Last updated: July 27, 2025

Introduction

Ropinirole hydrochloride (HCl) is a dopamine agonist primarily prescribed for Parkinson’s disease and restless legs syndrome (RLS). Market dynamics surrounding Ropinirole HCl are influenced by the aging global population, evolving therapeutic guidelines, patent statuses, generic entry, and competitive landscape shifts. This analysis evaluates the current market environment, future price projections, and strategic considerations relevant for stakeholders.

Market Overview

Therapeutic Indications and Market Size

Ropinirole HCl primarily addresses two indications:

- Parkinson’s Disease: An increasingly prevalent neurodegenerative disorder impacting approximately 10 million people globally, with prevalence rising due to aging populations.

- Restless Legs Syndrome (RLS): A common neurological disorder affecting around 7-10% of the adult population in Western countries.

The combined market for dopamine agonists, including Ropinirole, is projected to reach USD 2.5 billion by 2025, driven by rising diagnosis rates, expanded approval for broader age groups, and new formulations (e.g., controlled-release versions).

Key Market Participants

- Original Developers: GlaxoSmithKline (brand name Requip), approved in the early 1990s.

- Generics Manufacturers: Numerous companies globally, as patent exclusivity has largely expired in multiple jurisdictions.

- Emerging Competitors: Dopamine agonists like pramipexole and rotigotine, offering either alternative efficacy or convenience.

Regulatory and Patent Landscape

GSK's patent for Ropinirole expired in most major markets by the late 2000s and early 2010s, triggering widespread generic entry. Depending on jurisdiction, patent cliffs have led to significant price erosion, with some markets seeing reductions exceeding 80%. Ongoing patent protections for formulation-specific features or combination products are limited.

Market Dynamics and Trends

Growth Drivers

- Aging Demographics: Increased incidence of Parkinson's and RLS in senior populations.

- Prescribing Trends: Preference for oral dopamine agonists in early and mid-stage Parkinson's therapy.

- Expanded Indications: Off-label use and potential for combination therapies enhance demand prospects.

Challenges

- Generic Competition: Intense price competition from multiple generics has dramatically lowered retail and hospital prices.

- Side Effect Profile: Adverse effects (e.g., impulse control disorders, somnolence) influence patient adherence, affecting overall market size.

- Regulatory Changes: Evolving prescribing guidelines and approval of newer agents may marginalize Ropinirole's market share.

Market Segments

- Brand vs. Generic: Post-patent expiry, generic versions dominate, accounting for over 80% market share in many regions.

- Formulation Variations: Immediate-release (IR) versus controlled-release (CR), with the latter offering improved convenience but often at a premium.

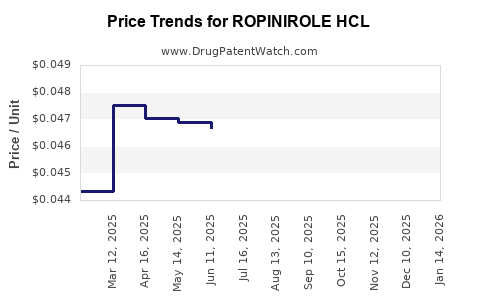

Price Trends and Projections

Historical Price Trajectory

Following patent expiration, Ropinirole prices have seen a steep decline:

- Original Brand (Requip): Peak prices ranged from USD 10-15 per tablet in the US, with annual treatment costs exceeding USD 3,600 for brand-name.

- Generics: Market entry in the late 2000s led to price drops of approximately 70-80%, with generic prices decreasing to USD 2-4 per tablet.

Current Pricing Spectrum

- United States: USD 2-4 per tablet for generics, depending on quantity and pharmacy discounts.

- Europe: Similar trends, with some variation based on country-specific reimbursement policies.

- Emerging Markets: Prices often lower due to local manufacturing and procurement policies.

Future Price Projections (2023-2030)

Given the current landscape, the following projections are reasonable:

- Stable Low Pricing: Since high market penetration of generics already occurred, prices are likely to stabilize with minimal further decline.

- Impact of Biosimilar and Competitor Entry: Limited, as biosimilars are not applicable, but newer dopamine agonists could exert market cannibalization.

- Formulation Innovations: Novel delivery systems or combination therapies could command slightly premium pricing, but their impact on Ropinirole’s core pricing is expected to be modest.

In essence, average generic prices are projected to hover around USD 1.5-3 per tablet by 2030, with some variability depending on developments in healthcare policies and market competition.

Strategic Market Considerations

Potential for Premiumization

Limited, due to the availability of cost-effective generics. However, niche markets such as pediatric formulations or once-daily CR formulations might sustain higher prices.

Impact of New Therapeutics

Emerging treatments like rotigotine transdermal patches or levodopa/carbidopa combinations could influence Ropinirole’s market share but are unlikely to drastically alter its price trajectory due to differentiation factors.

Global Market Expansion

Emerging markets present growth opportunities, with local manufacturing driving down prices further. However, regulatory hurdles and reimbursement policies are key considerations.

Conclusion

The Ropinirole HCl market is predominantly a mature, heavily commoditized environment characterized by aggressive generic competition and low price volatility. While the therapeutic demand remains stable owing to the aging population and expanding indications, future price erosion is expected to plateau. Stakeholders should focus on optimizing manufacturing efficiencies, exploring niche formulations, and strategic market positioning to sustain profitability.

Key Takeaways

- Market maturity and patent expiries have led to significant price declines, with current generic prices stable around USD 1.5-3 per tablet.

- The global Parkinson’s and RLS markets are expanding, but price competition constrains profit margins.

- Innovative formulations or combination therapies could offer limited premium pricing but are unlikely to reverse downward price trends substantially.

- Emerging markets provide growth opportunities, but regulatory and reimbursement landscapes are critical determinants.

- Maintaining market share in a commoditized environment necessitates strategic manufacturing, cost control, and potential niche product development.

FAQs

1. What factors have most impacted Ropinirole HCl pricing post-patent expiry?

Generics entering the market, increased competition, and policy-driven price controls have driven prices down, stabilizing at low levels in most jurisdictions.

2. Are there upcoming formulations of Ropinirole that could command higher prices?

Potentially, controlled-release formulations or combination products could warrant marginally higher prices, but their impact is limited due to existing generic competition.

3. How does the competitive landscape influence future pricing strategies?

Intense generic competition constrains pricing power; manufacturers must focus on cost efficiencies, niche markets, or differentiation to maintain margins.

4. In which markets is Ropinirole HCl most cost-effective?

Emerging markets often offer lower prices due to local manufacturing and procurement policies, though quality and regulatory standards vary.

5. What are the prospects for Ropinirole HCl in the context of newer dopamine agonists?

While newer agents might capture some share, Ropinirole remains a cost-effective option, especially in resource-limited settings, sustaining its relevance over the forecast period.

Sources

[1] GlobalData, "Dopamine Agonists Market Outlook," 2022.

[2] IQVIA, "Pharmaceutical Pricing and Market Data," 2022.

[3] U.S. Food & Drug Administration, "Approved Drugs Database," 2022.

[4] World Health Organization, "Global Burden of Parkinson’s Disease," 2021.

[5] FDA and EMA regulatory updates on patent and exclusivity statuses, 2023.