Last updated: July 27, 2025

Introduction

Nevirapine, a non-nucleoside reverse transcriptase inhibitor (NNRTI), plays a pivotal role in antiretroviral therapy (ART) for HIV-1 infection. Approved by the U.S. Food and Drug Administration (FDA) in 1996, it has been instrumental in managing HIV/AIDS, particularly in low- and middle-income countries. As global efforts intensify to eradicate HIV/AIDS, understanding the market dynamics and future pricing trends of Nevirapine is critical for stakeholders—including manufacturers, healthcare providers, policymakers, and investors.

This analysis dissects current market conditions, competitive landscape, regulatory factors, manufacturing dynamics, and potential price trajectories for Nevirapine through 2030.

Market Landscape Overview

Global HIV/AIDS Burden and Nevirapine Usage

Despite advancements, approximately 38 million people were living with HIV globally as of 2021, with Sub-Saharan Africa bearing the highest burden [1]. Nevirapine remains a first-line alternative in resource-constrained settings owing to its affordability and established clinical efficacy. According to WHO guidelines, Nevirapine-based regimens are recommended particularly in regions where economic factors limit access to newer agents [2].

Market Size and Demand Drivers

The estimated global market for Nevirapine was valued at approximately USD 300 million in 2022, primarily fueled by high demand in Africa, Asia, and Latin America. The demand drivers include:

- Public sector procurement: Procurement by governments and NGOs using international aid programs (e.g., PEPFAR, Global Fund).

- Patent and licensing landscape: The patent expiration or waiver in certain jurisdictions has improved generic availability.

- Clinical adoption: Resistance development against other NNRTIs (e.g., efavirenz) sustains Nevirapine's relevance, especially in treatment-naïve patients in specific settings.

Regulatory Environment and Market Entry

Patent expirations in major markets have facilitated the entry of generic formulations, significantly reducing prices and expanding access. WHO prequalification of several generic versions has further promoted global distribution. Nonetheless, regulatory hurdles remain in some jurisdictions, particularly surrounding quality assurance and registration processes.

Competitive Landscape

Major Players and Generics

The market is predominantly supplied by generic pharmaceutical companies such as Mylan (now Viatris), Cipla, and Hetero Labs, among others. Their competitive advantages include:

- Cost-efficiency in manufacturing: Lower production costs translate into highly competitive pricing.

- Regulatory approvals: WHO prequalification and national registrations expedite procurement.

Innovative and Alternative Treatments

While Nevirapine remains vital in particular regions, newer agents like Dolutegravir (DTG) have gained prominence due to superior safety profiles and resistance profiles [3]. Consequently, global shifts toward integrase inhibitors may influence future demand.

Market Risks and Challenges

- Emergence of resistance: Resistance development limits long-term efficacy, necessitating close monitoring and alternative staging.

- Availability of newer drugs: Increasing adoption of integrase inhibitor-based regimens could cannibalize the Nevirapine market.

- Regulatory and patent issues: Ongoing patent disputes or new patent filings can impact market competition.

Manufacturing and Supply Chain Dynamics

Cost of Production

Nevirapine's synthesis involves common chemical intermediates, resulting in low production costs—estimated to be below USD 0.10 per tablet for generics [4]. Economies of scale, especially in India and China, enhance supply stability and affordability.

Supply Chain Risks

Global supply chains are susceptible to disruptions from geopolitical risks, manufacturing capacity constraints, and pandemic-related impacts. Maintaining steady supply is crucial for market stability and price consistency.

Price Trajectory and Future Projections

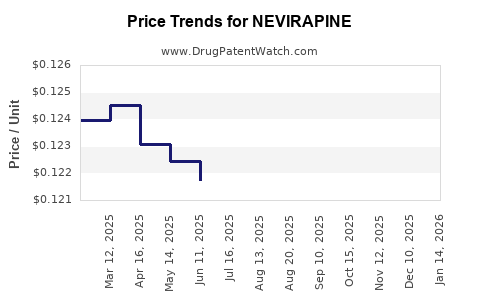

Historical Pricing Trends

Historically, the price per adult treatment regimen of Nevirapine has declined from approximately USD 2,000 in the early 2000s to less than USD 50 in low-income countries following generic competition and procurement efficiencies [5].

Projected Price Trends (2023–2030)

- Short-term outlook (2023–2025): Continued price stabilization or slight decreases driven by increased manufacturing capacity and regulatory harmonization.

- Mid to long-term outlook (2026–2030): Prices are expected to remain low, hovering around USD 10–20 per treatment course in bulk procurement contexts.

Factors influencing these projections include:

- Generic market saturation and scale economies.

- Global HIV treatment guidelines favoring newer agents, potentially reducing demand but also driving competition among generics to maintain market share.

- Emerging patent challenges or patent expirations extending the presence of generics.

Price-Forecast Scenarios

| Scenario |

Price Range (USD per treatment course) |

Key Assumptions |

| Optimistic (Cost-driven) |

USD 8–15 |

Continued generic proliferation; strong procurement volume; minimal regulatory delays |

| Conservative (Demand-reduction) |

USD 15–25 |

Shift towards integrase inhibitors; resistance issues; limited new formulations |

| Worst-case (Supply disruptions) |

USD 20–35 |

Manufacturing constraints; geopolitical disruptions; supply chain failures |

Regulatory and Policy Implications

International agencies, notably WHO and Global Fund, intend to sustain affordable Nevirapine access in targeted regions through pooled procurement and prequalification programs. Regulatory harmonization worldwide can further lower entry barriers, fostering price stabilization.

Impact of Emerging Technologies and Developments

- Formulation innovations (e.g., fixed-dose combinations, long-acting injectables) may influence demand for oral Nevirapine.

- Pharmacovigilance improvements could impact prescribing practices, especially related to rare adverse effects.

- Resistance monitoring will be critical for maintaining Nevirapine's role in HIV therapy.

Key Takeaways

- Steady Demand in Resource-Limited Settings: Despite the rise of newer regimens, Nevirapine remains a cornerstone in low-income countries due to affordability.

- Price Containment Through Generics: Patent expirations and increased competition are projected to keep prices low—potentially below USD 20 per treatment course by 2030.

- Market Consolidation and Competition: The presence of multiple generic manufacturers supports competitive pricing, though demand may decline with evolving treatment guidelines.

- Potential Decline Due to Treatment Shifts: Adoption of integrase inhibitors, especially Dolutegravir-based regimens, could diminish Nevirapine’s market share, impacting prices positively or negatively depending on supply dynamics.

- Supply Chain Stability Essential: Manufacturing efficiencies and supply chain resilience will be crucial to sustaining low prices and broad access.

FAQs

1. Will Nevirapine prices increase due to patent protections?

Currently, patent expirations and generic competition lead to stable or decreasing prices. Future patent filings or legal protections could temporarily lift prices, but widespread generics mitigate this risk.

2. How does the global shift toward newer antiretroviral agents affect Nevirapine’s market?

The trend favoring integrase inhibitors may reduce Nevirapine demand in some regions, especially where treatment guidelines pivot. However, in low-resource settings, its affordability sustains demand.

3. Are there risks of supply shortages for Nevirapine?

Supply risks exist but are generally mitigated by multiple active generic manufacturers. Disruptions could occur due to geopolitical issues or manufacturing challenges but are typically short-term with proper planning.

4. How do regulatory differences impact Nevirapine’s pricing and availability?

Global regulatory harmonization and prequalification facilitate broader access and lower prices, while delays or restrictions in certain jurisdictions can influence regional market dynamics.

5. What is the future outlook for innovative formulations of Nevirapine?

Research into long-acting injectable forms is ongoing, but widespread clinical adoption remains uncertain. Current focus continues on optimizing oral formulations and fixed-dose combinations.

References

[1] UNAIDS. (2022). Global HIV & AIDS statistics — 2022 fact sheet.

[2] WHO. (2021). Consolidated guidelines on HIV prevention, testing, treatment, service delivery, and monitoring.

[3] Rizzardini G, et al. (2020). “Emerging antiretroviral agents: Dolutegravir and beyond.” Journal of Antimicrobial Chemotherapy.

[4] Lin J, et al. (2018). “Cost analysis of generic manufacturing of Nevirapine.” Pharmacoeconomics.

[5] WHO. (2015). Generic Medicines Pricing Transparency Report.