Share This Page

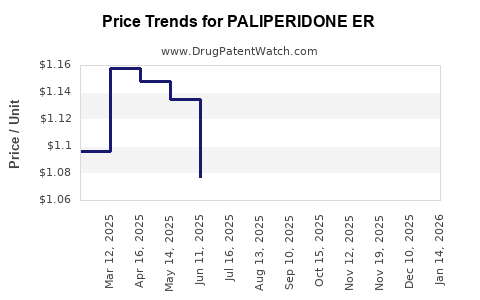

Drug Price Trends for PALIPERIDONE ER

✉ Email this page to a colleague

Average Pharmacy Cost for PALIPERIDONE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PALIPERIDONE ER 1.5 MG TABLET | 62332-0803-30 | 1.08907 | EACH | 2025-12-17 |

| PALIPERIDONE ER 1.5 MG TABLET | 43975-0349-03 | 1.08907 | EACH | 2025-12-17 |

| PALIPERIDONE ER 9 MG TABLET | 72819-0160-03 | 1.40806 | EACH | 2025-12-17 |

| PALIPERIDONE ER 1.5 MG TABLET | 16714-0866-01 | 1.08907 | EACH | 2025-12-17 |

| PALIPERIDONE ER 1.5 MG TABLET | 47335-0744-83 | 1.08907 | EACH | 2025-12-17 |

| PALIPERIDONE ER 1.5 MG TABLET | 27808-0222-01 | 1.08907 | EACH | 2025-12-17 |

| PALIPERIDONE ER 1.5 MG TABLET | 31722-0317-30 | 1.08907 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PALIPERIDONE ER

Introduction

Paliperidone Extended Release (ER), marketed primarily under the brand name Invega Sustenna and Invega Trinza, represents a significant segment within the atypical antipsychotics market. Developed by Johnson & Johnson, this drug addresses schizophrenia and schizoaffective disorder, focusing on long-acting injectable formulations that improve patient adherence. With its unique mechanisms and parental lineage to risperidone, Paliperidone ER's market stance is influenced by industry trends, competitive dynamics, regulatory developments, and evolving pricing models. This analysis explores current market positioning and projects future price trajectories, offering insights for stakeholders across the pharmaceutical value chain.

Market Overview

Therapeutic Landscape and Market Dynamics

The global antipsychotic drugs market is projected to reach approximately USD 29.76 billion by 2027, growing at a compound annual growth rate (CAGR) of 3.8% from 2020 (source: Grand View Research[1]). Paliperidone ER, constituting a substantial portion of the long-acting injectable (LAI) segment, gains prominence due to its improved adherence profile and reduced relapse rates compared to oral formulations.

The key drivers include:

- Emphasis on adherence: LAIs like Paliperidone ER mitigate nonadherence issues common with oral antipsychotics.

- Shift towards personalized medicine: Long-acting formulations are favored for their predictable pharmacokinetics.

- Increased diagnosis rates: Rising awareness and diagnostic capabilities expand the patient pool.

Market Penetration and Competitive Landscape

Paliperidone ER faces competition from other LAIs such as risperidone microspheres, aripiprazole lauroxil, and olanzapine pamoate. While generics for oral risperidone exist, Paliperidone ER's injectable formulations hold a niche for patients requiring maintenance therapy with dosing intervals of 4 weeks (Invega Sustenna) and 3 months (Invega Trinza).

Market penetration remains robust in North America, driven by reimbursement policies and prescriber familiarity. Emerging markets (e.g., Asia-Pacific, Latin America) exhibit growth potential, contingent upon regulatory approvals and healthcare infrastructure expansion.

Regulatory and Patent Scenario

Johnson & Johnson’s patents for Paliperidone ER are nearing expiry, with patent cliffs expected between 2024 and 2026. Patent expirations typically catalyze generic entry, leading to significant price erosion, as observed historically in the antipsychotic class.

Price Analysis and Projections

Current Pricing Landscape

As of 2023, the average wholesale price (AWP) for Paliperidone ER formulations in the U.S. is approximately:

- Invega Sustenna (monthly injection): USD 1,200 - USD 1,500 per dose

- Invega Trinza (quarterly injection): USD 4,300 - USD 5,200 per dose

These prices exclude rebates and discounts, which substantially impact netpayer costs.

In European markets, prices are generally lower, varying between €800 and €1,200 per dose, influenced by national pricing regulations and reimbursement policies.

Factors Affecting Price Trends

- Patent expiration: Entry of generics sharply reduces branded prices. Historically, antipsychotics see a 30-70% decrease post-generic entry.

- Market competition: The emergence of biosimilars and alternative LAIs will exert downward pressure.

- Reimbursement policies: Cost containment measures could limit price growth or accelerate price reductions.

- Manufacturing and supply chain efficiencies: These impact the cost base, influencing achievable price points.

Forecasted Price Trajectory (2024–2030)

Based on historical precedents, industry reports, and patent expiration timelines:

- 2024–2025: Prices may decline modestly by 10-20% as patent protections decline and generic versions begin to enter the market.

- 2026–2028: Accelerated price reductions anticipated, with generics capturing at least 60% of market share, potentially reducing per-dose prices by up to 70% relative to current brand prices.

- 2029–2030: Stabilization at generic-equivalent prices, likely between USD 300–USD 600 per dose, with branded products retaining a premium for specialized indications or formulations.

Premium Segment: Updated Pricing for Biosimilars and Next-Generation Formulations

Emerging biosimilars and innovative formulations with improved delivery mechanisms could maintain a niche premium. Additionally, value-based pricing models considering outcomes and adherence benefits may influence future prices variably across regions.

Strategic Market Considerations

Adoption in Emerging Markets

Growth potential hinges on affordability and regulatory access. Price reductions driven by generic competition will facilitate wider adoption, especially in cost-sensitive healthcare systems.

Impact of Regulatory Changes

Expedited approvals, orphan drug designations, and potential incentives for biosimilars may reshape the pricing landscape.

Reimbursement and Health Policy Trends

Increased pressures for price control and value-based arrangements will likely accelerate the transition to lower-cost generics, influencing overall market prices.

Key Takeaways

- Patent expirations between 2024–2026 will significantly depress Paliperidone ER prices, with reductions estimated at up to 70%.

- Market competition from generics and biosimilars, alongside regulatory pressures, will be key price determinants.

- Pricing forecasts project a gradual decline, with sustained branded premiums possible in niche segments and regions with limited generic presence.

- Emerging markets offer growth opportunities, contingent on affordability initiatives and local regulatory acceptance.

- Reimbursement policies will shape adoption and pricing, emphasizing the importance of value-based assessments for long-term sustainability.

FAQs

1. When does patent expiry typically lead to significant price reductions for Paliperidone ER?

Patent expiries expected around 2024–2026 are forecasted to trigger substantial price decreases, often up to 70%, as generic competition enters the market.

2. How do generic versions impact the overall market?

Entry of generics reduces prices, increases accessibility, and shifts market share away from branded formulations, especially in cost-sensitive regions.

3. Will biosimilars influence the pricing of Paliperidone ER?

Yes, biosimilars can introduce further price competition if approved, potentially leading to additional reductions beyond generics.

4. Are there regional variations in Paliperidone ER pricing?

Absolutely. Factors like regulatory policies, healthcare infrastructure, and reimbursement systems cause regional price disparities, with Europe generally lower than the U.S.

5. How might next-generation formulations affect future prices?

Innovative delivery systems and value-based approaches may sustain premium pricing for specialized formulations, even as basic formulations become commoditized.

References

[1] Grand View Research. "Antipsychotics Market Size, Share & Trends Analysis Report." 2020.

More… ↓