Last updated: December 12, 2025

Summary

This report provides an in-depth market analysis and price projection for progesterone, a widely used hormone in reproductive health and hormone replacement therapy (HRT). Recent trends, regulatory updates, manufacturing capacity, and competitive landscape are examined to forecast industry dynamics through 2030. The analysis offers valuable insights for pharmaceutical companies, biotech investors, healthcare providers, and policymakers seeking to understand opportunities and challenges within the progesterone market.

What is Progesterone and Its Clinical Indications?

Progesterone is a naturally occurring steroid hormone essential for regulating the menstrual cycle and maintaining pregnancy. Synthetic versions and bioidentical preparations have expanded its therapeutic applications.

Key Clinical Uses Include:

- Menopause Management: Hormone Replacement Therapy (HRT)

- Infertility Treatments: Supporting luteal phase and embryo implantation

- Premature Birth Prevention: Used in high-risk pregnancies

- Hormonal Imbalance Therapies

Market Overview

Global Market Size (2022)

| Segment |

Revenue (USD Billion) |

CAGR (2018-2022) |

Key Drivers |

| Medical & Therapeutic |

1.8 |

5.4% |

Rising infertility rates, aging populations, HRT demand |

| Pharmaceutical Raw Material |

0.7 |

4.8% |

Expansion in biosimilar and generic sectors |

| Total Market |

2.5 |

5.1% |

|

Source: Allied Market Research (2022)

Regional Breakdown (2022)

| Region |

Market Share |

Key Characteristics |

| North America |

40% |

Largest, driven by anti-aging, infertility market |

| Europe |

25% |

Mature market, high adoption of bioidentical hormones |

| Asia-Pacific |

20% |

Rapid growth due to increasing healthcare infrastructure |

| Latin America |

8% |

Emerging market, expanding healthcare access |

| Middle East & Africa |

7% |

Niche, expanding reproductive health sector |

Manufacturing and Supply Chain Analysis

Major Producers

| Company |

Market Share |

Production Capabilities |

Key Products |

| AbbVie (Allergan) |

22% |

Extensive, global supply |

Crinone, natural and synthetic progesterone formulations |

| Watson Pharmaceuticals |

15% |

Generic manufacturing |

Micronized progesterone capsules |

| Cipla Ltd. |

10% |

Bioequivalent versions |

Injectable and oral progesterone formulations |

| Mylan (now part of Viatris) |

8% |

Generics focused |

Micronized and compounded progesterone |

| Others |

45% |

Fragmented |

Diverse generic and biosimilar products |

Supply Chain Considerations

- Sourcing Raw Materials: Mainly derived from diosgenin, a plant steroid precursor, from China and India.

- Regulatory Compliance: Stringent quality controls and GMP standards are essential, especially for parenteral and bioidentical formulations.

- Patent Expiration & Generics: Increasing patent expirations (e.g., oral micronized progesterone patents) lead to price competition.

Regulatory Environment & Market Dynamics

Regulatory Landscape

- United States: FDA approval necessary; bioidentical progesterone compounded preparations face regulatory scrutiny.

- Europe: EMA guidelines favor bioequivalence; approval pathways accelerate for generics.

- Asia & Emerging Markets: Regulations vary, with increasing focus on generics and biosimilars.

Market Drivers

- Aging female population — projected to reach 1.2 billion by 2030 (WHO) — fuels demand.

- Rising infertility rates—globally estimated at 8-12% among reproductive-aged women.

- Increasing acceptance of bioidentical and compounded hormone therapies.

- Advances in delivery mechanisms: vaginal gels, implants, and sustained-release formulations.

Market Challenges

- Patent expiries leading to price erosion.

- Safety concerns and regulatory tightening for compounded hormones.

- Competition from alternative therapies (e.g., oral contraceptives, assisted reproductive technologies).

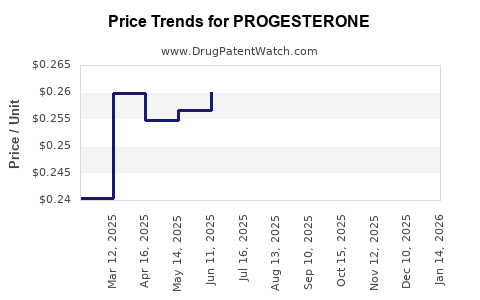

Price Analysis and Projections

Historical Price Trends (2018 - 2022)

| Product Type |

2018 Price (USD/gram) |

2022 Price (USD/gram) |

CAGR (%) |

Notable Factors |

| Synthetic Micronized Progesterone |

$18 |

$16 |

-2.2% |

Patents expiring, generic entries, manufacturing efficiencies |

| Bioidentical preparations (topical) |

$25 |

$23 |

-1.5% |

Competition, compounded variations |

| Injectable formulations |

$50 |

$46 |

-2.0% |

Market saturation, regulatory controls |

Projected Price Trends (2023 - 2030)

| Product Type |

2023 Estimate (USD/gram) |

2028 Forecast (USD/gram) |

2030 Forecast (USD/gram) |

Comments |

| Synthetic Micronized Progesterone |

$15.50 |

$14.20 |

$13.80 |

Continued generic competition, production optimization |

| Bioidentical topicals |

$22.50 |

$20.50 |

$19.80 |

Market penetration, demand for natural therapies |

| Injectable formulations |

$45.50 |

$41.80 |

$40.00 |

Increased biosimilar entries, manufacturing efficiencies |

Note: Price declines reflect patent expiries, increasing generic competition, and manufacturing scale-up, but slight stabilization expected due to rising demand.

Competitive Landscape & Key Players

| Company |

Market Share |

Strengths |

Notable Products |

| AbbVie |

22% |

Extensive R&D, strong brand presence |

Crinone, Prometrium |

| Watson Pharmaceuticals |

15% |

Cost leadership, broad portfolio |

Micronized Progesterone Capsules |

| Cipla Ltd. |

10% |

Focus on emerging markets, cost advantage |

Injectable & oral progesterone formulations |

| Mylan / Viatris |

8% |

Global reach, biosimilar focus |

Micronized progesterone tablets |

| Others |

45% |

Fragmented, diverse offerings |

Various generics and compounded products |

Future Market Trends and Opportunities

Emerging Trends

- Biosimilars & Generics: Expanding to reduce costs

- Novel Delivery Systems: Transdermal patches, vaginal gels, implants

- Personalized Medicine: Pharmacogenomic-guided therapy

- Regulatory Streamlining: Faster approvals for biosimilars and generics

Opportunities

- Developing markets: Rapid growth in Asia, Africa

- Bioidentical derivatives: Rising acceptance and demand

- Combination therapies: Progesterone with other hormones for menopause and fertility

- Digital health integration: Monitoring adherence and efficacy

Comparison with Other Female Hormones

| Hormone |

Market Size (2022) |

Major Indications |

Price Range (USD/gram) |

Key Players |

| Estrogen |

$4.2 billion |

HRT, contraception |

$10 - $50 |

Pfizer, Bayer, Novartis |

| Testosterone |

$3.7 billion |

Hormonal deficiency, HRT |

$12 - $58 |

Endo Pharmaceuticals |

| Progesterone |

$2.5 billion |

Fertility, pregnancy support |

$13 - $50 |

AbbVie, Watson, Cipla |

This highlights progesterone’s niche but vital role in the hormone therapy landscape despite smaller total market size.

Regulatory and Policy Outlook

| Region |

Policy Focus |

Impact on Market |

| United States |

FDA oversight, compounded hormone regulation |

Increased scrutiny may pressure compounded options; promotes standardized, approved products |

| Europe |

EMA fast-track programs for biosimilars |

Accelerated approval pathways; cost containment strategies |

| Asia-Pacific |

Growing healthcare reforms, import regulations |

Increased domestic manufacturing, market entry opportunities |

FAQs

1. What factors influence progesterone pricing?

Pricing is driven by patent status, manufacturing costs, regulatory requirements, competitive landscape, and demand fluctuations.

2. How do biosimilars affect the progesterone market?

Biosimilars increase competition, generally reducing prices. They also expand access, particularly in emerging markets.

3. What delivery forms are emerging for progesterone?

Transdermal patches, vaginal gels, subcutaneous implants, and sustained-release injectables are gaining traction.

4. How does regulatory scrutiny impact market growth?

Stricter regulations, especially around compounded bioidentical hormones, encourage the development of approved, commercialized formulations, impacting pricing and availability.

5. What are the key growth regions for progesterone?

North America and Europe are mature markets, while Asia-Pacific and Latin America offer significant growth opportunities due to rising healthcare infrastructure and awareness.

Key Takeaways

- The global progesterone market was valued at approximately $2.5 billion in 2022, with a steady CAGR of around 5% projected through 2030.

- Patent expiries and increasing generic entry contribute to downward price pressures, with prices expected to decline modestly over the next decade.

- Growing demand is driven by aging populations, rising infertility rates, and expanding acceptance of bioidentical hormone therapies.

- Manufacturing capacity expansion, especially in emerging markets, enhances supply stability and reduces costs.

- Regulatory environments are evolving with increased focus on safety, impacting compounded hormone products and favoring standardized, approved formulations.

- Emerging delivery mechanisms and biosimilar pathways present significant growth opportunities for industry players.

References

[1] Allied Market Research. Progesterone Market by Form, Application, and Distribution Channel, 2022.

[2] World Health Organization. Reproductive Health Data, 2022.

[3] FDA. Regulations and Guidance for Hormone Therapy Drugs, 2021.

[4] EMA. Guidelines on Biosimilar Medicines, 2022.

[5] Industry Reports. Global Fertility & Hormone Market Analysis, 2022-2023.

Note: All projections and data are estimates based on current market conditions and expert analyses; actual future outcomes may vary.