Share This Page

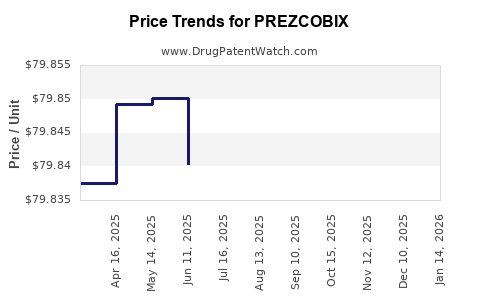

Drug Price Trends for PREZCOBIX

✉ Email this page to a colleague

Average Pharmacy Cost for PREZCOBIX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PREZCOBIX 800 MG-150 MG TABLET | 59676-0575-30 | 79.99089 | EACH | 2025-12-17 |

| PREZCOBIX 800 MG-150 MG TABLET | 59676-0575-30 | 79.96390 | EACH | 2025-11-19 |

| PREZCOBIX 800 MG-150 MG TABLET | 59676-0575-30 | 79.90185 | EACH | 2025-10-22 |

| PREZCOBIX 800 MG-150 MG TABLET | 59676-0575-30 | 79.87312 | EACH | 2025-09-17 |

| PREZCOBIX 800 MG-150 MG TABLET | 59676-0575-30 | 79.87843 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PREZCOBIX

Introduction

PREZCOBIX (darunavir and cobicistat) is an antiretroviral therapy (ART) approved for the treatment of HIV-1 infection. Developed by Janssen Pharmaceuticals, a subsidiary of Johnson & Johnson, PREZCOBIX is primarily indicated for adult patients requiring a complete regimen for HIV-1 infection, often utilized in combination with other antiretroviral agents. Given the global burden of HIV/AIDS and the increasing demand for effective therapies, an analysis of PREZCOBIX’s market landscape and price trajectory is crucial for stakeholders ranging from healthcare providers to investors.

This report comprehensively evaluates the current market dynamics of PREZCOBIX, reviews key competitors, assesses pricing strategies, and projects future price trends based on patent status, regulatory changes, market demand, and competitive pressures.

Market Landscape for PREZCOBIX

Global HIV/AIDS Epidemiology and Unmet Needs

The World Health Organization (WHO) estimates over 38 million people worldwide are living with HIV/AIDS, with Sub-Saharan Africa bearing the highest prevalence [1]. Despite advances in ART, challenges such as drug resistance, treatment adherence, and access disparities persist, driving demand for potent, tolerable, and convenient therapies.

Therapeutic Position of PREZCOBIX

PREZCOBIX is a fixed-dose combination comprising darunavir, a protease inhibitor, and cobicistat, a pharmacokinetic booster that enhances darunavir's plasma concentration. Its once-daily dosing and favorable side-effect profile position it favorably within the second-generation HIV therapeutics market. However, it faces competition from other combination therapies, including:

- Atripla (efavirenz/emtricitabine/tenofovir)

- Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide)

- Dolutegravir-based regimens

Pricing Strategies and Reimbursement Landscape

PREZCOBIX’s pricing varies significantly across markets, influenced by patent protections, direct manufacturing costs, negotiations with health authorities, and local healthcare economics. In the U.S., list prices range approximately from $2,600 to $3,200 per month, reflecting a premium compared to generic options but aligning with branded HIV treatments’ typical cost structure [2].

Global pricing adjustments are evident, with lower prices in emerging markets constrained by economic factors and generic availability. Reimbursement policies in different countries influence patient access and overall market penetration, with high-income nations demonstrating steady adoption driven by formulary placements.

Market Penetration and Adoption Trends

In North America and Europe, PREZCOBIX maintains a solid market share, especially where physicians prioritize potent, once-daily regimens with a tolerable side-effect profile. The growth trajectory is driven by:

- Expanding indications (including treatment-naïve and treatment-experienced patients)

- Updated guidelines favoring integrase inhibitor-based regimens, although protease inhibitors like darunavir remain relevant

- The emergence of resistance and tolerability profiles favoring boosted protease inhibitor use in specific patient subsets

In low- and middle-income countries, generics and combination therapies costing significantly less are displacing PREZCOBIX, impacting volume growth predominantly in these regions.

Competitive Analysis

Key Competitors

- Biktarvy: Leading high-efficacy, once-daily integrase inhibitor combination with a favorable safety profile. It commands premium pricing but is often preferred for treatment-naïve patients.

- Juluca/Stilesta (Dolutegravir-based fixed-dose combinations): Known for high resistance barriers and lower costs.

- Generic Protease Inhibitors: Significantly undercut branded PREZCOBIX in emerging markets, influencing global market share.

Market Share Dynamics

While PREZCOBIX retains importance among patients with resistance or intolerances to integrase inhibitors, its market penetration has slackened in regions prioritizing cost-effectiveness and newer oral regimens. Its role is increasingly niche, focusing on specific subpopulations or treatment scenarios where protease inhibitors remain advantageous.

Regulatory and Patent Considerations

Patent Status and Generic Competition

Patent protection for PREZCOBIX extends into the mid-2020s in key markets:

- U.S. patent expiry expected around 2024, with potential for extensions

- In Europe and other regions, patent expiration varies, with some markets experiencing earlier generic entry

The impending patent expiry is projected to induce significant price erosion, particularly in developed markets, with generics promising 60-80% cost reductions.

Regulatory Developments

Recent guidance and evolving treatment guidelines emphasize integrase inhibitor-based regimens, marginalizing protease inhibitors like darunavir except for specific cases. Regulatory agencies supporting adherence to updated protocols could accelerate market decline for PREZCOBIX post-patent expiry.

Price Projections for PREZCOBIX

Short-term Outlook (Next 1-2 Years)

In mature markets, the expected near-term trend remains stable, with prices maintained by successful negotiations, insurance coverage, and formulary placements. However, the threat of generic entries in the U.S. and Europe in 2024–2025 will exert downward pressure, likely leading to a 15-25% price reduction through negotiations and competitive tactics.

Medium to Long-term Outlook (3-5 Years)

Post-patent expiration, prices are projected to decline sharply:

- Discounted generic versions could reduce prices by approximately 60-80%

- Smaller geographic markets and emerging economies may see generic availability earlier, intensifying price competition

- Pharmaceutical companies’ strategies, including launching authorized generics or biosimilars, could mitigate revenue losses

Impact of Market Dynamics

The rising prominence of integrase inhibitors and the push for simplified, cost-effective regimens will continue to erode PREZCOBIX’s market share, further accelerating price erosion post-expiry. Efforts by Janssen to position PREZCOBIX for niche markets will influence pricing retention margins temporarily but are unlikely to alter fundamental downward trends.

Conclusion

PREZCOBIX holds a mature, somewhat niche role within the global HIV treatment landscape. Its high pricing is justified by brand recognition, efficacy, and tolerability but faces escalating pressure from generics and evolving treatment guidelines favoring newer, oral integrase inhibitors. Short-term stability is probable, but patent expiration in the next few years will catalyze significant price erosion, particularly in high-income markets. Stakeholders should monitor patent timelines, competitor strategies, and formulary trends to forecast revenue and market share shifts accurately.

Key Takeaways

- Market Position: PREZCOBIX remains relevant in specific patient populations but faces stiff competition from integrase inhibitor-based therapies.

- Pricing Outlook: Current prices are relatively stable, with a projected 15-25% decrease in the near term due to negotiations. Long-term prices will decline sharply following patent expiry.

- Competitive Threats: Generic and biosimilar entries post-2024 are expected to reduce prices significantly, especially in mature markets.

- Regulatory and Guidelines Impact: Evolving HIV treatment guidelines favor newer regimens, limiting PREZCOBIX’s growth potential.

- Strategic Focus: Stakeholders should prepare for post-patent market entry, considering diversification and positioning in niche markets.

FAQs

-

When does PREZCOBIX’s patent protection expire?

Patent protections in key markets like the U.S. are expected to expire around 2024, opening the door for generic competition. -

What factors influence the price of PREZCOBIX in different markets?

Pricing is affected by patent status, negotiation power of payers, local healthcare policies, manufacturing costs, and the availability of generics. -

How will generic entrants impact PREZCOBIX’s market share?

Generics are expected to significantly reduce prices and displace the branded product, especially in high-volume, cost-sensitive markets. -

Are there any upcoming regulatory changes that could affect PREZCOBIX?

Evolving HIV treatment guidelines favoring integrase-based regimens may limit future indications for protease inhibitors like darunavir, impacting demand. -

What is the outlook for PREZCOBIX’s revenue post-patent expiration?

Revenue is likely to decline sharply unless market share can be maintained in niche segments or through strategic diversification.

References

[1] WHO. (2022). HIV/AIDS Fact Sheet. World Health Organization.

[2] GoodRx. (2023). PREZCOBIX Price and Cost Analysis. |

More… ↓