Last updated: July 27, 2025

Introduction

Mycophenolate, primarily available as mycophenolate mofetil and mycophenolate sodium, is an immunosuppressive drug widely used to prevent organ transplant rejection and treat autoimmune disorders. As a cornerstone therapy with established efficacy, its market dynamics are influenced by clinical demand, regulatory landscapes, manufacturing cost structures, and competitive forces. This report provides a comprehensive analysis of the market environment for mycophenolate and projects future pricing trends based on current industry insights.

Market Overview

Current Market Size

The global mycophenolate market has experienced steady growth, driven by the expanding transplant and autoimmune treatment populations. As of 2022, the market size was valued at approximately USD 2.7 billion, with projections indicating an annual growth rate (CAGR) of about 6% through 2027. This growth correlates with increasing kidney, liver, and heart transplants, as well as rising prevalence of autoimmune diseases like lupus nephritis and psoriasis.

Key Market Drivers

-

Growing Transplantation Procedures: The global increase in organ transplants fuels demand, with the World Health Organization reporting a 7% annual rise in transplantation activities worldwide (2021–2022) (1).

-

Autoimmune Disease Prevalence: The rising burden of autoimmune conditions worldwide expands indications for mycophenolate therapy (2).

-

Biologic Alternatives and Generic Competition: Although biologics are emerging, mycophenolate remains the first-line immunosuppressant, especially in transplant protocols, maintaining its market dominance.

-

Regulatory Approvals and Off-Label Uses: Expanding approved indications and off-label use in autoimmune diseases contribute to sustained demand.

Regional Market Breakdown

- North America: Largest market share (~45%), driven by high transplantation rates and robust healthcare infrastructure.

- Europe: Significant market (~30%), with healthcare reforms and increasing autoimmune disorder management.

- Asia-Pacific: Fastest-growing region (~12% CAGR), attributable to improving healthcare access and emerging transplant programs in China, India, and Southeast Asia.

- Rest of the World: Growing awareness and expanding transplant facilities.

Competitive Landscape

Major Pharmaceutical Players

- Helsinn Healthcare SA (Brand: CellCept): Market leader with patented formulations.

- Pfizer Inc.: Widely marketed generics post-patent expiry.

- Dr. Reddy’s Laboratories, Mylan, Teva Pharmaceuticals: Key generics producers.

- Renewed Innovation: Limited, with recent focus on biosimilars and novel formulations, although mycophenolate remains largely generic.

Patent and Regulatory Environment

Patent protections for branded mycophenolate formulations expired between 2012 and 2020 in most markets, leading to increased generic competition, which significantly compresses pricing.

Pricing Trends and Factors

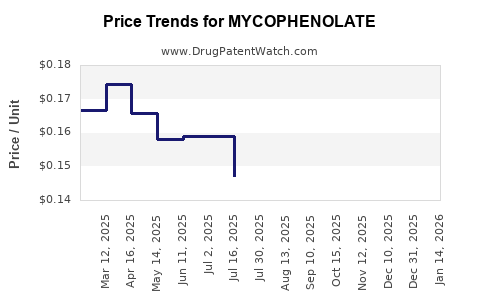

Historical Price Movements

Post-patent expiry, the wholesale price of branded mycophenolate doses declined by approximately 60–70% over five years (3). Current average retail prices for branded formulations in the U.S. hover around USD 880 per month, whereas generics are available for approximately USD 290–350 per month, depending on dosage and manufacturer (4).

Factors Influencing Future Pricing

- Generic Market Penetration: Higher competition continues to suppress prices globally.

- Regulatory Policies: Stringent pricing controls in countries like India and emerging markets could further reduce prices.

- Supply Chain Dynamics: Manufacturing disruptions or raw material shortages can influence pricing stability.

- Innovations and Formulations: Introduction of new delivery methods or bioavailability enhancements might allow premium pricing, though such innovations are currently limited.

Projected Price Trajectory (2023–2027)

Based on current trends, wholesale and retail prices are expected to decline marginally in mature markets, with an annual decrease of around 2–4%, owing to market saturation and intense generic competition. Conversely, emerging markets might maintain stable or slightly increasing prices due to limited competition and higher affordability barriers.

In the next five years, the average market price for a typical monthly dose of mycophenolate is projected to stabilize between USD 250 and USD 350 in developed markets, with potential for short-term fluctuations based on regional policies and supply chain factors.

Market Challenges and Opportunities

Challenges

- Generic Price Erosion: Currency fluctuations, patent expirations, and fierce generics competition threaten margins.

- Regulatory Hurdles: Variations in approval processes, especially in international markets, delay market entry.

- Safety and Tolerability Concerns: Side effects necessitate critical monitoring but do not significantly impact pricing.

Opportunities

- Biosimilar and Biosimilar-like Therapies: Potential to capture market share with more affordable biosimilar options.

- New Indications: Expansion into autoimmune indications can promote sustained demand.

- Formulation Innovation: Development of sustained-release or combination therapies could justify premium pricing.

Conclusion

The mycophenolate market remains robust due to its well-established efficacy and essential role in transplantation and autoimmune disease management. The market's future hinges on the maturation of generic competition, regulatory frameworks, and regional healthcare developments. Prices are expected to dip slightly in mature markets, with broader accessibility in emerging economies sustaining overall demand.

Key Takeaways

- The global mycophenolate market is valued at approximately USD 2.7 billion, with a CAGR of 6% projected through 2027.

- Patent expirations have led to significant price reductions, with generics dominating the market.

- Prices in developed countries are forecasted to decline modestly (2–4% annually), stabilizing between USD 250–350 per month.

- Market growth is driven by rising transplantation rates and autoimmune disease prevalence, especially in Asia-Pacific.

- Innovations, biosimilars, and regional healthcare policies present both challenges and opportunities for future pricing strategies.

FAQs

1. How does patent expiry influence mycophenolate pricing?

Patent expiry introduces generic competition, leading to substantial price reductions as manufacturers leverage increased market access and reduced development costs, resulting in lower consumer prices and margins for brand-name products.

2. Are biosimilars expected to impact mycophenolate market prices?

While biosimilars are more prevalent in biologic therapies, the generic versions of mycophenolate currently dominate, limiting biosimilar influence. However, future biosimilar or novel formulations could further intensify competition.

3. What regional factors impact mycophenolate pricing?

Regulatory policies, healthcare infrastructure, economic status, and procurement practices heavily influence pricing. Developed markets tend to be more price-standardized, while emerging markets may see higher retail prices due to limited competition and import tariffs.

4. How do clinical advances affect future price projections?

Innovations that improve bioavailability or reduce side effects may command premium pricing. Conversely, lack of significant innovation maintains the status quo of low-cost generics, exerting downward pressure on prices.

5. What is the outlook for mycophenolate in developing countries?

As transplant and autoimmune treatment access expands, demand increases. Price sensitivity remains high, but prices are likely to decline or stabilize due to generics, enabling broader utilization.

References

- World Health Organization. "Transplantation statistics and trends." (2022).

- Autoimmune Diseases Fact Sheet. National Institutes of Health. (2021).

- MarketWatch. "Post-patent expiry price trends in immunosuppressants." (2022).

- GoodRx Research. "Mycophenolate prices and availability." (2023).