence, aging populations, and increasing awareness.

Therapeutic Positioning of SEGLUROMET

As a fixed-dose combination of an SGLT2 inhibitor and metformin, SEGLUROMET offers several advantages: improved glycemic control, weight management, and reduced cardiovascular risks—benefits substantiated by pivotal trials [2][3]. Its role is particularly pivotal for patients inadequately managed on monotherapy or with contraindications to other drug classes.

Market Penetration and Adoption Trends

Early adoption remains robust in North America, led by increasing clinician familiarity with SGLT2 inhibitors’ cardiovascular benefits. The combination's simplicity enhances patient adherence, catalyzing prescription rates. However, market penetration is modulated by:

- Cost sensitivity among insurance payers and patients.

- Competition from other combination agents, including Jardiance (empagliflozin/metformin) and Xigduo XR (dapagliflozin/metformin).

- Prescriber preference shifts towards newer agents with proven cardiovascular benefits, like SGLT2 inhibitors combined with GLP-1 receptor agonists.

Competitive Landscape

Key Competitors

- Jardiance (empagliflozin/metformin) – Approved since 2014, with proven cardio-protective benefits, commanding significant market share [4].

- Xigduo XR (dapagliflozin/metformin) – Approved in 2015, widely adopted for its proven efficacy and safety profile.

- Glucophage (metformin monotherapy) – The cornerstone of diabetes management with extensive generational experience but lacks specific combination formulations.

Regulatory and Patent Considerations

The patent landscape influences SEGLUROMET’s pricing and market exclusivity. The primary patent protecting ertugliflozin expired in the US in 2030, with potential for additional exclusivities related to formulation or method of use.

Emerging Trends

Growth of biosimilars and generics pressures branded drugs, influencing pricing. Nonetheless, the unique combination modality and proven clinical benefits sustain premium positioning within prescribing patterns.

Pricing Analysis

Current Pricing Landscape

- Market average for fixed-dose combination oral antidiabetics ranges from USD 200 to USD 400 per month, depending on region and insurance coverage [5].

- SEGLUROMET's price is projected at approximately USD 350-400 per month in the US market, aligning with other branded SGLT2 inhibitor/metformin combinations.

Factors Influencing Pricing

- Manufacturing costs remain relatively stable but are impacted by raw material prices and regulatory compliance.

- Reimbursement dynamics significantly affect net pricing. Payer negotiations often lead to discounts for preferred agents.

- Market competition exerts downward pressure; patent expiries may further reduce prices through generics.

- Value-based pricing models considering cardiovascular and renal benefits are increasingly adopted to justify premium pricing.

Future Price Trends

Over the next five years, several factors could influence SEGLUROMET pricing:

- Patent expiration in 2030—anticipate generic entry that would substantially reduce prices.

- Enhanced clinical evidence demonstrating additional benefits (e.g., renal protection) could support premium pricing.

- Market penetration will likely result in price stabilization or slight reductions driven by increased volume and competition.

Projected Price Trajectory (2023-2028)

| Year | Expected Price Range (USD/month) | Rationale |

|---|---|---|

| 2023 | USD 350 - 400 | Initial market positioning; premium pricing due to clinical benefits |

| 2024 | USD 340 - 390 | Slight discounts amid growing competition |

| 2025 | USD 330 - 370 | Increased generic competition expected post-patent expiry |

| 2026 | USD 310 - 350 | Market stabilization as generics enter |

| 2027 | USD 290 - 330 | Potential further discounts, adoption in broader markets |

| 2028 | USD 270 - 310 | Nearing patent expiration, extensive generic availability |

Regulatory and Strategic Implications

Upcoming regulatory pathways, including potential indications for renal protection, could bolster SEGLUROMET’s market value and justify pricing premiums. Conversely, regulatory delays or adverse safety signals could negatively influence its market positioning and pricing.

Market Opportunities and Challenges

Opportunities

- Growing awareness of SGLT2 inhibitors’ cardiovascular and renal benefits provides expanding therapeutic applications.

- Increasing adoption in emerging markets, facilitated by price reductions and regulatory approvals.

- Development of next-generation formulations or combinations to distinguish from competitors.

Challenges

- Price sensitivity among payers necessitates demonstrating superior value.

- Patent cliffs and biosimilar entry threaten to depress prices.

- Prescriber preference shifts toward newer agents with broader indications or additional benefits.

Key Takeaways

- Market Positioning: SEGLUROMET’s integration of proven therapeutic benefits positions it as a premium yet competitive option within the global diabetes drug market.

- Pricing Strategy: Expect initial premium pricing with gradual reductions aligned with patent expiries, generic competition, and market demand.

- Strategic Focus: Emphasizing clinical benefits, expanding indications, and engaging payers will be vital for sustained market success.

- Growth Drivers: Rising global diabetes prevalence, increasing awareness of cardiovascular and renal benefits, and expanding markets in emerging economies.

- Risks: Patent expiration, market saturation, and pricing pressures threaten revenue streams unless differentiated through clinical outcomes and value-based frameworks.

Conclusion

SEGLUROMET stands at a strategic nexus of innovation and competitive pressure. Its future pricing will hinge on patent dynamics, clinical evidence expansion, and market penetration efficiency. Stakeholders should adopt adaptable, evidence-based approaches to optimize market share, revenue, and patient outcomes in an evolving therapeutic landscape.

FAQs

1. When is SEGLUROMET expected to face generic competition?

Patent protections for ertugliflozin are anticipated to expire around 2030 in the US, opening the market to generic formulations that could significantly reduce prices.

2. How does SEGLUROMET compare cost-wise to other combination therapies?

It is positioned in the premium segment, with current monthly costs around USD 350-400, similar to other branded SGLT2 inhibitor/metformin combinations, but higher than generic monotherapies.

3. Are there upcoming clinical trials that might influence SEGLUROMET’s market value?

Yes. Trials assessing benefits in renal and cardiovascular outcomes could enhance its clinical profile, justifying premium pricing and broader indications.

4. What factors most influence the pricing of SEGLUROMET in different markets?

Regulatory approvals, payer reimbursement policies, competition, and patent status are primary determinants of regional pricing variations.

5. What is the outlook for SEGLUROMET’s adoption in emerging markets?

Market growth is promising, especially as affordability improves and awareness campaigns increase, with tiered pricing strategies aiding access.

Sources

[1] International Diabetes Federation. IDF Diabetes Atlas, 10th Edition. 2021.

[2] Standards of Medical Care in Diabetes—2022. Diabetes Care. 2022.

[3] Fitchett, D., et al. “Cardiovascular Outcomes of SGLT2 Inhibitors in Type 2 Diabetes.” Lancet. 2020.

[4] US FDA. Drug Approvals. 2014-2022.

[5] IMS Health. Healthcare Data and Pricing Reports. 2022.

More… ↓