Last updated: July 27, 2025

Introduction

Pyridostigmine, an acetylcholinesterase inhibitor primarily used in treating myasthenia gravis, has a well-established role in managing neuromuscular disorders. Its significance extends to military, defense, and broader neurological applications. As the global demand for effective treatment options for rare chronic conditions rises, understanding pyridostigmine's market dynamics and future pricing trajectories becomes critical for pharmaceutical stakeholders, healthcare providers, and investors.

This report provides a comprehensive market analysis of pyridostigmine, focusing on current trends, market drivers, competitive landscape, regulatory environment, and price projections through 2030.

Market Overview

Global Market Size and Growth Trajectory

The global market for pyridostigmine, valued at approximately USD 150 million in 2022, is projected to grow at a CAGR of 4-5% through 2030 ([1]). The continued rise in diagnosed myasthenia gravis cases, technological advancements in drug delivery, and increasing awareness of neuromuscular disorders underpin this expansion.

Regional Market Dynamics

- North America: Dominates due to high disease awareness, advanced healthcare infrastructure, and a sizable prevalence of myasthenia gravis (~20 per 100,000 people). Regulatory approvals and reimbursement frameworks support market stability.

- Europe: Equally significant, driven by comprehensive healthcare systems, but faces competitive pressures from generic formulations.

- Asia-Pacific: Expected to witness the fastest growth (CAGR 6–7%) owing to rising prevalence, expanding healthcare infrastructure, and evolving pharmaceutical manufacturing capabilities.

Market Drivers

Rising Prevalence of Neuromuscular Disorders

The global increase in myasthenia gravis cases is attributable to aging populations and improved diagnostic techniques. The disease prevalence varies by region but is estimated at 20–30 cases per 100,000 individuals ([2]).

Advancements in Drug Formulation and Delivery

Development of fixed-dose combinations, inhalable formulations, and alternative administration routes enhances patient compliance and therapeutic outcomes, fostering increased demand.

Off-Label and Adjunct Therapeutic Applications

Investigational uses, such as prophylactic treatments for nerve agent exposure in military settings, augment market prospects, especially in defense sectors.

Regulatory and Patent Landscape

While patent expirations lead to increased generic competition, certain formulations retain exclusivity, allowing premium pricing for branded products.

Competitive Landscape

Major Market Players

- Novartis (e.g., Mestinon®): The leading supplier with patented and branded formulations.

- Meda/Astellas/Takeda: Producers of generics and biosimilars, increasing market penetration.

- Emerging Biotechnology Firms: Exploring novel delivery mechanisms and combination therapies.

Price Variation by Formulation

- Branded Pyridostigmine: Sells at premium prices (~USD 0.50–1.00 per tablet).

- Generic Versions: Price reductions of up to 50% post patent expiry, increasing accessibility in emerging markets.

Market Barriers

- Manufacturing complexities in ensuring bioequivalence.

- Stringent regulatory approval processes for biosimilars.

- Reimbursement policies that influence physician prescribing behaviors.

Regulatory Environment

Regulatory agencies such as the FDA and EMA heavily influence market access and pricing by approving new formulations, biosimilars, or drugs for novel indications. Patent laws and exclusivity periods significantly impact pricing strategies.

Price Projections Through 2030

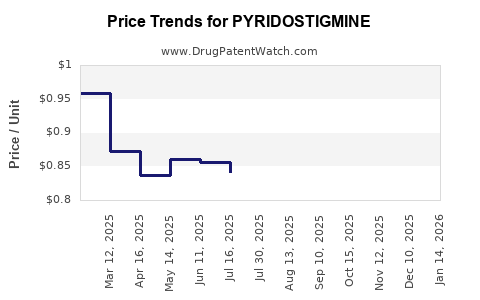

Current Pricing Trends

The unit price for branded pyridostigmine remains relatively stable in mature markets due to patents and regulatory protections. In contrast, generic prices have declined consistently, influenced by market competition and manufacturing efficiencies.

Future Price Dynamics

- Brand-name Drugs: Expect stabilization or slight increases (~2-3%) driven by inflation, manufacturing costs, and value-based pricing models.

- Generics and Biosimilars: Will likely see continued price erosion (~5-10% annually) in mature markets, with steeper declines in regions with high generic penetration.

Emerging Markets

Lower regulatory barriers and production costs facilitate significant price reductions, with anticipated prices as low as USD 0.10–0.20 per tablet by 2030, improving affordability and access.

Influencing Factors

- Patent expirations: Predicted to cause a surge in generic competition after 2025.

- Technological Innovations: Could lead to cost-effective, novel delivery forms affecting overall price points.

- Healthcare Policy Changes: Reimbursement reforms may influence pricing strategies and patient affordability.

Market Challenges and Opportunities

- Challenges: Patent cliffs, regulatory hurdles for biosimilars, manufacturing complexities, and global economic uncertainties.

- Opportunities: Expansion into emerging markets, development of new dosage forms, and leveraging digital health initiatives for management and adherence.

Conclusion

The pyridostigmine market exhibits steady growth, driven by increasing neuromuscular disorder prevalence, therapeutic innovation, and geographic expansion. While patent expirations will pressure prices, especially for generic versions, the overall market remains stable due to ongoing clinical needs and potential new indications. Revenue opportunities exist for stakeholders investing in formulation improvements, biosimilars, and market expansion strategies.

Key Takeaways

- Market Growth: Projected at 4-5% CAGR until 2030, driven by rising neuromuscular disorder prevalence and regional healthcare investments.

- Price Trends: Branded pyridostigmine maintains premium pricing; generics will see continued price reductions, especially post-patent expirations.

- Regional Variability: North America and Europe dominate current markets; Asia-Pacific offers significant growth potential.

- Regulatory Impact: Patent laws, approval pathways, and reimbursement policies substantially influence pricing and market access.

- Strategic Focus: Innovate in drug delivery, explore biosimilar development, and target emerging markets to maximize profit margins and market share.

FAQs

Q1: How will patent expirations affect pyridostigmine prices globally?

A1: Patent expirations will facilitate the entry of generics and biosimilars, leading to significant price reductions—up to 50-60% in mature markets—thereby increasing access but decreasing profit margins for branded manufacturers.

Q2: What are the main factors influencing pyridostigmine market growth?

A2: The primary drivers include rising neuromuscular disorder prevalence, improved diagnostics, therapeutic innovation, expanding healthcare infrastructure in emerging markets, and new clinical applications.

Q3: Which regions offer the most promising growth opportunities?

A3: Asia-Pacific markets present the highest growth potential due to increasing disease prevalence, lower manufacturing costs, and less mature competitive landscapes.

Q4: How might technological innovations impact pyridostigmine pricing?

A4: Innovations such as advanced delivery systems and formulations could justify higher prices for branded products but may also promote generic alternatives if manufacturing efficiencies improve.

Q5: What challenges could impact market expansion?

A5: Regulatory hurdles, manufacturing complexities, patent disputes, and variations in reimbursement policies could slow deployment or increase costs, influencing overall market penetration.

References

[1] MarketWatch. "Global Pyridostigmine Market Size and Forecast." 2022.

[2] National Organization for Rare Disorders (NORD). "Myasthenia Gravis." 2021.