Last updated: July 27, 2025

Introduction

Oxazepam is a benzodiazepine widely prescribed for short-term management of anxiety and insomnia. Developed in the 1960s, it has been a mainstay in psychopharmacology due to its relatively favorable safety profile compared to earlier benzodiazepines. The global pharmaceutical market for benzodiazepines, including oxazepam, is undergoing transformation driven by regulatory shifts, generic competition, evolving prescription trends, and increasing scrutiny over dependence-related concerns.

This analysis provides a comprehensive overview of the current market landscape, future demand trajectories, regulatory influences, competitive dynamics, and price projections for oxazepam over the next five years.

Market Landscape Overview

Current Market Size and Composition

Global sales of benzodiazepines, estimated at approximately $2.5 billion in 2022 (source: IQVIA), reflect strong demand driven by anxiety and sleep disorder treatment needs. Oxazepam accounts for roughly 15-20% of this market, primarily within European and North American markets, where prescription practices favor its use due to its safety profile and efficacy.

In developed markets, oxazepam's market share has plateaued owing to the proliferation of newer therapeutic options, including non-benzodiazepine hypnotics and antidepressants with anxiolytic properties. Conversely, in emerging markets, demand remains steady owing to lower drug costs, established prescriber familiarity, and regulatory approval.

Key Markets and Patient Demographics

-

Europe: Leading the demand for oxazepam, with countries like the UK, Germany, and France accounting for significant share. Prescriptions often reflect long-term management of chronic anxiety or sleep issues.

-

North America: Usage is more conservative, with stricter regulations and a preference for newer agents such as buspirone or zolpidem. However, oxazepam remains a prescribed option, especially for elderly populations due to its safety profile.

-

Asia-Pacific: Growing prescriptions driven by expanding mental health awareness, rising stress levels, and broader healthcare access, with India and China showing notable upticks.

Competitive Dynamics

Generic Competition and Pricing

The expiration of patents for oxazepam's primary formulations has led to an influx of generic producers, intensifying price competition. This has resulted in significant price erosion, particularly in markets with well-established generic manufacturing infrastructure. Generic suppliers, including Teva, Sandoz, and Mylan, dominate the landscape, offering competitively priced alternatives.

Brand vs. Generic Market Share

While branded oxazepam products offered by originators such as Roche or Pfizer comprised the majority of sales historically, generics now dominate most markets due to cost advantages. Consequently, the average price per unit has decreased progressively, with recent data indicating a downward trajectory of approximately 10-15% annually in mature markets.

Formulation and Patent Landscape

Oxazepam formulations include tablets of varying strengths (e.g., 10 mg, 15 mg, 30 mg). Patent protections have expired for many formulations, allowing broad generics manufacturing. No recent patent litigations or exclusivity extensions have been observed.

Regulatory Environment and Its Impact

Prescribing Guidelines and Restrictions

Regulatory agencies like the EMA and FDA have emphasized cautious benzodiazepine prescribing, emphasizing short-term use and monitoring for dependence. As a result, prescription volumes have stabilized or declined marginally in some jurisdictions, exerting downward pressure on sales volumes.

Import Regulations and Control Measures

Several countries impose strict controls on benzodiazepine prescriptions, often requiring special licenses, which in turn influence market accessibility and prices. In regions with regulatory tightenings, demand may decrease, contributing to price stabilization.

Market Entry Barriers

High regulatory standards and established generic manufacture mean minimal new entrants are likely, maintaining a competitive environment dominated by existing generics.

Future Demand and Price Projections (2023–2028)

Demand Projections

Analyzing current prescription trends, demographic shifts, and regulatory influences yields the following expectations:

-

Europe and North America: Moderate decline in prescription volume (~2-3% annually) owing to increased awareness of dependency risks and regulatory constraints.

-

Emerging Markets: Steady growth (~5% annually), driven by expanding mental health initiatives and healthcare infrastructure improvements.

-

Total Market Volume: Expected to decline slightly or stabilize in the next 3-5 years, with total sales estimated to hover around $2.2–$2.4 billion by 2028.

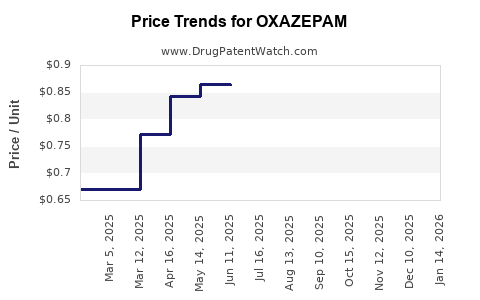

Price Trajectories

-

Current Price Range: A typical 30-count pack of 10 mg oxazepam tablets ranges from $8 to $15 in the US, with generics pricing as low as $4 to $7 per pack.

-

Projected Price Trends: Due to extensive generic competition, prices are projected to decline by an additional 10-20% over five years, driven by economies of scale and increased manufacturing efficiencies.

-

Premium Pricing Factors: Limited, primarily in niche markets where prescribers prefer branded formulations for perceived quality or stability. However, these are minor segments.

Factors Influencing Future Pricing

- Trend toward formulary de-listings and deprescribing initiatives.

- Increased adoption of non-benzodiazepines.

- Regulatory restrictions inflating costs for prescription acquisition.

- Competitor drug dynamics impacting benzodiazepine class pricing.

Conclusion

The future market for oxazepam reflects a landscape of mature, highly competitive generic products amid declining overall demand. The combination of regulatory caution, generic price erosion, and shifting prescribing patterns suggests a gradual decrease in unit prices paired with stable or slightly declining sales volume.

Stakeholders should anticipate moderated revenue growth, with cost-saving strategies becoming increasingly critical. Opportunities may arise in emerging markets where demand is rising, especially if tailored formulations or targeted marketing strategies are employed. Continued monitoring of regulatory changes and prescription trends will remain essential for accurate forecasting and strategic planning.

Key Takeaways

- The global oxazepam market is expected to decline modestly over the next five years, driven mostly by regulatory and prescriber preference shifts.

- Price erosion due to generic competition is projected to continue, with a 10-20% decrease expected in retail prices.

- Emerging markets may present growth opportunities, especially with increasing awareness of mental health issues.

- Regulatory constraints and deprescribing initiatives are likely to restrict prescription volumes further in mature markets.

- Stakeholders should prioritize cost-efficient manufacturing and explore niche markets or formulations to maintain profitability.

FAQs

1. What are the main factors impacting oxazepam prices?

Pricing is primarily influenced by patent expirations, generic competition, regulatory restrictions, prescription volume trends, and regional market dynamics.

2. How does the regulatory environment affect oxazepam sales?

Stricter prescribing guidelines and controls reduce prescription volumes, leading to decreased sales and downward pressure on prices.

3. Are there upcoming patent protections or exclusivities for oxazepam?

No significant patent protections are currently active; most formulations are in the public domain, enabling widespread generic manufacturing.

4. Which markets are expected to show demand growth for oxazepam?

Emerging markets such as India, China, and parts of Southeast Asia are poised for incremental growth owing to expanding mental health services.

5. How do alternative medications impact oxazepam's market?

Non-benzodiazepine anxiolytics and hypnotics, with favorable safety profiles, are replacing oxazepam in some regions, further constraining its market share.

References

[1] IQVIA. (2022). Global Benzodiazepine Market Report.

[2] European Medicines Agency. Benzodiazepines prescribing guidelines.

[3] FDA Drug Approval and Patent Data.

[4] World Health Organization. Mental health and prescription trends.

[5] Industry analysis reports on generic drug manufacturing and price trends.