Share This Page

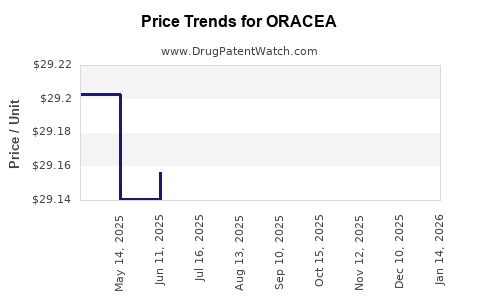

Drug Price Trends for ORACEA

✉ Email this page to a colleague

Average Pharmacy Cost for ORACEA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ORACEA 40 MG CAPSULE | 00299-3822-30 | 29.14188 | EACH | 2025-12-17 |

| ORACEA 40 MG CAPSULE | 00299-3822-30 | 29.10208 | EACH | 2025-11-19 |

| ORACEA 40 MG CAPSULE | 00299-3822-30 | 29.12612 | EACH | 2025-10-22 |

| ORACEA 40 MG CAPSULE | 00299-3822-30 | 29.14038 | EACH | 2025-09-17 |

| ORACEA 40 MG CAPSULE | 00299-3822-30 | 29.14467 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ORACEA (Minoxidil Topical Foam)

Introduction

ORACEA (minoxidil topical foam) is a topical treatment primarily indicated for androgenetic alopecia in men and women. Approved by the U.S. Food and Drug Administration (FDA) in 2017, ORACEA offers a novel formulation of minoxidil, delivering rapid absorption and superior cosmetic profile compared to traditional minoxidil solutions. Given its recent market entry and distinctive position within the hair loss therapeutics segment, understanding its current market landscape and future pricing trajectory is essential for pharmaceutical stakeholders and investors.

Market Overview

Therapeutic Area and Industry Context

Androgenetic alopecia, or pattern baldness, impacts approximately 50 million men and 30 million women in the United States alone [1]. The global hair loss treatment market is projected to reach USD 4 billion by 2026, with a compound annual growth rate (CAGR) of roughly 4.9% [2]. This growth is spurred by increasing awareness, technological advancements, and the rising prevalence among aging populations.

Market Dynamics for Minoxidil Products

Minoxidil has been a cornerstone in hair loss management since its topical formulation was approved in the late 1980s. Conventional solutions like Rogaine (over-the-counter, OTC) have dominated due to affordability and widespread availability, yet patients often cite issues such as scalp irritation and cosmetically unappealing residue.

ORACEA’s emergence with a foam formulation targeting improved user experience and higher compliance presents a strategic advantage. It is positioned initially as a prescription-only product, with potential OTC conversion in the future, which would significantly alter market dynamics.

Current Market Position of ORACEA

Market Penetration and Adoption Trends

Since its 2017 launch, ORACEA has garnered steady adoption, particularly among patients dissatisfied with OTC solutions seeking a prescription-grade alternative. Its targeted marketing to dermatologists and hair specialists, emphasizing benefits such as faster absorption (within 30 seconds) and a non-greasy finish, has driven early uptake.

However, market penetration remains limited compared to longstanding solutions due to factors such as:

- High direct-to-consumer (DTC) costs (approx. USD 50 per month)

- Prescriber awareness and acceptance rates

- Competition from OTC formulations and emerging biologics

Competitive Landscape

Key competitors include:

- OTC minoxidil solutions (Rogaine, Kirkland)

- Prescription formulations (finasteride, dutasteride)

- Emerging laser therapies and hair transplant procedures

ORACEA’s differentiation hinges on its foam formulation, which addresses tolerability and cosmetic concerns, creating a niche for patients prioritizing simplicity and efficacy.

Pricing Analysis

Current Pricing Strategy

In the U.S., ORACEA retails at approximately USD 50–55 per month, translating into about USD 600–660 annually. Insurance reimbursement is limited, with most patients paying out-of-pocket, heightening the importance of perception of value.

Factors Influencing Pricing

- Formulation advantages: Superior absorption, reduced scalp irritation, aesthetic benefits

- Manufacturing costs: Foam formulations typically incur higher production costs

- Market positioning: As a prescription drug, pricing can be calibrated based on perceived clinical benefit and patient segment targeting

- Competitive pricing: OTC solutions cost around USD 30–40 annually, providing a comparative baseline

Pricing Trends and Projections

Given the initial premium pricing and market receptivity, there is potential for incremental price adjustments aligned with inflation, manufacturing efficiencies, and competitive pressures. A prospective price reduction for broader OTC access may occur within 3-5 years, driven by:

- Regulatory pathway for OTC conversion

- Increased competition from generic formulations

- Cost reductions from scale-up and technology advancements

It is plausible that, over a 5-year horizon, retail prices could decrease by 15–25%, reaching USD 40–45 per month (USD 480–540 annually).

Future Market and Price Projections

Market Growth Drivers

- Increased awareness and diagnosis: Growing societal acceptance and early detection

- Product diversification: Introduction of OTC formulations and combination therapies

- Emerging therapies: Advancements in biologics and regenerative medicine, potentially impacting market size and pricing

Price Trajectory

Considering current dynamics, the following projections are poised:

- Short-term (1–2 years): Stable pricing around USD 50–55/month as market adoption gradually increases

- Mid-term (3–5 years): Potential price reductions to USD 40–45/month upon OTC conversion and increased competition

- Long-term (5+ years): Possible cost declines to USD 35–40/month, with options for bundled or subscription offerings

Additionally, premium formulations incorporating novel delivery systems or combination therapies might command even higher prices, maintaining niche premium segments.

Regulatory and Market Implications

The FDA’s consideration to allow OTC status for minoxidil products represents a significant inflection point. If approved, this transformation could:

- Drive volume growth markedly, subsidizing price reductions

- Create price competition, benefitting consumers

- Shift revenue models, emphasizing market share over unit price

Furthermore, payers and healthcare providers may influence pricing strategies through formulary decisions, favoring cost-effective options.

Key Challenges and Opportunities

- Price sensitivity: Patients' willingness to pay a premium for foam formulation versus OTC solutions

- Reimbursement pathways: Limited insurance coverage necessitates value-based pricing

- Innovation potential: Advanced delivery and combination products offer revenue diversification

- Market expansion: Entry into emerging markets where hair loss treatments are gaining popularity

Key Takeaways

- ORACEA currently occupies a premium niche with a subscription price around USD 50–55/month.

- The product’s unique foam formulation enhances patient experience, supporting initial premium pricing.

- Over the next 3–5 years, market expansion, OTC conversion, and increased competition are projected to reduce prices by approximately 20–25%.

- Long-term market growth hinges on regulatory decisions, technological innovations, and demographic trends emphasizing early intervention.

- Strategic positioning and continued innovation are essential for maximizing profitability amid evolving market conditions.

FAQs

1. Will ORACEA become available over-the-counter?

Regulatory agencies are evaluating the OTC switch for minoxidil formulations. If approved, ORACEA could be marketed directly to consumers, significantly altering pricing and accessibility.

2. How does ORACEA’s pricing compare to OTC minoxidil products?

Currently, ORACEA’s retail cost is roughly USD 50–55/month, higher than OTC solutions (USD 30–40/year). Future OTC availability may lead to price parity or reduction, enhancing competitive edge.

3. What factors could influence future price adjustments?

Regulatory changes, manufacturing efficiencies, market competition, reimbursement policies, and consumer demand all impact pricing strategies.

4. Is there potential for premium pricing beyond current levels?

Yes, innovations like combination therapies or advanced delivery systems could command higher prices in niche segments targeting specific patient needs.

5. What is the outlook for market share growth for ORACEA?

With increased awareness and potential OTC status, ORACEA could capture a substantial share of the hair loss treatment market, especially among consumers seeking premium formulations.

References

[1] American Hair Loss Association. (2023). Hair Loss Statistics.

[2] MarketsandMarkets. (2022). Hair Loss Treatment Market by Type, Application, and Region — Global Forecast to 2026.

More… ↓