Share This Page

Drug Price Trends for NITROFURANTOIN MONO-MCR

✉ Email this page to a colleague

Average Pharmacy Cost for NITROFURANTOIN MONO-MCR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NITROFURANTOIN MONO-MCR 100 MG | 72603-0196-01 | 0.35193 | EACH | 2025-12-17 |

| NITROFURANTOIN MONO-MCR 100 MG | 00185-0122-01 | 0.35193 | EACH | 2025-12-17 |

| NITROFURANTOIN MONO-MCR 100 MG | 00185-0122-10 | 0.35193 | EACH | 2025-12-17 |

| NITROFURANTOIN MONO-MCR 100 MG | 00904-7137-61 | 0.35193 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Nitrofurantoin Mono-MCR

Introduction

Nitrofurantoin Mono-MCR is a high-demand antimicrobial primarily used for the treatment and prevention of uncomplicated urinary tract infections (UTIs). As resistance to other antibiotics increases, this drug has garnered renewed interest among healthcare providers. This analysis assesses the current market landscape, competitive positioning, regulatory environment, and price trajectory projections for Nitrofurantoin Mono-MCR, equipping stakeholders with strategic insights for informed decision-making.

Market Landscape Overview

Global Therapeutic Need and Epidemiology

Urinary tract infections rank among the most common bacterial infections globally, with an estimated 150 million cases annually. Nitrofurantoin remains a cornerstone therapy due to its efficacy against common causative organisms like Escherichia coli.

Market Drivers

- Rise of Antibiotic Resistance: The increased resistance to fluoroquinolones and sulfonamides emphasizes Nitrofurantoin’s role, especially for uncomplicated UTIs.

- Guideline Endorsements: Organizations such as the Infectious Diseases Society of America (IDSA) recommend Nitrofurantoin as a first-line treatment for cystitis [1].

- Growing Prescriber Preference: Due to its favorable safety and resistance profile, prescribers increasingly favor Nitrofurantoin, particularly the mono-MCR formulation.

Market Segments

- Hospitals and clinics: Significant for acute management of UTIs.

- Pharmacies: Over-the-counter and prescription channels.

- Long-term care: Used for recurrent infection prevention.

Regional Market Dynamics

- North America: Largest market, driven by high UTI incidence and antimicrobial stewardship policies.

- Europe: Growing awareness and guidelines endorse Nitrofurantoin as first-line therapy.

- Asia-Pacific: Rapidly expanding due to rising UTI prevalence and healthcare infrastructure improvements.

Regulatory Environment

Patent and Patent Expiry

Nitrofurantoin formulations are generally off-patent, although specific mono-MCR formulations may have patent protections granting market exclusivity until 2030+ [2].

Pricing and Reimbursement Policies

In developed markets, reimbursement policies favor generic formulations, but branded mono-MCR versions may command premium pricing due to patent protections or formulation advantages.

Competitive Landscape

Key Players

- Generic Manufacturers: Multiple goods available in the segment, often at low cost.

- Innovators: Firms holding patents on extended-release or combination formulations.

- Biosimilars and Biosimilar-like approaches: Limited due to the nature of small molecule drugs but relevant for formulation innovations.

Differentiation Factors

- Formulation Stability and Bioavailability

- Ease of Administration

- Packaging and Storage Solutions

- Pricing Strategies

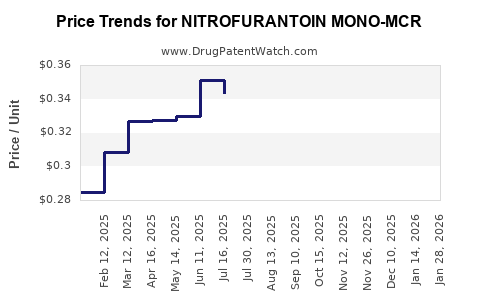

Price Trend Analysis and Projections

Historical Price Trends

Over the past five years, the price of Nitrofurantoin Mono-MCR has remained relatively stable in mature markets, primarily influenced by generic competition and regulatory policies. However, branded versions with patent protections have maintained higher margins due to exclusivity.

Factors Influencing Future Prices

- Patent Durations and Exclusivity Periods: Recent patents or patent extensions could sustain higher prices until ~2030.

- Manufacturing Costs: Slight reductions anticipated due to process optimizations.

- Market Competition: Entry of generics continues to exert downward pressure.

- Regulatory Incentives: Possible policy-driven rebates or price caps, especially in European countries.

Price Projection Outlook (2023–2030)

- Base Case Scenario: Gradual decline in unit prices of generic Nitrofurantoin Mono-MCR from current levels (e.g., $10–15 per pack) to approximately $8–12 as more generics enter the market.

- Optimistic Scenario: Patent extension or new formulation patents sustain prices at $15–20 until 2027.

- Pessimistic Scenario: Accelerated generics entry reduces prices to <$8 per pack by 2025, driven by increased competition.

Implications for Stakeholders

- Manufacturers: Innovate formulation or delivery methods to preserve premium pricing.

- Distributors and Pharmacies: Leverage volume sales, particularly in regions with high UTI prevalence.

- Regulatory Bodies: Monitor for price gouging and implement policies to promote affordability.

Strategic Recommendations

- Invest in formulation innovation to secure patent protections beyond current expiries.

- Expand geographic footholds in emerging markets where regulatory barriers are lower.

- Engage in price optimization strategies with payers based on regional price ceilings and reimbursement policies.

- Monitor resistance trends to adapt marketing and development strategies accordingly.

Key Takeaways

- Nitrofurantoin Mono-MCR is positioned for continued market demand driven by antimicrobial resistance and clinical guidelines favoring its use.

- Patent expiration and generic approval will likely exert downward pressure on prices; however, formulation innovations can preserve higher margins.

- The Asia-Pacific and European markets present significant growth opportunities, especially as prescribing practices evolve.

- Strategic investments in formulation patents and regional expansion can mitigate the impact of market competition.

- Monitoring resistance patterns, regulatory changes, and healthcare policies remains essential for accurate price and market forecasts.

FAQs

1. What factors influence Nitrofurantoin Mono-MCR's pricing in the global market?

Pricing is shaped by patent protections, market competition from generics, regional regulatory policies, manufacturing costs, and formulary preferences aligned with antimicrobial stewardship initiatives.

2. How does antimicrobial resistance impact the demand for Nitrofurantoin Mono-MCR?

Rising resistance to other antibiotics enhances Nitrofurantoin’s clinical utility, thereby increasing demand, especially in settings with high resistance rates to alternatives.

3. What is the outlook for generic vs. branded Nitrofurantoin Mono-MCR prices?

Generics are expected to drive prices downward due to competition, whereas branded versions with patent protections will maintain higher prices until patent expiry or legal challenges.

4. Are there regional variations in pricing and market potential?

Yes. North America and Europe have mature markets with established pricing dynamics; emerging markets in Asia-Pacific present rapid growth potential with lower price points initially.

5. What strategic moves can stakeholders make to maximize profitability?

Innovation in formulations, securing patent protections, strategic geographic expansion, and engaging with payers for favorable reimbursement policies are key strategies.

Sources:

[1] Infectious Diseases Society of America (IDSA). “Uncomplicated Urinary Tract Infections: Treatment Guidelines,” 2019.

[2] U.S. Patent and Trademark Office (USPTO). Patent filings and expirations for Nitrofurantoin formulations.

More… ↓