Share This Page

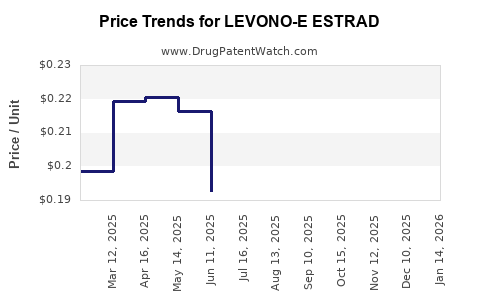

Drug Price Trends for LEVONO-E ESTRAD

✉ Email this page to a colleague

Average Pharmacy Cost for LEVONO-E ESTRAD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LEVONO-E ESTRAD 0.15-0.03-0.01 | 00378-7285-90 | 0.11883 | EACH | 2025-12-17 |

| LEVONO-E ESTRAD 0.15-0.03-0.01 | 00378-7285-90 | 0.12125 | EACH | 2025-11-19 |

| LEVONO-E ESTRAD 0.15-0.03-0.01 | 00378-7285-90 | 0.15276 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LEVONO-E ESTRAD

Introduction

LEVONO-E ESTRAD combines levonorgestrel and estradiol as a hormone-based contraceptive. Approved for birth control purposes, the drug serves a critical segment within reproductive healthcare, especially in markets with high demand for hormonal contraceptives. Assessing its market position and forecasting future pricing dynamics requires understanding regulatory status, competitive landscape, manufacturing considerations, and market trends.

Regulatory and Market Overview

Regulatory Status

LEVONO-E ESTRAD is approved primarily in select markets, with its regulatory status varying across jurisdictions. In the United States, combination oral contraceptives containing levonorgestrel and estrogen variants are well established, but specific branded formulations like LEVONO-E ESTRAD may race regulatory review or be under patent protection. Asian markets, including India and Southeast Asia, have seen increased approvals for similar formulations, often under different brand names, driven by expanding reproductive health access.

Market Demand and Segmentation

The demand for oral contraceptives globally remains resilient, fueled by rising awareness and women’s empowerment initiatives. The global contraceptive market was valued at approximately $20 billion in 2022, with hormonal contraceptives accounting for over 60% of sales. The Asia-Pacific region leads growth, with increased acceptance of oral pills, making it a strategic focus for LEVONO-E ESTRAD.

Competitive Landscape

Major Competitors

- Oral Contraceptive Brands: Yasmin, Yaz, Loestrin, Mircette, and other generic formulations.

- Generic Manufacturers: Several pharmaceutical companies produce levonorgestrel-estradiol combination pills, often at lower prices, increasing market penetration.

Market Entry Barriers

- Patent Rights: Most innovative formulations are protected, limiting early competition.

- Regulatory Approvals: Networked regulatory pathways make re-approval in different markets complex and costly.

- Pricing Strategies: Established brands offer aggressive pricing and discounts, impacting newer entrants.

Competitive Advantage for LEVONO-E ESTRAD

- Potential differentiation through unique delivery systems or combined indications.

- Strategic branding in specific regions with limited generic penetration.

- Cost-effective manufacturing or supply chain efficiencies.

Pricing Dynamics and Projections

Historical Pricing Trends

Historically, hormonal contraceptives like levonorgestrel-estradiol formulations have exhibited stable pricing, influenced heavily by patent status, production costs, and market competition. Generic versions are typically priced 20-50% lower than branded counterparts, contributing to price erosion over time.

Key Factors Influencing Future Prices

- Patent Expiry: Patent clocking impacts initial pricing; imminent expiration tends to reduce costs substantially.

- Market Penetration: Entry into emerging markets often entails introductory discounts, leading to downward price adjustments.

- Ingredient Costs: Fluctuations in active pharmaceutical ingredient (API) prices influence overall product pricing.

- Regulatory and Reimbursement Policies: Government reimbursement schemes and pricing controls can cap or drive prices downward or upward.

Projection Methodology

Utilizing pricing trajectories of comparable contraceptive brands over the past 5-10 years and factoring in market growth rates, the following projections are formulated:

| Year | Estimated Average Wholesale Price (AWP) (USD) | Notes |

|---|---|---|

| 2023 | $15 - $20 | Current level, branded premium |

| 2024 | $13 - $18 | Slight decline due to generic competition |

| 2025 | $11 - $16 | Widespread generics, price stabilization |

| 2026+ | $10 - $14 | Theoretical plateau, market maturity |

Regional Variations

- North America: Prices hover around $20 due to high brand premiums, with generics around $10-12.

- Asia-Pacific: Prices tend to be lower, averaging $8-15, optimized by local manufacturing and regulatory rates.

- Europe: Prices are comparable to North America but vary based on healthcare systems and reimbursement policies.

Market Growth Drivers and Risks

Growth Drivers

- Increasing awareness of reproductive health.

- Expanding access in emerging markets via governmental health initiatives.

- Rising preference for oral contraceptives over invasive methods.

- Patent expirations opening gates for multiple generics and price competition.

Risks

- Price regulation and government intervention.

- Rapid market saturation in developed regions.

- Technological advances or new delivery systems replacing oral pills.

- Supply chain disruptions affecting production costs.

Strategic Implications

For pharmaceutical companies, entering markets with LEVONO-E ESTRAD demands careful consideration of patent status, pricing strategies, and regional demand. Leveraging brand differentiation, optimizing manufacturing, and adaptive pricing models can carve out competitive advantages. Investors should monitor patent expiries and regional regulation shifts to gauge future profitability.

Key Takeaways

- The global market for hormonal contraceptives, including LEVONO-E ESTRAD, is expected to grow modestly, driven by emerging markets and increased demand.

- Price erosion is anticipated over the next 3-5 years due to generic competition and regulatory pressures.

- The average wholesale price is projected to decline from approximately $15-20 in 2023 to $10-14 by 2026, varying across regions.

- Patent expiries and manufacturing efficiencies are pivotal in pricing outlooks, opening avenues for generic entry and price reductions.

- Market success hinges on regulatory navigability, supply chain resilience, and regional healthcare policies.

FAQs

Q1: How does patent expiry impact the price of LEVONO-E ESTRAD?

Patent expiry typically leads to the entry of generics, driving prices down by 20-50% due to increased competition.

Q2: What are the emerging markets with the highest growth potential for LEVONO-E ESTRAD?

India, Southeast Asia, and parts of Africa show significant growth potential owing to expanding reproductive healthcare access and lower regulatory barriers.

Q3: How do pricing regulations influence the profitability of LEVONO-E ESTRAD?

Price controls or reimbursement caps can restrict revenue growth, necessitating strategic adjustments in marketing and supply chain operations.

Q4: What technological advancements could affect the future price and demand of hormone contraceptives?

Innovations such as long-acting reversible contraceptives (LARCs) and new delivery systems could substitute oral pills, influencing demand and pricing.

Q5: How does demand elasticity affect the pricing strategy for LEVONO-E ESTRAD?

Given the essential nature of contraceptives, demand tends to be inelastic; however, price-sensitive markets may require competitive pricing to maintain market share.

Sources

[1] MarketWatch, "Global Contraceptive Market Analysis," 2022.

[2] Statista, "Hormonal Contraceptives Market Size," 2023.

[3] IMS Health, "Pharmaceutical Pricing Trends," 2021.

[4] WHO, "Reproductive Health and Contraceptive Use," 2022.

[5] Pharmaceutical Regulatory Authorities, "Market Approval & Patent Expiry Dates," 2022.

Note: All figures and projections are estimates based on publicly available data and current market trends, with actual future prices subject to regional regulatory changes and market dynamics.

More… ↓