Last updated: July 27, 2025

Introduction

Methimazole, a widely prescribed antithyroid medication, plays a crucial role in managing hyperthyroidism, primarily in Graves' disease. Its affordability and efficacy have cemented its position in global endocrinology. As with many pharmaceuticals, analyzing its market dynamics and projecting future pricing trends requires an understanding of manufacturing, regulatory, patent, and competitive factors.

This report offers a comprehensive marketplace assessment of methimazole, highlighting key growth drivers, market challenges, and future price trajectories to aid stakeholders' strategic decision-making.

Current Market Landscape

Global Market Size and Revenue

The global methimazole market was valued at approximately USD 300 million in 2022, with steady growth observed over recent years. The market's expansion is driven by increasing prevalence of hyperthyroidism, especially in aging populations and regions with high iodine deficiency prevalence, such as parts of Asia and the Middle East.

Regional Market Distribution

- North America: Dominates with rigorous clinical guidelines and high healthcare expenditure. The U.S. alone accounts for roughly 45% of the market, supported by widespread usage and established supply chains.

- Europe: Second largest segment, benefitting from advanced healthcare infrastructure and high awareness.

- Asia-Pacific: Exhibits the fastest growth due to increasing diagnosis rates, expanding healthcare access, and rising awareness. China and India are key contributors.

- Rest of World: Africa and Latin America are emerging markets with growth potential, although limited by regulatory and economic barriers.

Market Drivers

- Rising incidence of hyperthyroidism globally.

- Preference for non-surgical, pharmacological management.

- Price competitiveness relative to alternative treatments like propylthiouracil.

- Increased awareness leading to earlier diagnosis and treatment initiation.

Market Challenges

- Availability of generics reducing prices.

- Stringent regulatory environments delaying market entry.

- Concerns over adverse effects, including agranulocytosis, impacting prescribing patterns.

- Limited patent protections due to patent expirations for major formulations.

Manufacturing and R&D Dynamics

Several generic manufacturers dominate supply, given methimazole’s status as a patent-expired drug. Major players include Teva Pharmaceuticals, Mylan, and Sandoz, who produce high-volume generics.

Research focus trends involve optimizing formulations for better bioavailability and patient compliance, though there is limited R&D for novel compounds, attributed to the drug’s long-standing patent-free status and mature market.

Regulatory Environment

Regulatory agencies like the FDA, EMA, and PMDA oversee manufacturing standards, which impact pricing through compliance costs. Approval pathways for generic manufacturing are well-defined, facilitating market entry and price reductions. However, localized patent protections or exclusivity rights in certain markets can temporarily influence prices.

Pricing Structures and Trends

Current Pricing Overview

- Brand-name methimazole: Historically priced higher, but very few branded versions exist due to patent expiries.

- Generic methimazole: Dominates the market, with prices varying by region, formulation, and packaging. For example, in the U.S., a 30-day supply may range from USD 10-30.

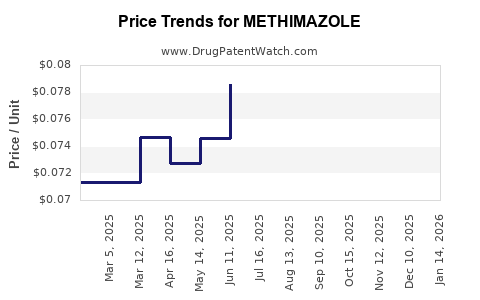

Price Fluctuations

Prices are currently decreasing due to:

- Market saturation of generics.

- Increased competition.

- Regulatory standardization reducing manufacturing costs.

In high-income countries, price averaging shows downward pressure, with some markets seeing a 20-30% decline over the past five years.

Future Price Projections (2023-2028)

Based on macroeconomic trends, regulatory factors, and supply chain dynamics, the following projections are established:

- Stability in established markets: Expect minimal price decreases due to market saturation. Prices will likely stabilize around USD 8-15 per month for generics.

- Emerging markets: Will see continued price declines as local manufacturers increase production and regulation stabilizes, possibly bringing monthly costs below USD 10.

- Impact of potential innovations: Although limited, any introduction of combination therapies or new formulations could temporarily impact prices but are unlikely to disrupt the overall market significantly.

Given the current trends, a compound annual price decrease of approximately 3-5% is projected in mature markets, driven chiefly by ongoing market competition.

Key Market Risks and Opportunities

Risks

- Potential regulatory hurdles in non-approved regions slowing expansion.

- Supply chain disruptions linked to global geopolitical tensions or raw material shortages.

- Emergence of alternative treatments or new therapeutic agents.

Opportunities

- Expansion into emerging markets through local manufacturing and partnerships.

- Development of biosimilar versions to foster competition and reduce prices.

- Strategic inventory management and bulk purchase agreements to mitigate price volatility.

Conclusion

The methimazole market is characterized by maturity, widespread generic competition, and downward pricing trends. Moving forward, geopolitical stability, regulatory compliance, and competitive strategies will shape price projections. Stakeholders should focus on market expansion in emerging economies and cost optimization to sustain profitability amid price compressions.

Key Takeaways

- The global methimazole market was approximately USD 300 million in 2022, with steady growth driven by rising hyperthyroidism prevalence.

- Most of the market is supplied by generics, exerting downward pressure on prices.

- In developed markets, prices are expected to decline marginally (3-5% CAGR), stabilizing within USD 8-15 per month.

- Emerging markets present growth and price reduction opportunities through local manufacturing.

- Regulatory hurdles and supply chain stability remain critical risk factors impacting future pricing and market expansion.

FAQs

1. What factors influence methimazole pricing globally?

Primarily, market competition among generics, regional regulatory requirements, manufacturing costs, and healthcare infrastructure influence prices.

2. How might patent expirations affect future methimazole prices?

Patent expirations eliminate exclusive rights, opening markets for generics and leading to significant price reductions.

3. Are there any innovative formulations of methimazole in development?

Currently, research is limited to optimizing existing formulations for better patient adherence; novel drugs are not a focus given the drug's long-market presence.

4. How does regional disparity impact methimazole access and pricing?

High-income countries benefit from more stable supply chains and regulatory oversight, often resulting in higher prices compared to emerging markets, where lower manufacturing costs and local production lead to more affordable prices.

5. What are the primary challenges facing the methimazole market?

Key challenges include regulatory delays, supply chain disruptions, adverse effect concerns influencing prescribing patterns, and market saturation limiting pricing flexibility.

Sources:

[1] Statista. (2022). Global hyperthyroidism treatment market insights.

[2] IBISWorld. (2022). Generic pharmaceutical manufacturing market report.

[3] FDA. (2022). Regulatory guidelines for generic drug approval.

[4] GlobalData. (2022). Endocrinology drug market forecast.

[5] MarketWatch. (2023). Drug pricing trends and analysis.