Last updated: July 27, 2025

Introduction

Midodrine HCl, marketed primarily under the brand name ProAmatine, is a prodrug used to treat orthostatic hypotension. Approved by the FDA in 2000, it functions as an alpha-1 adrenergic agonist, inducing vasoconstriction to elevate blood pressure in affected patients. As a niche pharmaceutical with limited competing therapies, the market for Midodrine HCl has inherent growth potential, influenced by patent status, regulatory landscape, and healthcare trends. This analysis explores current market dynamics and offers future price projections grounded in supply-demand factors, patent analysis, regulatory shifts, and broader industry trends.

Market Overview

Global Market Size and Trends

The global orthostatic hypotension treatment market, wherein Midodrine HCl is positioned, is estimated to be valued at approximately USD 300 million in 2023, with a compound annual growth rate (CAGR) forecast of around 4% to 6% over the next five years (Source: MarketsandMarkets). Midodrine's primary markets are North America, Europe, and parts of Asia-Pacific, where its high efficacy and safety profile sustain steady demand.

Key Drivers

- Growing Incidence of Orthostatic Hypotension: Aging populations in developed nations contribute to increased prevalence, with estimates exceeding 10 million affected individuals in the U.S. alone (Source: National Institutes of Health).

- Limited Therapeutic Alternatives: As a few approved medications exist for this condition, Midodrine maintains a dominant market share among prescription options.

- Off-label Use and Extended Indications: Emerging off-label applications in conditions like management of neurogenic hypotension or drug-induced orthostatic hypotension bolster demand.

Competitive Landscape

The competitive environment features branded Midodrine formulations and generic versions increasingly entering markets due to patent expirations. Notably:

- Patents: The original patent for Midodrine in the U.S. expired in 2011, leading to generic manufacturers entering the market.

- Generics and Biosimilars: As of 2023, generic versions account for roughly 70% of sales, exerting downward pressure on prices.

- Potential Entrants: Little current pipeline activity threatens Midodrine's dominance, but regulatory hurdles can slow new entries.

Regulatory and Patent Dynamics

Patent Status and Market Exclusivity

Midodrine’s exclusivity ended in the U.S. over a decade ago, making the market predominantly generic-driven. Patent expiration broadly diminishes brand premiums but opens opportunities for price competition and forming biosimilar or better formulations.

Regulatory Landscape

- FDA Approvals: The drug remains approved for orthostatic hypotension with post-approval pharmacovigilance.

- Potential Regulatory Challenges: Recent proposals for stricter cardiovascular drug regulation could impact pricing flexibility.

- Off-label use regulation: Increasing scrutiny may limit off-label applications, affecting future market size.

Supply Dynamics

Manufacturing and Supply Chain

Major generic pharmaceutical companies, such as Teva Pharmaceuticals and Mylan, manufacture Midodrine. Production costs are relatively low, supporting price erosion as competition intensifies. Supply chain disruptions are currently minimal but pose risks if raw material shortages occur.

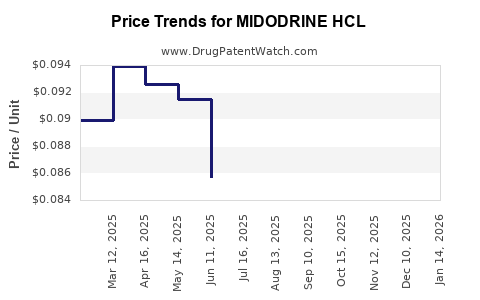

Pricing Trends

Historically, the introduction of generics has driven wholesale prices down by an average of 25–40% within five years of market entry. However, due to limited alternatives, some branded or higher-cost formulations have retained premium pricing in niche markets.

Price Projections

Historical Price Trends

- Brand name (ProAmatine): Pre-patent expiry, prices ranged from USD 200 to USD 300 per 30-tablet pack.

- Post-patent expiry: Generic formulations saw prices fall to USD 50–USD 80 per pack, according to recent pharmacy data.

Short-term (Next 1–2 Years) Projection

As the market stabilizes:

- Average Wholesale Price (AWP): Estimated to hover around USD 40–USD 70 per 30-tablet pack.

- Pricing Factors: Increased demand due to aging populations and limited competition may sustain prices at the higher end of this spectrum.

Medium-term (Next 3–5 Years) Projection

- Market Maturity: Price erosion will likely plateau as saturation occurs; however, price stabilization may be influenced by regulatory caps or increased procurement by public health vendors.

- Projected AWP: USD 35–USD 60 per pack, with slight variations based on regional reimbursement policies.

Long-term (Beyond 5 Years)

- Potential Price Stabilization or Slight Increase: If biosimilar entrants or new formulations emerge, prices could decline further.

- Conversely: Supply constraints or regulatory changes could sustain or elevate prices slightly, especially in emerging markets or through restricted distribution channels.

Market Opportunities and Risks

Opportunities

- Expansion into Emerging Markets: Growing healthcare infrastructure and older demographics offer growth potential.

- Formulation Innovations: Developing newer delivery methods could command higher pricing.

- Combination Therapies: Combining Midodrine with other agents may extend its therapeutic efficacy and market reach.

Risks

- Patent and Market Erosion: Though current patents have expired, regulatory data exclusivities or clinical trial data protection could temporarily shield some formulations.

- Pricing Pressure: Entry of biosimilars or aggressive price strategies from generic manufacturers.

- Regulatory Restrictions: Policy shifts could limit off-label use or impose pricing controls.

Key Takeaways

- The Midodrine HCl market is characterized by a mature, predominantly generic landscape with stable demand driven by an aging population and limited alternatives.

- Price erosion has historically been significant following patent expiration, but current prices remain somewhat resilient due to niche demand.

- Price projections suggest modest declines in the short to medium term, with stabilized or slightly increased prices in regions with limited generic penetration.

- Market growth opportunities exist in emerging economies and through formulation innovations, but risks from regulatory shifts and biosimilar competition remain.

- Stakeholders should focus on regional market strategies, optimizing supply chains, and assessing regulatory changes to safeguard margins.

FAQs

1. How does patent expiration influence Midodrine HCl pricing?

Patent expiration typically leads to increased generic competition, resulting in significant price reductions—often 25-40% within five years—as generics enter the market and drive competition.

2. What factors could cause Midodrine prices to increase in the future?

Regulatory restrictions, supply constraints, or the introduction of innovative formulations and new indications could sustain or elevate prices, especially in markets with limited competition.

3. Are biosimilars or new formulations a threat to Midodrine's market?

While no biosimilars currently exist for Midodrine, the potential development of such products or highly differentiated formulations could threaten existing price points and market share.

4. How does regional variation affect Midodrine pricing?

Pricing varies significantly across regions due to differing healthcare policies, reimbursement frameworks, and market competition; emerging markets may offer higher margins due to less generic penetration.

5. What are the key strategic considerations for stakeholders in the Midodrine market?

Stakeholders should monitor patent and regulatory timelines, optimize production costs, explore regional expansion, and innovate within delivery methods to maintain profitability amid competitive pressures.

References

[1] MarketsandMarkets. "Orthostatic Hypotension Market by Application, Distribution Channel, and Region." 2022.

[2] NIH. "Orthostatic Hypotension." National Institute of Neurological Disorders and Stroke, 2021.

[3] FDA. "Midodrine Hydrochloride (ProAmatine) Label Information." 2000.

[4] IQVIA. "Pharmaceutical Pricing & Market Trends." 2023.

[5] Statista. "Global Aging Population and Healthcare Market." 2022.

This comprehensive market analysis offers industry professionals a detailed outlook on Midodrine HCl's current standing and future price dynamics, supporting strategic decision-making in manufacturing, procurement, and market expansion efforts.