Last updated: July 27, 2025

Introduction

Levonorgestrel, a synthetic progestogen widely used in contraception and emergency contraception, occupies a significant position in the global reproductive health market. This analysis explores the current market landscape, competitive dynamics, regulatory considerations, and future price projections for levonorgestrel-based products, providing stakeholders with an authoritative guide to strategic decision-making.

Market Overview

Product Portfolio and Applications

Levonorgestrel is primarily marketed as a key ingredient in oral contraceptives and emergency contraceptive pills (ECPs). The product's versatility and efficacy have secured its place across various markets. Major formulations include daily oral pills like Mirena, Levora, and Plan B One-Step, as well as intrauterine devices (IUDs) such as Skyla, which contain levonorgestrel for long-term contraception.

Global Market Size

The global reproductive health market, encompassing contraception, fertility, and reproductive diagnostics, was valued at approximately USD 27 billion in 2022, with hormonal contraceptives constituting roughly 60% of this segment[1]. Levonorgestrel's subset within this space has exhibited steady growth, driven by increasing awareness, expanding healthcare infrastructure, and shifting societal attitudes toward family planning.

Key Geographic Markets

- North America: The largest market, driven by high contraceptive prevalence, regulatory support, and extensive healthcare coverage.

- Europe: Moderate growth, supported by mature healthcare systems and public health initiatives.

- Asia-Pacific: The fastest-growing region, with rising demand for affordable contraception and expanding awareness campaigns.

- Latin America and Africa: Emerging markets with increasing acceptance of hormonal contraceptives, but facing barriers like regulatory hurdles and affordability challenges.

Competitive Landscape

Major Players

The market is characterized by a mix of pharmaceutical giants and generic manufacturers:

- Pfizer Inc.: With a robust portfolio of contraceptive brands, including those containing levonorgestrel.

- Bayer AG: Long-standing manufacturer with diversified reproductive health products.

- Schwarz Pharma (powered by Teva): A leader in generic levonorgestrel formulations.

- MNCs (Multinational Corporations): Entering the market with biosimilar or low-cost generics targeting emerging markets.

Generic and Biosimilar Entrants

In recent years, the proliferation of generics has driven price competition, particularly in markets like India, China, and Latin America. The entry of biosimilars and off-patent formulations has reduced prices significantly, pressuring branded product margins.

Research & Development Trends

Innovations focus on long-acting reversible contraceptives (LARCs), such as hormonal IUDs, with improved delivery mechanisms, duration, and safety profiles. This evolution influences demand and pricing strategies.

Regulatory Environment

Regulatory Approvals

- United States (FDA): Levonorgestrel-based ECPs like Plan B One-Step are approved and widely available.

- European Medicines Agency (EMA): Approved formulations and regional variations influence market entry.

- Emerging Markets: Varying approval timelines impact availability and price setting.

Pricing and Reimbursement Policies

Government subsidies, insurance coverage, and public health programs substantially influence pricing strategies, especially in the U.S. and Europe. In low- and middle-income countries, affordability remains a key obstacle, impacting both volume and pricing.

Market Trends Impacting Price Dynamics

Increasing Competition and Patent Expiry

Patent expiration of key levonorgestrel formulations has prompted an influx of generics, reducing average selling prices (ASP) across markets.

Shift Toward Long-Acting Contraceptive Devices

The rising preference for IUDs and subdermal implants containing levonorgestrel suggests a shift in demand from traditional pills, influencing pricing structures due to differences in manufacturing and distribution costs.

Emerging Markets Growth

Price sensitivity in emerging markets combined with government procurement programs fosters a highly competitive environment, exerting downward pressure on prices.

Regulatory and Patent Extensions

Patent extensions and regulatory data exclusivity in certain jurisdictions can temporarily sustain higher prices for branded formulations, delaying generic entry.

Price Projections (2023–2030)

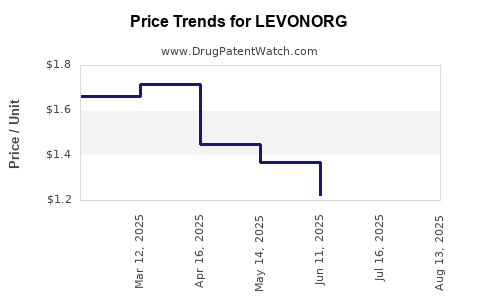

Current Price Benchmarks

- Oral Contraception (Brand): USD 30-50 per cycle in mature markets.

- Generic Levonorgestrel (per pill): USD 0.10-0.50, depending on region.

- Emergency Contraceptive (Brand): USD 35-55 per pack.

- Generic ECPs: USD 10-20 per pack in emerging markets.

Forecasted Trends

-

Price Decreases Due to Generic Competition

The expiration of patents on key formulations by 2024–2026 will lead to a significant price decline, notably in the U.S. and Europe. It is projected that generic prices could reduce by approximately 40-60% within five years post-patent expiry[2].

-

Rise in Long-Acting Methods

As demand shifts toward IUDs and implants, prices for levonorgestrel-containing devices are expected to stabilize or increase modestly due to higher manufacturing complexities and longer durations of efficacy.

-

Market Penetration in Emerging Economies

Lower-cost generics are set to dominate markets like India, Southeast Asia, and parts of Africa, with prices as low as USD 0.05–0.10 per dose. This will create volume-driven growth rather than price-driven revenue increases.

-

Impact of Regulatory and Policy Changes

Reimbursement schemes and healthcare policies extending coverage can sustain or elevate prices, particularly in public health systems.

-

Innovation and Differentiation

Next-generation formulations emphasizing safety, delivery, or user convenience could command premium prices, offsetting declines elsewhere.

Overall Price Outlook:

- In mature markets, prices for branded levonorgestrel products are expected to decline by 30-50% over the next five years, reaching USD 15-25 per cycle on average.

- Generic prices in emerging markets could decrease by as much as 60-70%, settling around USD 0.05–0.15 per dose.

- Long-acting formulations may see stable or slightly increased prices reflecting technological advancements.

Market Drivers and Risks

Drivers:

- Rising awareness and acceptance of hormonal contraception.

- Expanding healthcare infrastructure in emerging markets.

- Regulatory approvals facilitating broader access.

- Innovations in delivery systems increasing product appeal.

Risks:

- Regulatory delays or restrictions.

- Price erosion from aggressive generic competition.

- Changes in reimbursement policies.

- Sociopolitical factors impacting healthcare spending.

Key Takeaways

- The levonorgestrel market is poised for revenue compression in mature markets due to patent expirations and generic proliferation.

- Emerging markets represent a significant growth opportunity, favoring low-cost generic formulations.

- Innovation in long-acting delivery systems may stabilize or slightly increase prices, particularly in developed markets.

- Stakeholders should monitor regulatory timelines and patent statuses closely to optimize product positioning.

- Price sensitivity in developing regions necessitates flexible, tiered pricing strategies to maximize reach and profitability.

FAQs

1. When are key patents for levonorgestrel formulations set to expire?

Most patents for branded levonorgestrel contraceptives are expected to expire between 2024 and 2026, opening the market for generic competition[2].

2. How will increasing generics influence global pricing?

Generic entry is anticipated to drive down average prices by 40-70%, especially in markets with high regulatory standards and competitive procurement processes.

3. What is the potential for long-acting levonorgestrel products?

Long-acting devices like hormonal IUDs and implants are gaining popularity; their prices are stable or rising moderately due to manufacturing complexity and prolonged efficacy.

4. Which regions offer the most growth opportunities for levonorgestrel-based contraceptives?

Emerging economies in Asia-Pacific, Africa, and Latin America present substantial growth due to increasing contraceptive demand and price-sensitive markets.

5. How do regulatory policies impact levonorgestrel pricing?

Regulatory approvals, reimbursement schemes, and pricing controls significantly influence product accessibility and profit margins across different jurisdictions.

References

[1] MarketResearch.com, "Global Reproductive Health Market Analysis," 2022.

[2] IQVIA, "Pharmaceutical Patent Expiry and Market Dynamics," 2023.