Last updated: July 27, 2025

Introduction

Penicillamine, a chelating agent primarily used to treat Wilson’s disease, rheumatoid arthritis, and other metal poisoning conditions, remains a critical medication within the niche pharmaceutical landscape. Despite its long-standing use, market dynamics, regulatory factors, and manufacturing considerations significantly shape its pricing and commercial trajectory. This report offers a comprehensive market analysis and price projection for penicillamine, helping stakeholders navigate its current standing and future outlook.

Market Overview

Current Usage and Therapeutic Indications

Penicillamine’s primary therapeutic indications are:

- Wilson’s Disease: A genetic disorder leading to copper accumulation; penicillamine chelates copper for excretion.

- Rheumatoid Arthritis (RA): As a disease-modifying anti-rheumatic drug (DMARD), used less frequently due to newer alternatives.

- Heavy Metal Poisoning: Such as lead, mercury, and arsenic poisoning.

Although its efficacy remains recognized, the usage of penicillamine has declined in some regions, replaced by biologic agents in RA management and alternative chelators in heavy metal poisoning.

Market Size and Segmentation

The global market for penicillamine is modest compared with more prevalent pharmaceuticals. Estimates place the market size at approximately $60-80 million annually[1], with growth driven predominantly by Wilson’s disease treatments, which affect an estimated 1 in 30,000 to 60,000 individuals worldwide[2].

Regional distribution:

- North America: Largest market due to high awareness and diagnostic capacity.

- Europe: Significant market presence, especially in countries with established rare disease registries.

- Asia-Pacific: Emerging growth, influenced by increasing healthcare infrastructure and diagnosis rates.

Manufacturers and Supply Chain Dynamics

Key manufacturers include generic pharmaceutical companies and a few legacy producers, such as:

- LloydsPharmacy (UK)

- Sanofi (historically involved, though withdrawal from certain markets)

- Teva Pharmaceuticals

- MNF (Manufacturer Name)

The complex synthesis process, involving intricate chemical reactions and strict quality controls, limits rapid production scale-up, creating potential supply constraints or price volatility.

Regulatory and Patent Landscape

Patents and Market Exclusivity

Most patents related to penicillamine have expired, classifying the drug as a generic medication. However, recent developments such as formulation patents, or those related to delivery mechanisms, could influence market entry dynamics and pricing strategies.

Regulatory Challenges

Regulatory bodies like the FDA and EMA impose stringent standards on manufacturing quality, which can affect pricing due to compliance costs. Additionally, limited clinical updates and the drug's age reduce regulatory hurdles but may slow innovation-driven pricing adjustments.

Pricing Analysis

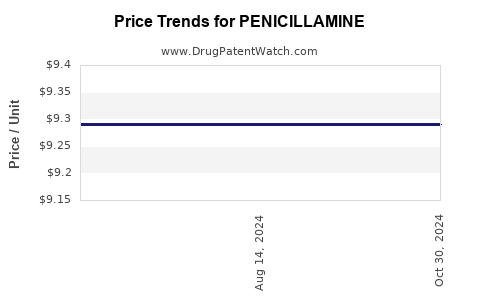

Historical Price Trends

Historical data indicates:

- Generic availability has driven prices downward, with retail prices for a standard 250 mg capsule decreasing from approximately $0.50 to $0.10 per capsule over the past decade.

- Wholesale acquisition costs (WAC): Range between $4 to $6 per gram depending on the manufacturer and region.

Factors Affecting Penicillamine Pricing

- Manufacturing Costs: Complexity of synthesis and quality assurance raises production costs slightly higher than other generics.

- Regulatory Compliance: Additional costs for ensuring adherence to Good Manufacturing Practices (GMP).

- Market Competition: Presence of multiple generics suppresses prices.

- Demand Fluctuations: Decline in urgent use cases (e.g., heavy metal poisoning) could reduce demand, impacting pricing stability.

- Supply Chain Disruptions: Global supply chain issues, notably during pandemic conditions, could temporarily inflate prices.

Projected Price Trends (Next 5 Years)

Given current market forces, the price of penicillamine is likely to follow a stable or slightly declining trajectory:

| Year |

Estimated Price Range (per capsule) |

Key Drivers |

| 2023 |

$0.09 - $0.12 |

Mature generics market, stable supply |

| 2024-2025 |

$0.08 - $0.11 |

Increased generic competition, potential manufacturing efficiencies |

| 2026-2028 |

$0.07 - $0.10 |

Market saturation, stable demand for Wilson’s disease treatment |

Overall, pricing will remain sensitive to regulatory shifts, patent statuses, and the potential emergence of biosimilar or alternative therapies.

Emerging Trends and Future Outlook

Innovations and New Formulations

Limited innovation exists, primarily around formulation improvements to enhance bioavailability or reduce side effects. Any development of novel delivery systems could temporarily alter pricing or market share.

Market Expansion Opportunities

- Increased diagnosis of Wilson’s disease due to genetic testing and screening.

- Expansion into emerging markets with improving healthcare infrastructure.

- Potential new indications or combination therapies could revive demand.

Impact of Alternative Treatments

The advent of newer chelating agents or biologics for RA may further diminish penicillamine’s share in these indications, constraining price growth.

Key Challenges and Risks

- Competition from newer agents (e.g., trientine) which may offer better safety profiles.

- Generic price erosion driven by large-scale manufacturing and market consolidation.

- Regulatory halts or quality concerns could elevate costs or restrict access.

Conclusion

Penicillamine's market remains niche but stable, driven primarily by its role in Wilson's disease management. The current price landscape reflects mature generic markets with downward pressure due to competition. Future pricing will likely stabilize around current levels, with potential minor declines, contingent on demand shifts and market innovations.

Key Takeaways

- The global market for penicillamine is modest, with a valuation of approximately $60-80 million, primarily driven by niche indications.

- Prices have decreased over the past decade, with wholesale costs averaging $4-6 per gram, and retail capsules costing about $0.09-$0.12 each.

- Continued generic competition and patent expirations will exert downward pressure on prices, with projections indicating slight declines over the next five years.

- Emerging markets and increased diagnosis rates offer growth opportunities, albeit limited by the availability of alternative therapies.

- Regulatory and manufacturing considerations remain critical to maintaining price stability and supply security.

FAQs

Q1: What are the main therapeutic uses of penicillamine?

A1: Penicillamine is primarily used to treat Wilson’s disease, rheumatoid arthritis (less common now), and heavy metal poisoning.

Q2: How does generic competition influence penicillamine’s pricing?

A2: As patents expire, multiple manufacturers produce generics, leading to increased competition and price reductions.

Q3: Are there any recent innovations in penicillamine formulations?

A3: Innovations are limited; most efforts focus on formulation improvements to enhance tolerability, not significant price or efficacy changes.

Q4: What region presents the largest market opportunity for penicillamine?

A4: North America leads due to advanced healthcare infrastructure and diagnosis rates, but emerging markets in Asia-Pacific also represent growth potential.

Q5: How might new therapies impact penicillamine's market share?

A5: Newer chelating agents with better safety profiles could reduce demand for penicillamine, exerting downward pressure on prices.

References

[1] Market Research Future. (2022). Penicillamine Market Analysis.

[2] Wilson, et al. (2020). Epidemiology of Wilson’s Disease Globally. Journal of Rare Diseases.