Last updated: July 27, 2025

Introduction

Moxifloxacin, a broad-spectrum fluoroquinolone antibiotic, plays a pivotal role in combating respiratory tract infections, skin infections, and intra-abdominal infections. Its extensive spectrum of activity, pharmacokinetics, and favorable dosing profile have positioned it as a key asset within the antibiotic landscape. This analysis evaluates the current market environment for moxifloxacin, assesses competitive dynamics, regulatory influences, and provides price projections grounded in emerging trends and unmet medical needs.

Market Overview

Current Market Size and Penetration

The global antibiotic market was valued at approximately USD 45 billion in 2022, with fluoroquinolones constituting a significant share owing to their broad efficacy and oral bioavailability. Moxifloxacin specifically accounts for a substantial segment within third-generation fluoroquinolones, driven by its approval for respiratory infections including community-acquired pneumonia (CAP) and acute bacterial sinusitis (ABS).

North America remains the largest market, with substantial adoption driven by high healthcare expenditures, advanced infrastructure, and prescribing patterns favoring fluoroquinolones. Europe follows, with increased regulatory scrutiny and antimicrobial stewardship programs influencing prescribing behavior. The Asia-Pacific region demonstrates rapid growth potential, bolstered by rising bacterial infection prevalence, expanding healthcare access, and a large patient population.

Market Drivers

- Efficacy and Broad Spectrum: Moxifloxacin’s potency against atypical pathogens and anaerobes enhances its clinical utility.

- Convenient Dosing Regimen: Once-daily dosing improves adherence, especially in outpatient settings.

- Growth in Respiratory Infections: Rising incidences of pneumonia and sinusitis underpin demand.

- Evolving Resistance Patterns: Increasing resistance to other antibiotics sustains moxifloxacin’s relevance, although resistance development remains a concern.

Market Challenges

- Antimicrobial Resistance (AMR): The growing incidence of resistant strains prompts regulatory agencies to impose restrictions.

- Safety Concerns: Adverse effects such as tendinopathy and QT prolongation have led to cautious prescribing.

- Competition: Alternative antibiotics, including newer macrolides, tetracyclines, and novel agents, threaten market share.

Regulatory and Prescribing Dynamics

Regulatory Landscape

Regulators such as the FDA and EMA have tightened restrictions on fluoroquinolone use due to safety issues. In 2018, the FDA issued warnings against their use for uncomplicated infections when safer alternatives exist, emphasizing prudent prescribing. These regulations influence market growth and pricing strategies.

Prescriber Trends

Physicians are increasingly adopting antibiotic stewardship principles, favoring narrow-spectrum agents and limiting broad-spectrum fluoroquinolones. This shift influences volume sales but also drives demand for specific indications where moxifloxacin remains the most effective option.

Competitive Landscape

Key Players

- Bayer AG: Original manufacturer, with marketed formulations for multiple indications.

- Teva Pharmaceuticals: Generic producer, expanding access globally.

- Sandoz (Novartis): Active in producing biosimilar versions.

- Other Generic Manufacturers: Contribute significantly to price competition.

Generic vs. Branded Dynamics

The presence of multiple generic manufacturers has led to intense price compression. Generic versions typically sell at 60-80% discount relative to branded formulations, influencing overall market revenues and pricing strategies.

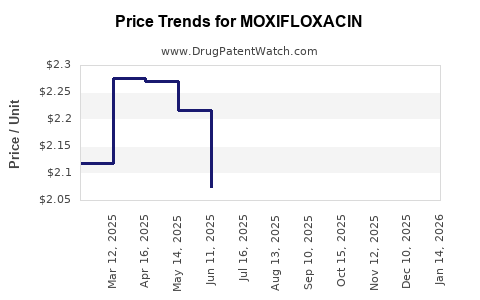

Price Trends and Projections

Current Pricing Scenario

- Branded formulations: Retail prices vary from USD 3 to USD 8 per capsule depending on jurisdiction.

- Generic products: Significantly lower, averaging USD 1–USD 3 per capsule, with regional variability.

Influencing Factors on Future Prices

- Patent Expiry and Generic Competition: Expected to push prices downward over the next 3–5 years.

- Regulatory Influences: Stricter guidelines could limit prescribing, reducing volume and impacting pricing power.

- Market Demand: Increased use in emerging markets will sustain some volume, but price erosion continues due to generics.

Projected Price Trajectory (2023–2028)

| Year |

Expected Average Price (USD per capsule) |

Key Influences |

| 2023 |

USD 2.50 – USD 4.00 |

Stabilization due to patent cliff, increased generic market penetration |

| 2024 |

USD 2.00 – USD 3.50 |

Continued generic proliferation, price competition intensifies |

| 2025 |

USD 1.75 – USD 3.00 |

Regulatory pressures and stewardship programs restrict high-volume prescribing |

| 2026 |

USD 1.50 – USD 2.75 |

Market saturation, emergence of biosimilars and alternative therapies |

| 2027 |

USD 1.25 – USD 2.50 |

Further consolidation, potential new indications could temporarily stabilize prices |

| 2028 |

USD 1.00 – USD 2.00 |

Mature generic market with minimal premium for branded versions |

Note: Prices are indicative and region-specific; disparity exists between developed and developing markets.

Market Forecasts by Region

- North America: Demand flattens due to stewardship; prices stabilize post-patent expiry with dominance of generics.

- Europe: Stringent regulations further suppress prices; high competition among generics moderates growth.

- Asia-Pacific: Rapid market expansion with high demand, though price sensitivity remains high, decreasing prices faster than in developed regions.

- Latin America and Africa: Growing access but limited purchasing power; prices tend toward lower ends of global ranges.

Future Opportunities & Risks

Opportunities

- New Indications: Development of moxifloxacin for multidrug-resistant infections could elevate its market value.

- Formulation Innovations: Extended-release or adjunct therapies could command premium pricing.

- Strategic Partnerships: Collaboration with emerging markets enhances distribution and market presence.

Risks

- AMR Escalation: Resistance may diminish clinical efficacy, limiting use.

- Safety Concerns: Adverse effect profiles could restrict prescribing and impact sales.

- Regulatory Hurdles: Stringent policies may impede market access or impose restrictions.

Key Takeaways

- The global moxifloxacin market is mature in developed regions but exhibits high growth potential in emerging markets.

- Competition from generics has driven prices downward; future pricing will largely depend on patent expiries, regulatory landscapes, and regional demand.

- Safety concerns and antimicrobial stewardship efforts influence prescribing patterns, constraining revenue but promoting responsible use.

- Despite challenges, moxifloxacin’s broad antimicrobial spectrum sustains its clinical importance, especially where resistance limits alternative options.

- Investors and strategists should track patent timelines, regulatory developments, and emerging resistant strains to adapt pricing and market strategies accordingly.

FAQs

1. How will patent expiries affect moxifloxacin's market prices?

Patent expiries will lead to increased generic competition, resulting in significant price reductions—potentially up to 80% decrease within five years—driven by market saturation and regulatory approvals.

2. What are the primary regulatory challenges impacting moxifloxacin sales?

Regulators have issued notices highlighting safety concerns like tendinopathy and QT prolongation, prompting restrictions on use for non-severe infections and mandating clear prescribing guidelines that may limit volume growth.

3. Is there potential for developing new formulations or indications for moxifloxacin?

Yes. Formulation innovations, such as extended-release tablets, and new indications for resistant infections could sustain or elevate its economic footprint, contingent on successful clinical development and regulatory approval.

4. How does antimicrobial resistance influence the future of moxifloxacin?

Rising resistance reduces the drug’s clinical utility, compelling prescribers to reserve it for specific cases. This trend may limit volume growth but could sustain higher prices temporarily if it remains a preferred agent in resistant infections.

5. Which regions offer the most promising market opportunities for moxifloxacin going forward?

Emerging markets in Asia-Pacific and Latin America offer growth opportunities due to increasing healthcare access and infection prevalence, despite price sensitivity. Mature markets will see volume stabilization with declining prices due to generics.

Sources:

- MarketsandMarkets. “Antibiotics Market by Type, Application, and Region – Global Forecast to 2027.”

- IQVIA. “Global Antibiotic Market Trends and Forecasts,” 2022.

- FDA Safety Alerts. “FDA Drug Safety Communication on Fluoroquinolone Antibiotics,” 2018.

- EvaluatePharma. “Pharmaceutical Market Intelligence: Antibiotics and Antimicrobials,” 2022.

- World Health Organization. “Global Action Plan on Antimicrobial Resistance,” 2015.