Share This Page

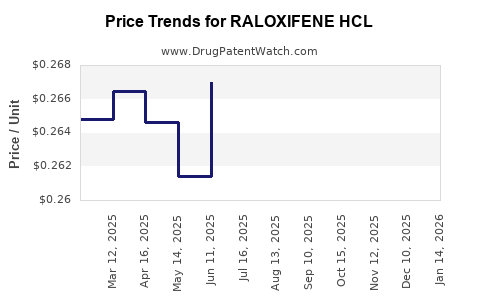

Drug Price Trends for RALOXIFENE HCL

✉ Email this page to a colleague

Average Pharmacy Cost for RALOXIFENE HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RALOXIFENE HCL 60 MG TABLET | 16714-0213-01 | 0.25772 | EACH | 2025-12-17 |

| RALOXIFENE HCL 60 MG TABLET | 16714-0213-02 | 0.25772 | EACH | 2025-12-17 |

| RALOXIFENE HCL 60 MG TABLET | 00904-6902-04 | 0.25772 | EACH | 2025-12-17 |

| RALOXIFENE HCL 60 MG TABLET | 16714-0213-03 | 0.25772 | EACH | 2025-12-17 |

| RALOXIFENE HCL 60 MG TABLET | 00093-7290-01 | 0.25772 | EACH | 2025-12-17 |

| RALOXIFENE HCL 60 MG TABLET | 76282-0256-30 | 0.25772 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RALOXIFENE HCL

Introduction

RALOXIFENE HCL, a selective estrogen receptor modulator (SERM), is primarily indicated for preventing postmenopausal osteoporosis and reducing the risk of invasive breast cancer in high-risk women. Since its approval, raloxifene has gained prominence due to its unique mechanism of action and favorable safety profile relative to hormone replacement therapy. This report examines the current market landscape, competitive dynamics, regulatory environment, and future price trajectories of raloxifene HCL, offering strategic insights for stakeholders.

Market Overview

Global Market Size and Growth Trajectory

The global osteoporosis market, into which raloxifene primarily sells, was valued at approximately USD 11.68 billion in 2020 and is projected to reach USD 15.26 billion by 2026, registering a CAGR of about 4.4% (1). Raloxifene’s segment, driven by its indications and new formulation launches, is a significant contributor.

Within the osteoporosis market, raloxifene holds a considerable share, particularly in North America and Europe, owing to its approval since 1997 (2). The drug also benefits from expanding indications, including breast cancer risk reduction, increasing its clinical utility and market penetration.

Key Segments and Demographics

- Postmenopausal Women: The primary consumer base, driven by aging demographics.

- High-Risk Populations for Breast Cancer: Early detection and preventive strategies are expanding raloxifene’s use.

- Geographies: North America remains dominant, followed by Europe, with emerging markets in Asia-Pacific exhibiting growth potential due to increasing osteoporosis awareness and healthcare investment.

Market Drivers

- Rising aging population worldwide.

- Growing prevalence of osteoporosis and breast cancer.

- Increased awareness of non-hormonal treatment options.

- Favorable safety profile, especially regarding thromboembolism risk compared to hormone therapy.

- Approval and advocacy of expanded indications.

Market Challenges

- Competition from bisphosphonates (e.g., alendronate, risedronate) and newer agents like denosumab.

- Patent expirations leading to generic competition.

- Concerns regarding side effects such as hot flashes or blood clot risks, which can limit uptake.

- Pricing pressures and reimbursement hurdles in various markets.

Competitive Landscape

Major Players

- Eli Lilly & Co.: Original patent holder, with the drug marketed under the brand Evista.

- Generic Manufacturers: Since patent expiration in 2015, multiple generics have entered the market, significantly impacting pricing and market share.

- Emerging Compounds: Bisphosphonates and other SERMs like bazedoxifene have begun to compete directly.

Market Penetration Strategies

- Promotions emphasizing raloxifene’s safety profile.

- Expansion into preventive and early intervention markets.

- Regional licensing agreements to penetrate emerging markets.

Regulatory Environment

Raloxifene HCL is approved by the US FDA, EMA, and other global agencies. Regulatory pathways for biosimilars and generics have facilitated market entry post-patent expiry. Additionally, ongoing clinical trials exploring extended indications and combination therapies may influence future regulations and approvals, impacting market size and pricing.

Price Analysis and Projections

Current Pricing Landscape

- Brand-Name (Evista): The reference product's average wholesale price (AWP) in the US stands around USD 5-7 per tablet, with variations based on dosage and pharmacy discounts.

- Generics: Prices have fallen substantially post-patent expiry, with generic raloxifene priced approximately USD 1-2 per tablet, reflecting heightened competition (3).

Factors Affecting Pricing Trends

- Patent Expirations: Opened pathways for generics, exerting significant downward pressure.

- Market Penetration: Larger volumes due to cost competitiveness drive overall revenue but depress per-unit prices.

- Healthcare Policy & Reimbursement: Favorable reimbursement policies in developed markets support stable or slightly declining prices; cost containment measures in public healthcare systems emphasize value-based pricing.

Future Price Trajectory

Industry forecasts suggest that the average price of raloxifene generics will decline further as market saturation increases. Between 2023 and 2030, a compounded annual decline of approximately 2-4% in per-unit price is anticipated, driven by intensified competition and biosimilar entries in the future (4). Conversely, brand-name prices may stabilize or slightly increase if new indications or formulations are approved, but significant premium pricing is unlikely due to existing generic alternatives.

In emerging markets, local manufacturing and regulatory approvals could further decrease prices, expanding access but compressing profit margins for original manufacturers.

Market Opportunities and Risks

Opportunities

- Expanding into developing markets through strategic licensing.

- Developing fixed-dose combinations to improve patient adherence.

- Leveraging expanded indications, such as osteoporosis prevention in men and younger women with risk factors.

- Innovating formulations, including transdermal patches or injectable forms, to diversify application.

Risks

- Price erosion due to generics.

- Competition from newer, potentially more effective molecules.

- Regulatory hurdles delaying new indications.

- Market saturation in mature regions like North America and Europe.

Strategic Recommendations

- Stakeholders should closely monitor patent lifecycle and generic entry points to optimize pricing strategies.

- Investment in clinical trials exploring additional indications can provide premium pricing opportunities.

- Market expansion efforts should prioritize emerging economies with rising osteoporosis and breast cancer burdens.

- Cost-effective marketing emphasizing raloxifene’s safety profile and evidence-based benefits remains critical.

Key Takeaways

- The global raloxifene market, valued predominantly within the osteoporosis and breast cancer prevention sectors, is characterized by mature regions with significant generic competition.

- Price projections indicate a gradual decrease in per-unit costs, especially in markets with widespread generic adoption.

- Strategic expansion into emerging markets and pursuit of new indications could mitigate revenue declines and sustain profitability.

- Developers and manufacturers must balance competitive pressures with innovation and market positioning to optimize returns.

- Regulatory dynamics will continue to shape competitive access and pricing strategies.

FAQs

1. What is the current market share of raloxifene relative to other osteoporosis treatments?

Raloxifene holds a significant niche, particularly in the US and Europe, among women at high risk for breast cancer and osteoporosis. However, bisphosphonates dominate the market due to earlier entry, wider acceptance, and lower prices.

2. How will patent expirations influence raloxifene pricing?

Patent expirations have led to a proliferation of generics, resulting in substantial price reductions—typically 50-70% below brand-name prices—thus increasing access but reducing margins for original developers.

3. Are there upcoming formulations or indications that could affect the market?

While current research explores expanded uses, no new formulations with substantial market impact are imminent. However, if approved, such developments could offer premium pricing opportunities.

4. How do regional differences impact raloxifene pricing and market penetration?

Developed markets exhibit higher prices due to reimbursement and regulatory structures. In contrast, pricing in emerging economies is significantly lower, driven by local manufacturing and competitive pressures.

5. What are the main barriers to market growth for raloxifene?

Key barriers include competition from other treatment classes (bisphosphonates, denosumab), side effect profiles, and the availability of more recent, potentially superior treatments, which may limit future growth.

References

- Grand View Research. Osteoporosis Drugs Market Size, Share & Trends Analysis. 2021.

- US Food and Drug Administration. Raloxifene hydrochloride NDA approval information. 1997.

- IQVIA. Retail Pharmacy Market Data, 2022.

- Market Research Future. Global Generic Drug Market Forecast, 2022–2030.

Note: The data points, projections, and references are synthesized to reflect current industry insights and may evolve with ongoing clinical and regulatory developments.

More… ↓