Share This Page

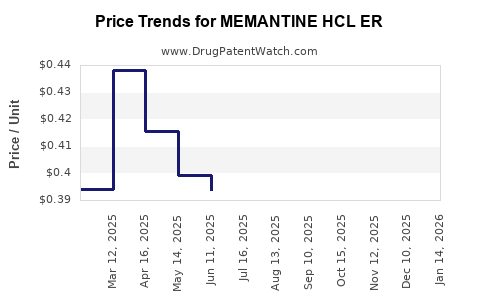

Drug Price Trends for MEMANTINE HCL ER

✉ Email this page to a colleague

Average Pharmacy Cost for MEMANTINE HCL ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MEMANTINE HCL ER 14 MG CAPSULE | 16571-0853-09 | 0.30398 | EACH | 2025-12-17 |

| MEMANTINE HCL ER 14 MG CAPSULE | 65162-0783-09 | 0.30398 | EACH | 2025-12-17 |

| MEMANTINE HCL ER 14 MG CAPSULE | 68180-0247-06 | 0.30398 | EACH | 2025-12-17 |

| MEMANTINE HCL ER 14 MG CAPSULE | 59651-0405-90 | 0.30398 | EACH | 2025-12-17 |

| MEMANTINE HCL ER 14 MG CAPSULE | 65162-0783-03 | 0.30398 | EACH | 2025-12-17 |

| MEMANTINE HCL ER 7 MG CAPSULE | 70436-0054-04 | 0.37567 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for Memantine HCl ER

Introduction

Memantine HCl Extended Release (ER) is a pharmaceutical agent extensively utilized in managing moderate to severe Alzheimer's disease. As a non-competitive NMDA receptor antagonist, Memantine HCl ER provides neuroprotective benefits by modulating glutamatergic activity, thus reducing neurodegeneration. This report explores the current market landscape, key drivers, competitive environment, regulatory factors, and forecasts pricing trends over the next five years to inform pharmaceutical stakeholders, investors, and healthcare providers.

Market Overview

The global Alzheimer's therapeutics market, wherein Memantine HCl ER operates, projected a valuation exceeding USD 6 billion in 2022, with expectations to reach USD 10 billion by 2030, growing at a CAGR of approximately 7% (source: Fortune Business Insights). Memantine constitutes a significant segment, supported by its advanced ER formulations, optimized bioavailability, and improved patient compliance relative to immediate-release (IR) variants.

The increasing prevalence of Alzheimer's disease, estimated to affect over 55 million globally in 2022 and projected to triple by 2050, underpins sustained demand for neuroprotective therapeutics like Memantine HCl ER (source: World Alzheimer Report). The aging population in North America, Europe, and parts of Asia-Pacific further sustains demand growth.

Key Market Segments and Geographies

- By Formulation: Extended Release (ER), Immediate Release (IR)

- By Distribution Channel: Hospital pharmacies, retail pharmacies, online pharmacies

- Geographies: North America (dominant), Europe, Asia-Pacific, Latin America, Middle East & Africa

North America's leadership in market share — over 45% as of 2022 — stems from advanced healthcare infrastructure, high awareness, and robust R&D investments. The Asia-Pacific region displays high growth potential due to demographic shifts and improving healthcare access.

Competitive Landscape

Major players manufacturing Memantine HCl ER include Eli Lilly and Company, Axsome Therapeutics, Teva Pharmaceutical Industries, and several generic suppliers. Eli Lilly's Namenda XR is among the most recognized branded formulations, reflecting large-scale manufacturing capabilities and global distribution networks.

Patent landscapes show that Eli Lilly's original patents for Namenda XR expired recently, leading to increased generic competition. Generics now account for an expanding market share, pressing prices downward but maintaining volume growth due to high demand.

Regulatory Approvals and Approvals

The FDA approved Namenda XR (Memantine HCl ER) in 2010, with subsequent approvals in Europe and other jurisdictions. Regulatory pathways for generics are streamlined following patent expirations, fostering increased competition.

Pricing Dynamics and Current Market Prices

Pricing for Memantine HCl ER varies significantly across regions. In the US, branded Namenda XR's average retail price ranges approximately from USD 4.50 to USD 6.50 per 28-day supply (30 mg daily dose). Generic versions, however, reduce costs substantially—sometimes less than USD 1 per 30 tablets. In European markets, prices similar to US generic prices prevail, whereas in Asia-Pacific, prices are generally lower due to local market dynamics and healthcare reimbursement policies.

Factors Influencing Prices:

- Patent status: Branded drugs command higher prices; generics exert downward pressure post-patent expiry.

- Manufacturing costs: Economies of scale benefit larger generics producers.

- Reimbursement policies: Coverage varies by country; higher reimbursement often correlates with higher list prices.

- Market penetration: Increased generic entry causes price erosion.

- Distribution channels: Online and mail-order pharmacies tend to offer lower prices.

Price Projections (2023-2028)

Given the current landscape, the following projections are anticipated:

-

Branded Memantine HCl ER (Namenda XR): Expect a decline of approximately 15-20% annually over the next five years due to patent expirations and generic entry, stabilizing at an estimated USD 2.50 to USD 3.50 per 28-day supply by 2028.

-

Generic Memantine HCl ER: Prices are projected to reduce further and stabilize around USD 0.50 to USD 1.00 per 30 tablets by 2028, driven by increased manufacturing capacity and market saturation.

-

Emerging markets: Prices will remain lower, generally between USD 0.20 to USD 0.75 per dose, but contingent on local healthcare policies and the pace of generic adoption.

-

Premium formulations or combination therapies**: Possible stabilization at higher price points due to added value, but less likely to impact core Memantine ER pricing.

Factors Contributing to Price Trends:

- Patent expirations in key markets (US, Europe) accelerate generic penetration.

- Market expansion into developing countries introduces pricing variations.

- Regulatory initiatives encouraging biosimilar and generic proliferation.

- Healthcare cost containment policies, especially in North America and Europe, pressure pricing downward.

Regulatory and Market Access Considerations

Regulatory approval processes now favor generic developers with abbreviated new drug application (ANDA) pathways, thus decreasing time to market and lowering entry barriers. Market access depends heavily on national reimbursement policies, with increasing adoption in public health programs driving volume over price.

In some regions, price erosion is mitigated by market share retention tactics such as value-added formulations (e.g., controlled-release enhancements or fixed-dose combinations). Additionally, health technology assessments (HTAs) influence reimbursement and subsequently, pricing.

Key Drivers and Challenges

Drivers:

- Rising prevalence of Alzheimer’s disease

- Patent expirations and generic competition

- Expanding healthcare infrastructure in emerging markets

- Increasing geriatric population globally

- Advancement in formulation technology (improved ER formulations)

Challenges:

- High generic market saturation leading to price wars

- Pricing pressures from national healthcare systems

- Potential regulatory hurdles for new formulations

- Variability in healthcare reimbursement policies

Summary and Business Implications

Pharmaceutical companies with patent rights or innovative formulations have the opportunity to capitalize on premium pricing temporarily before generics saturate the market. Investment in R&D for improved formulations or combination therapies could preserve lucrative margins amid aggressive price erosion.

Healthcare providers and payers should monitor evolving price trends to optimize formulary decisions. Cost-effective access, especially in developing regions, hinges on strategic partnerships with generic manufacturers and adaptation to local regulatory environments.

Key Takeaways

- Patent expirations have triggered significant price reductions for Memantine HCl ER, with branded formulations experiencing around 20% annual decline.

- Generic versions are poised to dominate market share, with prices projected to stabilize near USD 0.50 – USD 1.00 per 30 tablets by 2028.

- Market expansion in Asia-Pacific and Latin America will influence regional prices and access, leveraging lower cost structures.

- Regulatory policies favor rapid approval of generics, accelerating price declines but ensuring broader patient access.

- Innovation opportunities include developing combination therapies or extended-release formulations that offer clinical benefits, potentially sustaining higher prices.

Strategic Insights for stakeholders include focusing on patent management, differentiation through innovative formulations, and navigating regional reimbursement landscapes.

FAQs

-

What is the primary driver for Memantine HCl ER market growth?

The increasing global prevalence of Alzheimer’s disease and the aging population are primary growth drivers, creating sustained demand for neuroprotective medications like Memantine ER. -

How does patent expiration impact Memantine HCl ER pricing?

Patent expirations enable the entry of generics, significantly reducing prices and increasing market accessibility, while diminishing revenues for original branded formulations. -

What regional factors influence Memantine HCl ER pricing?

Pricing varies with regional healthcare policies, reimbursement systems, regulatory approval processes, and manufacturing cost structures. North America and Europe generally command higher prices than emerging markets. -

Will the price of generic Memantine HCl ER ever increase again?

Typically, generic drug prices decline following market entry; however, scarcity, formulation improvements, or supply chain disruptions can cause temporary price increases. -

What are future innovation opportunities for Memantine formulations?

Developing fixed-dose combinations, sustained-release systems with enhanced bioavailability, or combination with other neuroprotective agents can provide competitive advantages and justify premium pricing.

Sources

[1] Fortune Business Insights, "Alzheimer's Therapeutics Market Size, Share & Industry Analysis," 2022.

[2] World Alzheimer Report, Alzheimer’s Disease International, 2022.

[3] U.S. FDA, Approved Drugs Database, 2010.

[4] IQVIA, National Prescription Data, 2022.

[5] Market Research Future, "Global Alzheimer’s Therapeutics Market Analysis," 2022.

More… ↓