Last updated: July 27, 2025

Introduction

Ofloxacin, a fluoroquinolone antibiotic, has historically played a significant role in treating bacterial infections such as urinary tract infections, respiratory tract infections, and skin infections. Since its approval in the late 1980s, the drug has maintained prominence due to its broad-spectrum activity and oral bioavailability. This analysis explores current market dynamics, competitive landscape, regulatory influences, manufacturing considerations, and provides future price projections for ofloxacin, equipping stakeholders with strategic insights.

Market Overview and Dynamics

Global Market Size and Growth Trends

The global antibiotic market is valued at approximately USD 56 billion in 2022, with fluoroquinolones constituting a significant segment. Ofloxacin, accounting for roughly 8-10% of this category, demonstrates consistent demand driven by high prescription rates and emerging bacterial resistance patterns.

The infectious disease burden, especially in developing nations, sustains demand for affordable broad-spectrum antibiotics like ofloxacin. According to MarketsandMarkets, the global fluoroquinolone market is projected to grow at a CAGR of 3-4% over the next five years, reaching USD 6 billion by 2027.

Key Market Drivers

- Rising Incidence of Bacterial Infections: Increased prevalence of urinary tract infections, sexually transmitted infections, and respiratory ailments sustains demand.

- Cost-Effectiveness: Ofloxacin is comparatively inexpensive, making it preferred in low- and middle-income countries.

- Expanding Older Population: Age-related vulnerabilities heighten the need for antibiotics.

- Growing Antibiotic Resistance: While resistance undermines efficacy, it also fuels research into next-generation fluoroquinolones, indirectly sustaining ofloxacin demand through renewal cycles.

Market Restraints

- Adverse Effect Profile: Side effects such as tendinopathy and neurological effects have led to regulatory restrictions in certain regions.

- Emergence of Resistance: Quinolone resistance is rising, potentially reducing prescribing rates.

- Regulatory Scrutiny: More stringent approval and post-marketing surveillance may impact market access.

Competitive Landscape

Major Players

- Sanofi-Aventis (with commercial formulations)

- Zydus Cadila

- Intas Pharmaceuticals

- Lupin Pharmaceuticals

- Dr. Reddy’s Laboratories

The presence of multiple generic manufacturers ensures competitive pricing and widespread availability. Patent expirations in various markets have led to increased generic competition, exerting downward pressure on prices.

Market Entrance of Novel Fluoroquinolones

While newer agents like moxifloxacin and levofloxacin challenge ofloxacin's market share, the latter remains entrenched due to cost advantages, especially in emerging markets.

Regulatory and Patent Landscape

Ofloxacin’s original patent expired decades ago in most regions, leading to an extensive generic ecosystem. Regulatory agencies like the US FDA, EMA, and equivalents worldwide enforce strict guidelines for manufacturing standards and post-market surveillance. Recent bans or restrictions—for instance, in European countries over cardiac risks—pose potential impacts on market access.

Manufacturing and Supply Chain Considerations

Manufacturers must ensure compliance with Good Manufacturing Practices (GMP), especially considering the recent emphasis on quality and safety. Raw material sourcing, especially fluoroquinolone intermediates, has seen fluctuations owing to geopolitical tensions and supply chain disruptions, notably during COVID-19.

Price Trends and Projections

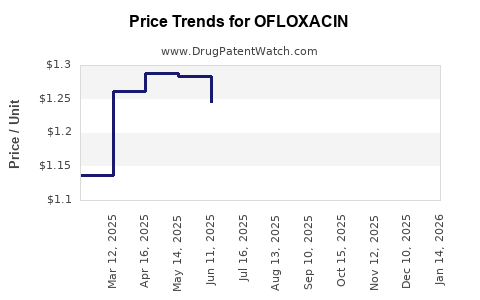

Historical Price Trajectory

Over the past decade, ofloxacin prices have exhibited a declining trend, attributable to:

- Entry of multiple generics

- Increased competition

- Regulatory pressures

- Affordable manufacturing costs

In developed markets, per-unit prices for finished formulations hover around USD 0.05–0.20, whereas in low-income regions, prices can be as low as USD 0.01–0.05 per tablet.

Near-Term Price Forecasts (Next 3-5 Years)

Given current market conditions, global ofloxacin prices are expected to decline modestly by approximately 2-3% annually, primarily driven by intensified generic competition and manufacturing efficiencies. However, certain regions with regulatory restrictions or limited competition (e.g., specific Asian or African countries) may retain relatively stable or slightly elevated prices.

Long-Term Price Outlook (Beyond 5 Years)

The future trajectory hinges on several factors:

- Antibiotic Stewardship Policies: Enhanced regulations could limit overusage, decreasing demand and potentially price stabilization or decline.

- Resistance Patterns: Increased resistance may suppress prescribed volumes, affecting pricing.

- Introduction of Next-Generation Alternatives: Novel antibiotics with superior safety profiles could displace ofloxacin, impacting historical demand and prices negatively.

- Production Cost Dynamics: Advancements in manufacturing and raw material sourcing could further reduce prices.

Estimating these influences, a conservative projection suggests a continued gradual decline, with prices stabilizing at approximately 10-15% below current levels over the next decade.

Regional Market Variations

- North America & Europe: Prices primarily driven by regulation and patent laws; prices may stabilize or increase marginally due to quality standards.

- Asia-Pacific: Dominated by generics, prices are expected to remain low, with potential slight reductions owing to manufacturer competition.

- Africa & Latin America: Price levels are among the lowest globally, with limited variation unless regulatory policies change.

Implications Amid Antibiotic Stewardship and Resistance Challenges

The global push toward rational antibiotic use and resistance mitigation could lead to decreased prescriptions of broad-spectrum agents like ofloxacin, affecting volumes but potentially stabilizing prices in constrained markets. Conversely, resistance-driven use of alternative agents could boost demand for newer drugs, further diminishing ofloxacin’s market share and influencing prices.

Conclusion and Strategic Recommendations

While ofloxacin’s cost-effectiveness sustains its market presence, evolving regulatory landscapes and resistance trends challenge its long-term profitability. Stakeholders should monitor regional policies and resistance data. Manufacturers might focus on optimizing production costs, ensuring regulatory compliance, and exploring niche markets or formulations to sustain profitable margins. Additionally, developing combination therapies or novel formulations may extend lifecycle value beyond traditional monotherapies.

Key Takeaways

- The global ofloxacin market remains robust primarily due to its affordability and broad-spectrum efficacy, especially in emerging markets.

- Competitive generics are exerting downward pressure on prices, with a projected annual decline of 2-3% over the next five years.

- Regulatory restrictions and rising resistance threaten prescription volumes but are offset by ongoing demand in low-income regions.

- Long-term prices are likely to stabilize or slightly decline, contingent on global antimicrobial stewardship policies.

- Strategic stakeholders should prioritize cost-efficient manufacturing, geographical diversification, and vigilance on regulatory developments to optimize market positioning.

Frequently Asked Questions (FAQs)

1. How is the rise in antibiotic resistance impacting ofloxacin's market?

Antibiotic resistance reduces prescribing, especially in countries implementing stewardship programs, potentially decreasing demand. Conversely, resistance to other antibiotics may increase reliance on ofloxacin if it remains effective, though resistance development remains an ongoing concern.

2. Are patent expirations influencing ofloxacin's market prices?

Yes. Patent expirations have facilitated the entry of multiple generics, intensifying competition and driving prices down globally.

3. What regional factors influence ofloxacin pricing trends?

Pricing varies based on regulatory policies, market competition, manufacturing costs, and healthcare infrastructure. Low-income regions benefit from affordability due to high generic competition, while regulatory restrictions in Europe and North America may prevent price increases.

4. Can ofloxacin substitutes impact its future viability?

Yes. The emergence of newer fluoroquinolones with better safety profiles or alternative classes of antibiotics can compete with ofloxacin, potentially reducing its market share.

5. What are the key considerations for manufacturers aiming to optimize profits?

Manufacturers should focus on maintaining compliance with regulatory standards, minimizing production costs, exploring new formulations, and targeting underpenetrated markets, particularly where demand remains strong.

References

- MarketsandMarkets. "Fluoroquinolone Market by Type, Application, and Geography." 2022.

- U.S. Food and Drug Administration (FDA). "Ofloxacin Product Details." 2021.

- European Medicines Agency (EMA). "Assessment Reports and Regulatory Updates." 2022.

- Global Antibiotic Market Reports. "Market Trends and Forecasts 2022–2027." 2022.

- World Health Organization (WHO). "Antimicrobial Resistance Global Report." 2019.