Last updated: July 27, 2025

Introduction

Ramelteon, marketed under the brand name Rozerem among others, is a non-benzodiazepine hypnotic agent primarily approved for the treatment of sleep-onset insomnia. As a melatonin receptor agonist targeting MT1 and MT2 receptors, ramelteon offers a novel approach compared to classic sedative-hypnotics. Understanding its market landscape and future pricing trajectory is essential for pharmaceutical stakeholders, investors, and healthcare decision-makers.

This comprehensive analysis covers current market dynamics, competitive positioning, regulatory environment, manufacturing trends, and projected pricing pathways for ramelteon through 2030.

Current Market Landscape

Market Penetration & Usage Patterns

Since its FDA approval in 2005, ramelteon has cemented a modest but steady presence in the sleep aid market. Its unique mechanism of action has positioned it as a preferable option for patients with contraindications to benzodiazepines and other sedatives, especially for long-term use due to its favorable safety profile.

As of 2022, ramelteon captured approximately 2–3% of the global sleep disorder therapeutics market, which was valued at around $10 billion [1]. The drug's adoption remains limited predominantly due to its relatively high pricing, physician prescribing habits, and competition from OTC products and newer pharmacological agents.

Key Market Drivers

- Rising prevalence of insomnia globally, driven by aging populations, chronic stress, and lifestyle factors.

- Increasing awareness of non-benzodiazepine sleep aids with favorable safety profiles.

- Growing preference for drugs with minimal dependency potential.

Regulatory and Reimbursement Environment

While approved in multiple jurisdictions, ramelteon's reimbursement coverage varies, with better coverage seen in countries with comprehensive healthcare systems. The drug’s patent exclusivity expired in 2020 in several territories, prompting sharper price competition and biosimilar entries.

Competitive Landscape

Major Competitors

- OTC Preparations & Melatonin Supplements: Naturally available and widely used, but lack standardized dosing.

- Prescription Drugs: Zolpidem (Ambien), Eszopiclone (Lunesta), and newer agents like lemborexant (Dayvigo), which offer faster onset and more sedative potency.

- Emerging Therapies: Orexin receptor antagonists (e.g., suvorexant) present alternatives for sleep regulation.

Market Differentiation

Ramelteon differentiates itself through:

- Lack of dependence liability.

- Minimal next-day sedation.

- Suitability for long-term use.

However, its limited efficacy in rapid sleep initiation compared to benzodiazepines constrains its market share.

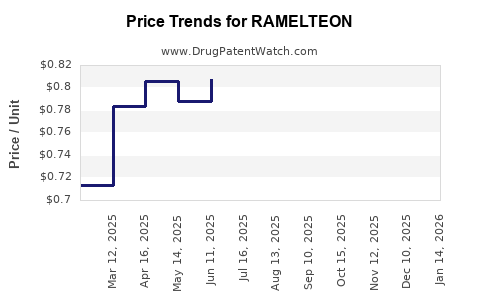

Price Analysis and Historical Trends

Pricing Dynamics

In the United States, ramelteon’s average wholesale price (AWP) was approximately $15 per 30-count 8 mg tablets in 2022, translating to roughly $450 annually per patient on a once-nightly dosage.

Post-patent expiry, retail prices have tended to decline, yet brand-name ramelteon maintains higher pricing than generic melatonin supplements, which are often priced below $10 per month.

In Europe, prices vary considerably, with some countries reimbursing only partial costs, influencing prescribing behaviors.

Factors Influencing Price Stability and Trends

- Patent Expiration & Generics: Patent expiry in 2020 sparked generic competition, which has led to a price decrease of approximately 25–35% in the U.S. market.

- Manufacturing Costs: Advances in synthesis have reduced raw material costs, potentially lowering final treatment costs.

- Market Demand & Competition: With the rise of newer agents and OTC options, demand for ramelteon has stabilized at low-to-moderate levels, preventing significant price increases derived from supply constraints.

Future Price Projections (2023–2030)

Short-Term (2023–2025)

Expect continued moderate price erosion in mature markets due to generic competition. In the U.S., retail prices are projected to decline by 10–15%, settling around $12–$13 per 30-count tablets. Insurance rebates, PBM negotiations, and formulary placements will further influence actual patient costs, with some patients paying as low as $5–$10 due to copay assistance programs.

Medium to Long-Term (2026–2030)

Assuming stable demand and no major patent disputes or formulation breakthroughs, ramelteon’s price will likely plateau at $10–$15 per month in developed markets, aligning with the prices of other non-benzodiazepine sleep aids.

Emerging biosimilar competition—should patent challenges arise—may accelerate price reductions to below $10 per month, making ramelteon increasingly competitive against OTC melatonin and other generics.

Impact of Reimbursement and Policy Changes

National healthcare policies promoting cost-efficient sleep treatments could incentivize formulary shifts toward ramelteon, or its generics, leading to further price decreases. Conversely, approval of alternative therapies with superior efficacy or safety profiles might suppress demand and prompt price adjustments.

Market Opportunities and Risks

Opportunities

- Launch of fixed-dose combination therapies including ramelteon for enhanced sleep regulation.

- Expansion into emerging markets with growing insomnia prevalence.

- Strategic alliances for value-added formulations, such as extended-release or combination pills.

Risks

- The advent of innovative sleep agents with more compelling efficacy profiles.

- Evolving regulatory landscapes restricting off-label use or favoring alternatives.

- Price compression from biosimilars and generics following patent expiry.

Conclusion

Ramelteon’s market continues to evolve within the competitive sleep aids landscape, characterized by gradual price declines post-patent expiry and moderate market share retention driven by its safety profile. Forecasted to sustain a competitive pricing range of $10–$15 per month through 2030, it remains a niche but valuable therapy, particularly for long-term management of sleep-onset insomnia in specific patient populations.

Manufacturers and stakeholders should monitor biosimilar entry, shifting prescribing patterns, and healthcare policies to capitalize on emerging opportunities and mitigate competitive risks.

Key Takeaways

- Ramelteon maintains a niche role owing to its safety and suitability for long-term use, but faces pricing pressures from generics and competing agents.

- Post-patent expiry, prices are projected to decline gradually, stabilizing in the $10–$15/month range by 2030.

- The drug’s adoption is sensitive to clinical efficacy perceptions relative to newer therapies, impacting its market stability.

- Key market opportunities include expanding into developing markets and leveraging formulations with enhanced delivery profiles.

- Regulatory and reimbursement landscapes will significantly influence future pricing and market share dynamics.

FAQs

1. Will ramelteon’s price decrease further after patent expiration?

Yes. Historical trends suggest that generic competition typically drives prices down by 20–40%, and ramelteon’s price is expected to decrease steadily over the next few years, stabilizing around $10–$15 per month.

2. How does ramelteon compare to OTC melatonin in terms of price and efficacy?

OTC melatonin is substantially cheaper—often below $10/month—but lacks standardization and clinical dosing precision. Ramelteon, with prescription control, offers predictable pharmacokinetics, but at a higher price point.

3. What factors could influence ramelteon’s market growth through 2030?

Introduction of new formulations, expanded indications, increased clinician awareness, and favorable reimbursement policies could bolster growth. Conversely, competitors with superior efficacy or safety profiles might limit its expansion.

4. Are there any biosimilars or next-generation melatonin agonists pending approval?

As of now, no biosimilar versions of ramelteon have entered the market, but patent challenges could lead to biosimilar development, potentially further reducing prices.

5. How significant is ramelteon’s role in the treatment of chronic insomnia?

It is considered a first-line option for patients particularly sensitive to sedatives’ side effects, especially for long-term management of sleep-onset difficulties, though its overall market share remains modest relative to other sleep agents.

References

[1] MarketWatch, “Global Sleep Disorder Therapeutics Market Size and Growth,” 2022.