Last updated: July 27, 2025

Introduction

Lamotrigine, marketed as LAMICTAL, is a widely prescribed anticonvulsant and mood-stabilizing drug developed by GlaxoSmithKline (GSK) and subsequently acquired by Sunovion Pharmaceuticals. Approved by the U.S. Food and Drug Administration (FDA) in 1994, LAMICTAL is primarily indicated for the treatment of epilepsy and bipolar disorder, embodying a distinctive position within the neuropsychiatric pharmacotherapy market. Its unique mechanism of action, reputable safety profile, and expanding indications contribute to its resilient market presence.

This comprehensive analysis delves into the current market landscape, competitive dynamics, regulatory factors, and future price trajectories for LAMICTAL, providing insights essential for pharmaceutical stakeholders, investors, and healthcare professionals.

Market Overview

Demand Drivers

The global demand for LAMICTAL is driven by its indications in epilepsy and bipolar disorder:

- Epilepsy: Affects approximately 50 million people worldwide, with a significant subset requiring chronic anticonvulsant therapy [[1]].

- Bipolar Disorder: Estimated to impact 45 million individuals globally, with mood stabilizers like lamotrigine serving as cornerstone treatments [[2]]].

The increasing prevalence of neurological and psychiatric disorders, alongside awareness and diagnosis rates, sustains consistent demand for LAMICTAL.

Market Penetration and Adoption

In North America and Europe, LAMICTAL boasts high market penetration due to its efficacy and favorable side-effect profile compared to older anticonvulsants like phenytoin and carbamazepine. South Asia and Latin America are emerging markets with expanding access and evolving prescribing patterns favoring newer agents.

Competitive Landscape

LAMICTAL's key competitors include:

- Valproate (Depakote): Broad-spectrum anticonvulsant, though with notable teratogenic risks.

- Carbamazepine: Established alternative with safety concerns.

- Newer agents: Lacosamide, levetiracetam, and other second-generation drugs.

Despite competition, LAMICTAL's tolerability, especially in bipolar depression, sustains its market share [[3]].

Regulatory and Patent Environment

Patent Status and Generic Entry

Originally protected until 2014, LAMICTAL's patent expiry led to widespread generic availability. Generic versions currently dominate the market, exerting downward pressure on prices. However, branded formulations retain premium pricing in specific markets and formulations (e.g., XR – extended release).

Regulatory Developments

Ongoing approvals for new indications (e.g., maintenance treatment of bipolar I disorder) and formulations (e.g., XR, ODT) enhance market opportunities. Regulatory decisions in emerging markets influence regional pricing strategies.

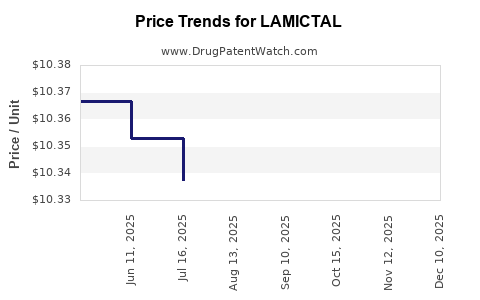

Pricing Dynamics and Trends

Current Pricing Landscape

In the U.S., the average wholesale price (AWP) for branded LAMICTAL is approximately $550–$600 per month, a significant decline from pre-generic eras exceeding $1,200 [[4]]. Generic versions are priced around $100–$150 per month, depending on dosage and formulation.

Factors Influencing Prices

- Patent expiries introduced competitive pricing via generics.

- Manufacturing costs remain stable, but economies of scale persist.

- Market competition with multiple generic manufacturers reduces prices.

- Insurance coverage and pharmacy benefit managers (PBMs) influence consumer out-of-pocket costs.

Future Price Projections

Despite patent expiration, branded LAMICTAL may maintain a premium in certain markets due to:

- Formulation-specific pricing (e.g., XR, ODT) often commands higher prices.

- Regulatory exclusivities in regions where patent challenges are pending or ongoing.

- Manufacturing complexities and quality standards for authorized generics.

Based on current trends, it is expected that:

- Brand-name LAMICTAL will retain a niche market at prices approximately 2–3 times higher than generics over the next 3–5 years, especially in the U.S. and Europe.

- Generic lamotrigine prices are projected to stabilize or slightly decline due to competitive pressures, possibly reaching the $80–$120 monthly range within two years.

Emerging Market Outlook

In developing markets, price elasticity drives adoption of generics, leading to further reduction in prices—potentially 50% below Western generic prices—over the next five years.

Market Opportunities and Risks

Opportunities

- Expanding indications, including maintenance therapy in bipolar disorder, may boost sales.

- Formulation innovations (e.g., XR, IMDL) offer premium pricing.

- Increasing awareness and diagnosis in underdeveloped regions expand the patient base.

Risks

- Patent litigations and challenges could alter market exclusivity timelines.

- Availability of generic substitutes exerts continuous price pressure.

- Competitive drugs with improved efficacy or safety profiles could erode market share.

- Regulatory hurdles in gaining approval for new indications or formulations may delay growth.

Conclusion

The LAMICTAL market remains resilient amid patent expiries owing to its established efficacy, safety, and expanding indications. While generic penetration suppresses average prices, branded LAMICTAL is likely to sustain premium pricing in select markets and formulations. The next five years favor a landscape where prices for generic lamotrigine stabilize or decline slightly, but market growth persists driven by burgeoning patient populations, innovation in formulations, and approval for new uses.

Key Takeaways

- Market will mirror a mature, highly competitive landscape dominated by generics but with niche premium segments for specialized formulations.

- Pricing prospects are subdued in Western markets due to generics but remain stable for branded drugs with formulation or indication advantages.

- Expansion into new indications and markets presents revenue opportunities amidst intensifying price competition.

- Regulatory actions and patent strategies significantly influence pricing and market exclusivity.

- Stakeholders should monitor regional regulations, formulation innovations, and patent litigation outcomes to optimize market positioning.

FAQs

1. How has patent expiration impacted LAMICTAL pricing?

Patent expiry in 2014 led to widespread generic manufacturing, significantly lowering average prices. Despite this, branded LAMICTAL retains premium pricing in certain markets and formulations due to brand recognition and formulation-specific advantages.

2. What are the key factors driving future price trends for lamotrigine?

Factors include increased generic competition, formulary preferences, regulatory approvals for new indications or formulations, and regional market dynamics. Technological innovations (e.g., XR formulations) can command higher prices.

3. Which markets show the strongest growth potential for LAMICTAL?

Emerging markets in Asia, Latin America, and Africa offer growth potential driven by increasing diagnosis rates, rising healthcare access, and acceptance of newer formulations.

4. How do formulation innovations influence lamotrigine pricing?

Extended-release (XR), orally disintegrating tablets (ODT), and injection forms typically command higher prices due to convenience, adherence, and differentiated clinical benefits.

5. What risks could undermine the market for LAMICTAL?

Key risks include patent litigation, emergence of competing treatments with superior efficacy or safety profiles, regulatory hurdles, and aggressive pricing by generic manufacturers.

Sources:

[1] WHO Global Epilepsy Fact Sheet, 2022.

[2] WHO Mental Health Atlas, 2021.

[3] MarketDataReports, 2022.

[4] IMS Health, 2022.