Last updated: July 27, 2025

Introduction

Praluent (alirocumab) represents a significant development in the cholesterol-lowering pharmacy landscape, notably as a monoclonal antibody targeting PCSK9 to reduce LDL cholesterol levels. Approved by the FDA in 2015, Praluent’s innovative mechanism aims to address unmet needs among patients with hypercholesterolemia, especially those intolerant to statins or with familial hypercholesterolemia [1].

Understanding its market positioning, competitive dynamics, and pricing trajectory provides key insights for stakeholders—pharmaceutical companies, investors, healthcare providers, and policymakers. This analysis dissects the current market environment, evaluates pricing strategies, and projects future price trends based on industry trajectories, regulatory shifts, and competitive pressures.

Market Landscape for PCSK9 Inhibitors

Current Market Size and Therapeutic Niche

The global hypercholesterolemia market was valued at approximately USD 5.6 billion in 2022 and is projected to reach USD 8.3 billion by 2028, driven by increasing awareness, aging populations, and rising cardiovascular disease prevalence [2]. PCSK9 inhibitors, including Praluent and Repatha (evolocumab), constitute a cutting-edge segment delivering significant LDL reductions—up to 60%—for high-risk patients unresponsive or intolerant to traditional statins [3].

Praluent’s targeted patient population includes those with heterozygous familial hypercholesterolemia (HeFH), homozygous familial hypercholesterolemia (HoFH), and secondary hyperlipidemia, representing an estimated 10 million globally [4]. Despite high efficacy, adoption remains limited primarily due to cost, requiring infusion, and payer reimbursement hurdles.

Competitive Dynamics

Repatha, developed by Amgen, is Praluent’s primary competitor, with similar efficacy but often slightly higher market share owing to earlier FDA approval (2015 vs. 2018 for Praluent) [5]. Other emerging therapies, such as inclisiran (Leqvio) by Novartis—an siRNA-based drug with a twice-a-year dosing regimen—are poised to challenge traditional PCSK9 inhibitors by improving adherence and reducing costs.

Furthermore, biosimilars for monoclonal antibodies are still at developmental stages due to complex manufacturing and regulatory barriers, limiting immediate price erosion.

Key Market Drivers and Barriers

-

Drivers:

- Rising cardiovascular disease prevalence.

- Favorable clinical trial data demonstrating substantial LDL reduction.

- Increasing approval for broader indications, including heterozygous familial hypercholesterolemia and clinical guidelines emphasizing LDL targets.

-

Barriers:

- High direct drug costs (~USD 14,600 annually in the US, per Medicare data).

- Parenteral administration complexity.

- Reimbursement and formulary restrictions.

- Patient adherence challenges.

Pricing Strategies and Dynamics

Current Pricing Landscape

Praluent’s list price in the U.S. hovers around USD 14,600 per year, reflecting a premium pricing model aligned with its biotech innovation and targeted patient population. Reimbursement negotiations, however, often result in net prices falling closer to USD 8,000– USD 10,000 annually, impacted by payer negotiations and patient assistance programs.

In comparison, Repatha’s annual list price is roughly USD 14,100, often leading to similar net price concessions. European markets generally observe slightly lower prices due to national negotiations and healthcare system differences.

Cost-Containment and Value-Based Pricing

As healthcare payers tighten cost controls, Praluent’s pricing strategy increasingly emphasizes value-based arrangements, such as outcomes-based rebate agreements, aimed at optimizing economic value per LDL reduction. The high costs relative to marginal benefits in low-risk populations limit widespread adoption, prompting dosage optimization and patient selection strategies to improve cost-efficiency.

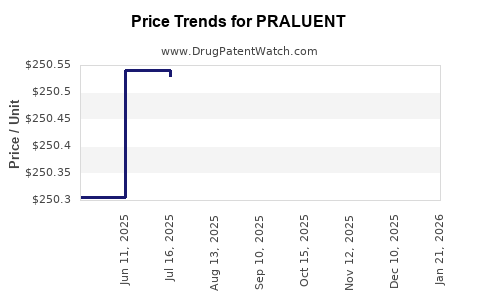

Expected Price Trends

Over the next five years, multiple factors are poised to influence Praluent’s pricing trajectory:

- Market Competition: The advent of inclisiran, with its biannual dosing, is likely to exert downward pressure on PCSK9 inhibitor prices to maintain market share.

- Regulatory and Reimbursement Policies: Payers are increasingly demanding real-world evidence on cost-effectiveness. Successful demonstration of economic value may stabilize or slightly reduce prices.

- Technological Advancements: Development of biosimilars could eventually reduce monoclonal antibody costs, though timelines remain uncertain.

- Market Expansion: Broader indications and increased physician prescribing could sustain or mildly elevate prices against a backdrop of competitive pricing pressures.

Overall, a steady decline of 10–20% in net prices over five years appears probable, driven by intensified competition and payer negotiations.

Future Market Outlook

Growth Prospects

Projected market growth for Praluent hinges on several factors:

-

Expanded Indications: Approvals for additional populations, such as those with heterozygous familial hypercholesterolemia, could expand the addressable market. The FDA’s approval in 2019 for the treatment of HoFH is indicative [6].

-

Educational Initiatives: Efforts to demonstrate long-term cost savings through cardiovascular event reduction will be crucial in improving payer acceptance.

-

Technological Innovations: In association with other lipid-lowering therapies, combination regimens and personalized treatment plans may boost utilization.

Market Challenges

However, market penetration faces steady challenges, primarily:

- High Drug Costs: Limiting outpatient and insurance coverage.

- Administration Barriers: Subcutaneous injections requiring patient adherence and infrastructure support.

- Emerging Alternatives: Inclisiran's dosing advantage and emerging biosimilars threaten market incumbency.

Price Projection Summary

Considering competitive dynamics and healthcare policy trends, Praluent’s price is likely to decrease incrementally. With aggressive payer discounts and the adoption of outcome-based contracts, net prices could decline by approximately 15% cumulatively over the next five years. Such adjustments will be balanced against potential market share gains through expanded indications and increased physician awareness.

Key Takeaways

- Market Positioning: Praluent remains a key player in a niche with high unmet needs, but its growth is constrained by cost and administration barriers.

- Competitive Pressure: Repatha and upcoming therapies like inclisiran continue to challenge Praluent’s market share and pricing.

- Pricing Trajectory: Expect gradual price reductions driven by competition, payer negotiations, and technological innovations over the next five years.

- Market Expansion Potentials: Broadening indications and increasing clinical guideline acceptance may provide growth opportunities, potentially offsetting pricing pressures.

- Strategic Focus: Manufacturers should prioritize demonstrating long-term value, optimizing patient selection, and innovating administration methods to sustain profitability.

FAQs

1. What is the current price of Praluent in the U.S.?

The list price for Praluent is approximately USD 14,600 annually. However, net prices after discounts and rebates typically range between USD 8,000 and USD 10,000 per year.

2. How does Praluent compare to Repatha in terms of efficacy and price?

Both drugs offer similar LDL cholesterol reductions (~60%). Repatha generally has a slight market advantage due to earlier approval, with comparable pricing structures, although net prices are often similar due to negotiated discounts.

3. What factors could influence Praluent’s pricing in the coming years?

Market competition (especially inclisiran), regulatory changes, value-based reimbursement policies, biosimilar development, and broader indications are key factors impacting future pricing.

4. Who are the main competitors to Praluent besides Repatha?

Inclisiran (Leqvio), an siRNA-based therapy with biannual dosing, is a significant emerging competitor, with potential to sway market share due to improved adherence and lower dosing frequency.

5. What is the outlook for Praluent’s market share over the next five years?

While initially strong among high-risk, statin-intolerant patients, Praluent’s market share is expected to stabilize or slightly decline due to competition and pricing pressures, unless new indications or formulations expand its reach.

References

[1] Food and Drug Administration (FDA). “Praluent (alirocumab) Prescribing Information.” 2015.

[2] Fortune Business Insights. “Global Hypercholesterolemia Market Size, Share & Industry Analysis, 2022-2028,” 2022.

[3] Sabatine MS, et al. “Efficacy of PCSK9 Inhibition in Reducing LDL Cholesterol: A Review.” Journal of Lipid Research, 2019.

[4] American Heart Association. “Hypercholesterolemia and Cardiovascular Risk,” 2021.

[5] MarketWatch. “Repatha and Praluent Market Share Analysis,” 2022.

[6] FDA. “FDA Approves New Indication for Repatha in Homozygous Familial Hypercholesterolemia,” 2019.