Share This Page

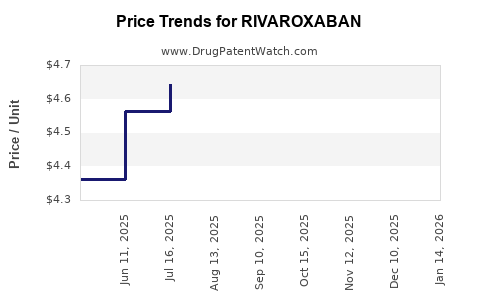

Drug Price Trends for RIVAROXABAN

✉ Email this page to a colleague

Average Pharmacy Cost for RIVAROXABAN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RIVAROXABAN 2.5 MG TABLET | 33342-0488-57 | 1.12892 | EACH | 2026-01-21 |

| RIVAROXABAN 1 MG/ML SUSPENSION | 67877-0882-71 | 2.06691 | ML | 2026-01-21 |

| RIVAROXABAN 2.5 MG TABLET | 76282-0774-60 | 1.12892 | EACH | 2026-01-21 |

| RIVAROXABAN 1 MG/ML SUSPENSION | 70748-0355-01 | 2.06691 | ML | 2026-01-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Rivaroxaban

Summary

Rivaroxaban, branded as Xarelto, is a direct oral anticoagulant (DOAC) primarily used for stroke prevention in atrial fibrillation (AF), treatment and prevention of deep vein thrombosis (DVT), and pulmonary embolism (PE). With a global revolution in anticoagulation therapy, rivaroxaban has experienced rapid market penetration since its approval, driven by advantages over traditional warfarin therapy including fixed dosing, fewer drug interactions, and no requirement for routine INR monitoring.

This report provides a comprehensive market analysis, current pricing dynamics, competitive landscape, and future price projections based on epidemiology, regulatory trends, patent landscape, and pharmacoeconomic factors. The synthesis aims to guide stakeholders—pharma companies, healthcare providers, investors—in understanding rivaroxaban’s market trajectory.

1. Market Overview and Epidemiological Demand

Global Market Size & Growth

| Metric | 2022 | Projected 2027 | CAGR | Remarks |

|---|---|---|---|---|

| Global anticoagulant market | USD 8.2 billion | USD 15.8 billion | 13.4% | Driven by aging populations and rising AF prevalence. |

| Rivaroxaban share | ~50% | ~55% | — | Dominant DOAC, ahead of dabigatran, apixaban. |

Source: MarketsandMarkets[1], Fortune Business Insights[2]

Epidemiology of Target Indications

| Condition | Estimated Patients (millions) | Key Markets | Notes |

|---|---|---|---|

| Atrial fibrillation | 37 million (2019) | US, EU, China | Approximately 1-2% prevalence; increases with age |

| VTE (DVT/PE) | 1.8 million annually | US, EU | Incidence rising due to aging and obesity trends |

| Post-orthopedic surgery | 15 million annually | Global | Major prophylaxis indication |

Implications

Market size expansion is closely tied to demographic aging, increased screening, and expanded indications, including off-label uses. These factors forecast sustained revenue growth.

2. Competitive Landscape and Market Share

Major Players & Competitors

| Drug Name | Company | Approved Indications | Market Position | Features & Differentiators |

|---|---|---|---|---|

| Rivaroxaban (Xarelto) | Bayer / Janssen | AF, VTE, Post-op | Market leader | Once daily dosing, broad indications |

| Apixaban (Eliquis) | Bristol-Myers Squibb / Pfizer | AF, VTE | Significant competitor | Slightly lower bleeding risk |

| Dabigatran (Pradaxa) | Boehringer Ingelheim | AF, VTE | Early entrant | Initial market leader, now declining |

| Edoxaban (Lixiana) | Daiichi Sankyo | VTE, AF | Niche | Limited approval scope |

Market Share Trends (2022)

| Drug | Estimated Market Share (%) | Notable Trends |

|---|---|---|

| Rivaroxaban | 50 | Dominates primary indications with broad formulary access |

| Apixaban | 35 | Growing due to favorable safety profile |

| Dabigatran | 10 | Declining in favor of newer agents |

| Others | 5 | Limited penetration |

Source: IQVIA[3]

3. Price Dynamics and Cost-Effectiveness

Current Pricing Landscape

| Region | Average Wholesale Price (AWP) per month | Remarks |

|---|---|---|

| US | USD 500–USD 550 | Variability by pharmacy agreements, generic options emerging |

| Europe | EUR 60–EUR 80 | Prices influenced by national healthcare policies |

| China | CNY 400–CNY 600 | Price controls and local manufacturing impacts |

Pricing Factors & Influences

- Patent Status & Generic Entry: Patent expiry forecasts for key formulations around 2024–2025 will introduce generics, substantially reducing tablet prices.[4]

- Pricing & Reimbursement Policies: Governments' willingness to reimburse DOACs influences affordability and adoption rates.

- Market Penetration & Volume: Price sensitivity varies; higher uptake in developed countries supports premium pricing initially, shifting towards cost-effectiveness later.

Pharmacoeconomic Considerations

- Rivaroxaban's higher drug acquisition cost versus warfarin is offset by reduced monitoring costs and lower adverse events.

- Cost-effectiveness analyses indicate that rivaroxaban remains competitive in markets with limited monitoring infrastructure, especially in aging populations.

4. Price Projections (2023–2030)

Assumptions

- Patent Expiry: 2024 (US/EU), prompting generic entry.

- Adoption Dynamics: Rapid uptake in developed markets, gradual in emerging economies.

- Pricing Trends: Steady decline post-generic entry, with stabilization around 50–70% of current branded prices.

- Regulatory & Policy Impact: Possible price controls in China and India may accelerate reductions.

Projected Price Trajectory

| Year | US Monthly Price (USD) | EU Monthly Price (EUR) | Key Notes |

|---|---|---|---|

| 2023 | 550 | 70 | Pre-generic prices stabilized |

| 2024 | 500 | 65 | Anticipated patent expiry; entry of generics |

| 2025 | 350–400 | 50–55 | Market share gains for generics; pricing competition |

| 2027 | 250–300 | 35–40 | Price stabilization; increased biosimilar presence in off-label extensions |

| 2030 | 200–250 | 25–30 | Further reduction, approaching parity with other DOACs |

Note: Prices are subject to regional reimbursement policies, negotiations, and patent litigation outcomes.

5. Regulatory and Patent Landscape

Patent Timeline

| Patent Type | Expiry Year | Impact | Notes |

|---|---|---|---|

| Composition of matter | 2024 | Launch of generics | Multiple generics licensed in India |

| Formulation patents | 2023–2025 | Generic market entries | Patent disputes and extensions possible |

Regulatory Approvals

- Widely approved across major markets including US (FDA), EU (EMA), Japan (PMDA), China (NMPA).

- Growing approval for extended indications (e.g., NVAF combined with other therapies).

6. Future Market Drivers & Challenges

Drivers

- Aging populations increasing AF and VTE prevalence.

- Healthcare policy push for reduced monitoring and hospitalizations.

- Expanding indications including cancer-associated thrombosis.

- Technological advances in pharmacogenomics enabling personalized therapy.

Challenges

- Patent cliff leading to price erosion.

- Competition from biosimilars and newer agents (e.g., edoxaban, betrixaban).

- Pricing pressures in emerging markets.

- Regulatory hurdles for off-label indications.

- Market saturation and payer reimbursements influencing profit margins.

7. Comparative Analysis with Emerging Agents

| Parameter | Rivaroxaban | Apixaban | Edoxaban | Betrixaban |

|---|---|---|---|---|

| Dosing frequency | Once daily | Twice daily | Once daily | Once daily |

| Bleeding risk | Moderate | Lower | Lower | Low |

| Cost | USD 500/month | USD 550/month | USD 600/month | USD 700/month |

| Patent status | Valid till 2024 | Valid till 2024 | Valid till 2024 | Patent expired |

8. Strategic Implications for Stakeholders

| Stakeholder | Recommendations | Rationale |

|---|---|---|

| Pharma companies | Invest in biosimilars, diversify indications | To defend market share and extend revenues post-patent expiry |

| Healthcare providers | Embrace pharmacoeconomic data | Optimize patient outcomes and manage costs |

| Payers | Negotiate prices proactively | To ensure access while controlling expenditures |

| Investors | Monitor patent status and regulatory trends | For informed portfolio management |

Key Takeaways

- Rivaroxaban has established itself as the market leader in DOACs with steady growth expected through 2027, driven by demographic shifts and expanding indications.

- Price reductions are inevitable post-patent expiry, with projections indicating a 50-70% decline starting in 2024.

- Generics will transform affordability landscapes, especially in price-sensitive markets like China and India.

- Competitive differentiation will increasingly depend on safety profiles, indications, and pharmacoeconomic benefits.

- Persistent regulatory, patent, and reimbursement challenges require proactive strategic planning.

FAQs

Q1: When will generic rivaroxaban become available in major markets?

A1: In the US and EU, patent expiration is anticipated around 2024, with generics entering shortly thereafter, subject to regulatory and legal proceedings.

Q2: How does rivaroxaban’s pricing compare across regions?

A2: US prices average USD 500–USD 550/month, whereas European prices range EUR 60–EUR 80/month. Prices are influenced by local healthcare policies and market dynamics.

Q3: What are the primary factors influencing rivaroxaban's market share?

A3: Efficacy profile, safety, dosing convenience, reimbursement policies, and patent status are critical determinants.

Q4: How will biosimilar entries affect rivaroxaban pricing?

A4: Introduction of biosimilars post-patent expiry will significantly drive prices downward, increasing accessibility.

Q5: Which emerging markets present significant growth opportunities for rivaroxaban?

A5: China, India, and Brazil, due to large populations, expanding healthcare infrastructure, and evolving reimbursement policies.

References

[1] MarketsandMarkets. "Anticoagulants Market," 2022.

[2] Fortune Business Insights. "Global DOAC Market," 2022.

[3] IQVIA. "Pharmaceutical Market Data," 2022.

[4] US Patent and Trademark Office. "Patent Landscape for Rivaroxaban," 2023.

More… ↓