Last updated: July 27, 2025

Introduction

Minocycline, a broad-spectrum tetracycline antibiotic, has maintained a prominent position in the pharmacopeia for treating diverse bacterial infections, including acne, respiratory tract infections, and certain sexually transmitted infections. As antibiotic resistance rises and new competitors emerge, analyzing the current market landscape and projecting future pricing trends for minocycline is vital for industry stakeholders, healthcare providers, and investors.

This report delivers an in-depth market analysis and forecast of minocycline prices, considering factors such as regulatory updates, patent status, manufacturing dynamics, competitive landscape, and global demand shifts. It aims to empower decision-makers with actionable insights rooted in current market realities and trends.

Market Overview

Global Market Size and Trends

The global antibiotic market, valued at approximately USD 54 billion in 2022, exhibits consistent growth driven by rising bacterial resistance, expanding healthcare infrastructure, and increasing infection burdens in emerging economies [1]. Minocycline occupies a significant niche within this market, especially owing to its dual role in treating resistant infections and acne vulgaris.

The tetracycline class, with minocycline as a leading agent, holds an estimated market share of around 8-10% in systemic antibiotics. Europe and North America are primary markets, accounting for over 60% of sales, while Asia-Pacific demonstrates rapid growth owing to improved healthcare access and increased prescription rates.

Regulatory Landscape

Current regulatory considerations influence market dynamics significantly. In the United States, the FDA approved generic formulations, with no recent patent protections on brand-name minocycline products. However, certain formulations and delivery mechanisms may have patent exclusivities, influencing pricing and market access.

The regulatory environment has adopted increased scrutiny regarding antibiotic stewardship to curb resistance, which may impact prescription trends. Moreover, emerging restrictions on antibiotic use in livestock could influence overall demand [2].

Manufacturing and Supply Chain Dynamics

Major producers include Mylan, Teva Pharmaceuticals, and Sun Pharmaceutical Industries. Manufacturing costs for generic minocycline have decreased over the past decade due to technological advancements and global sourcing of raw materials.

Supply chain disruptions owing to geopolitical issues, pandemics, or raw material shortages could temporarily impact pricing and availability, but these are typically short-term.

Key Competitive Factors

- Efficacy and Resistance: Rising bacterial resistance demands continuous development of formulations with enhanced potency.

- Formulation Diversity: Availability of intravenous, oral, and topical formulations broadens market applications.

- Pricing Strategies: Generics dominate the scene; therefore, price competition is intense, especially in cost-sensitive markets.

Market Drivers and Constraints

Demand Drivers

- Acne Treatment: Minocycline is a first-line oral therapy for moderate to severe inflammatory acne, notably in adolescents and young adults.

- Resistant Infections: Its efficacy against multi-drug resistant strains bolsters demand in hospital and outpatient settings.

- Expanding Indications: Research advances into conditions such as neurosyphilis and anthrax treatment sustain its relevance.

Constraints

- Antibiotic Resistance: Increased resistance reduces clinical efficacy, possibly leading to reduced prescription volumes.

- Regulatory Restrictions: Stewardship policies limit overuse, especially in agriculture, which may constrain market growth.

- Competitors: Emergence of newer antibiotics with improved safety profiles and resistance profiles challenge minocycline’s market share.

Price Projections (2023-2033)

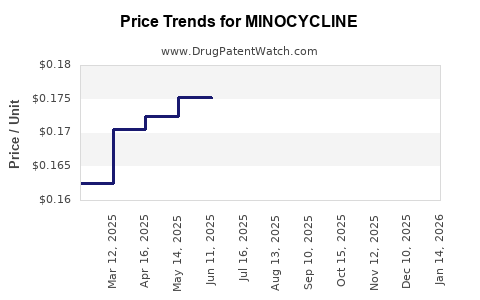

Current Pricing Landscape

The average retail price of branded minocycline 100 mg capsules in the U.S. ranges from USD 100-150 per 30-capsule bottle. Generic prices are significantly lower, often below USD 20-30 per bottle, owing to market competition.

Importantly, pricing varies across regions: in Europe, tariffs, taxes, and regulatory costs inflate prices by 10-30%. In developing markets, prices can drop below USD 10 due to local manufacturing and regulatory policies.

Forecasted Price Trends

-

Short-term (2023–2025): Due to the saturation of generic markets and stable demand, prices are expected to remain relatively steady, with minor fluctuations resulting from manufacturing costs and raw material prices.

-

Mid-term (2026–2030): Market saturation and intensified generic competition will exert downward pressure, driving prices lower—projected decreases of 10-15% in developed markets. However, formulations with extended-release or combination therapies may command premiums.

-

Long-term (2031–2033): Emergent resistance patterns and potential regulatory restrictions may limit prescription volumes for minocycline, leading to price stabilization or slight increases for premium formulations or in markets with limited substitutes.

Influencing Factors

-

Patent Expiry and Generics: Patent expiry in most jurisdictions in the late 2010s transitioned the market into a heavily commoditized space, exerting downward pricing pressure.

-

Emerging Resistance: As resistance undermines efficacy, demand may diminish, possibly causing price erosion unless new formulations or indications are developed.

-

Manufacturing Cost Dynamics: Continued technological improvements and raw material sourcing cost reductions could further lower production costs, translating to lower retail prices.

-

Healthcare Policy and Antibiotic Stewardship: Policies promoting judicious antibiotic use may limit overprescription, constraining demand growth but stabilizing prices in mature markets.

Regional Analysis

North America

Market is mature, with high generic penetration. Prices are stable but pressured downward by competition. Investment in new formulations or combination therapies could offer premium pricing opportunities.

Europe

Regulatory constraints and high healthcare standards restrict overuse, which maintains stable demand but limits price inflation.

Asia-Pacific

Rapid economic growth and expanding healthcare infrastructure foster increased demand. Local manufacturing and regulatory relaxations can potentially lead to lower prices, increasing accessibility.

Emerging Markets

Cost remains a significant barrier; thus, price points are lower, but growth prospects are high due to unmet needs and improved distribution channels.

Future Opportunities and Risks

Opportunities

- Development of novel formulations—such as topical gels or long-acting injectables—may command premium prices.

- Expanding indications through clinical research can open new markets.

- Strategic alliances with local manufacturers can optimize costs and improve penetration in emerging markets.

Risks

- Rising resistance may diminish clinical utility, reducing demand.

- Regulatory hurdles in key markets can delay or restrict sales.

- Competitive pressure from newer antibiotics with superior safety profiles can erode market share and pricing power.

Conclusion

Minocycline remains a clinically relevant antibiotic with steady demand, especially for acne and resistant infections. Its market is predominantly driven by generics in mature markets, constraining long-term price increases. However, innovative formulations and new indications present opportunities to sustain profitability. Price trends will likely reflect competitive dynamics, resistance patterns, and regulatory evolution, with prices stabilizing or declining modestly in the coming decade.

Key Takeaways

- The global minocycline market is mature with high generic penetration, exerting downward pressure on prices.

- Pricing in developed regions is stable but susceptible to further declines; emerging markets offer growth through lower price points.

- Innovations in formulations and expanding indications are critical to maintaining profitability amid resistance and competition.

- Regulatory policies emphasizing antibiotic stewardship could constrain demand but also solidify minocycline’s niche in specific therapeutic areas.

- Stakeholders should prioritize research into resistance-resistant formulations and strategic region-specific market entries for sustained growth.

FAQs

1. How will rising antibiotic resistance affect minocycline demand?

Increased resistance may diminish minocycline’s efficacy for some infections, potentially reducing its prescription volume. Conversely, ongoing research into resistance-resistant formulations and new indications could sustain or boost demand in specialized cases.

2. Are there any patent protections that could influence pricing?

Most patent protections for minocycline have expired globally. The market is primarily composed of generics, leading to intense price competition and limited ability for brand-name products to command premium prices.

3. How do regional differences impact minocycline pricing?

Pricing varies significantly, with Western markets exhibiting higher prices due to regulatory costs and healthcare standards, while economies in Asia and Africa benefit from lower manufacturing and distribution costs, resulting in more affordable prices.

4. What role do new formulations play in future market prospects?

Formulations like long-acting injectables or topical combinations could create niche markets and allow for higher pricing, offsetting reduced demand due to resistance and stewardship policies.

5. What are the key risks for investors in the minocycline market?

Risks include rising resistance reducing clinical utility, regulatory restrictions limiting markets, and intense competition from newer antibiotics that may offer better safety and efficacy profiles.

References

[1] Global Antibiotic Market Report 2022, MarketsandMarkets.

[2] FDA Antibiotic Stewardship Policies, 2022.