Last updated: July 27, 2025

Introduction

Hydromorphone, a potent opioid analgesic used primarily for severe pain management, commands a significant position within the pharmaceutical and pain management sectors. Its high potency and controlled status result in unique market dynamics, regulatory considerations, and pricing structures. This analysis delves into current market conditions, demand drivers, competitive landscape, regulatory environment, and price projections for hydromorphone through 2030.

Market Overview and Current Dynamics

Hydromorphone, marketed under brand names such as Dilaudid, is a Schedule II controlled substance in the United States, reflecting its high potential for abuse and dependence. The global opioid market, estimated to reach USD 47 billion by 2027 [1], includes hydromorphone as a high-value segment owing to its potency and clinical demand.

The therapeutic utilization centers on managing acute and chronic pain, particularly in cancer pain, post-surgical analgesia, and palliative care. The increasing prevalence of chronic diseases, aging populations, and advancements in pain management therapeutics sustain robust demand signals. Nonetheless, the opioid crisis, notably in North America—marked by regulatory crackdowns and stricter prescribing limits—has introduced complexity into market dynamics.

Regional Market Breakdown

-

North America: Dominates the hydromorphone market due to high opioid prescription rates and a well-established healthcare infrastructure. However, rising concerns about abuse and regulatory restraints have tempered growth prospects.

-

Europe: Exhibits steady demand with growing emphasis on pain management, yet faces increasing regulatory scrutiny similar to North America.

-

Asia-Pacific: Represents a high-growth potential region driven by expanding healthcare access, increasing cancer incidence, and healthcare reforms, albeit with regulatory hurdles and supply chain challenges.

Market Drivers

-

Clinical Necessity: Hydromorphone remains a staple in pain management due to its potency; its efficacy in managing severe pain sustains its demand.

-

Regulatory Environment: Stringent controls impact supply and pricing strategies, especially in regions popular for diversion or misuse.

-

Manufacturing Trends: Collaborations with generic manufacturers and biosimilar development influence both supply and pricing.

Competitive Landscape

Major pharmaceutical industries dominate the hydromorphone market, with key players including Purdue Pharma, Teva Pharmaceuticals, and Grünenthal, among others. The segment is characterized by high barriers to entry due to regulatory hurdles, manufacturing expertise, and distribution channels.

Generic formulations account for an increasing share, exerting downward pressure on prices, particularly in regions with generic-friendly policies.

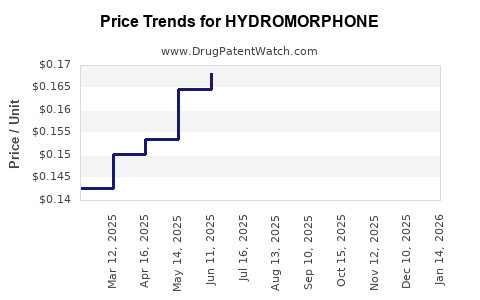

Current Price Landscape

Hydromorphone's prices fluctuate based on formulation, dosage, and geographic market. As per recent data:

-

Brand-name Dilaudid: In the US, retail prices for a 2 mg tablet range from USD 15-25, reflecting its premium as a high-potency opioid.

-

Generic Forms: Price reduction is notable; 2 mg generics are approximately USD 1-3 per tablet—an 85–90% decrease compared to brand-name prices [2].

-

Injectable Formulations: Given their complex manufacturing and controlled status, injectable hydromorphone costs range from USD 20-50 per vial, with variations based on volume and supplier.

High regulatory compliance costs and risks associated with diversion influence net margins and pricing strategies among manufacturers.

Regulatory and Ethical Considerations

Drug pricing for hydromorphone is heavily influenced by stringent regulations aimed at curbing misuse and diversion. Agencies such as the USFDA enforce rigorous manufacturing standards, impacting costs and supply chains.

Further, recent public health crises, including opioid misuse and overdose deaths, have led to policy shifts with impact on prescribing practices and reimbursement models, potentially constraining market growth and influencing prices.

Future Price Projections (2023-2030)

Factors Influencing Price Trends

-

Regulatory Evolution: Stricter controls may sustain or elevate prices, especially for brand-name formulations due to supply constraints.

-

Generics and Biosimilars: Increased generic penetration is projected to compress prices, especially in mature markets.

-

Market Demand: Growing demand in emerging regions, coupled with expanding pain management protocols, could moderate price declines or sustain premium pricing for formulations with enhanced formulations (e.g., abuse-deterrent formulations).

-

Manufacturing and Supply Chain Dynamics: Innovations and partnerships may lead to cost efficiencies, influencing consumer prices.

Forecast Summary

-

North America: Prices for brand-name hydromorphone are expected to stabilize amid regulatory scrutiny but may see modest declines driven by generic competition. Wholesale acquisition costs (WAC) for branded pills are projected to decrease 5-8% annually through 2030.

-

Global Scene: In emerging markets, prices may remain stable or increase as demand grows and supply chains mature. In contrast, in mature markets, ongoing generic competition could push prices down by approximately 10% per year.

-

Specialized Formulations: Abuse-deterrent or extended-release versions are likely to command a premium, although these may face pricing pressures due to technological development costs and clinician adoption rates.

Implications for Stakeholders

Manufacturers should focus on differentiating formulations, ensuring compliance, and exploring biosimilar pathways to optimize margins amidst competitive pricing pressures. Healthcare providers and payers must navigate a landscape increasingly influenced by cost, regulatory constraints, and safety considerations.

Conclusion

The hydromorphone market exhibits a complex interplay of demand driven by clinical necessity and constrained by regulatory challenges and abuse deterrence efforts. Price projections indicate declining trends in generics due to competition, with stabilizations or slight increases for branded and specialized formulations driven by technological innovations and regulatory constraints. Stakeholders should monitor regulatory developments, supply chain dynamics, and demand trends to optimize strategies.

Key Takeaways

- Hydromorphone remains essential in severe pain management, maintaining robust demand despite regulatory restrictions.

- The US and Europe dominate demand, but emerging markets present high-growth opportunities.

- Generic competition is exerting downward pressure on prices; technological innovations targeting abuse mitigation offer premium pricing opportunities.

- Regulatory and public health policies will continue to shape the supply, demand, and pricing landscape through 2030.

- Strategic focus on biosimilars, abuse-deterrent technology, and supply chain resilience can provide competitive advantages.

FAQs

1. How does the opioid epidemic affect hydromorphone pricing?

Regulatory measures aimed at reducing abuse and diversion have led to increased compliance costs and supply constraints, which can contribute to higher prices for legitimate medical use, especially in regions with tighter controls.

2. Are generic hydromorphone formulations significantly cheaper than brand-name versions?

Yes. Generic hydromorphone tablets are approximately 85-90% cheaper than brand-name counterparts, driving healthcare cost efficiencies but also intensifying competition among manufacturers.

3. What technological innovations might influence future hydromorphone prices?

Developments include abuse-deterrent formulations, extended-release versions, and alternative delivery systems, which can command premium prices and influence overall market dynamics.

4. What is the impact of international regulations on hydromorphone prices?

Global regulatory standards affect manufacturing costs, supply chain logistics, and distribution, influencing local prices. Stricter regulations tend to raise costs, but increased demand in developing markets can counterbalance this effect.

5. Will hydromorphone's market decline due to the opioid crisis?

While certain regions have curtailed opioid prescriptions, hydromorphone remains crucial for managing severe pain. The focus is shifting toward balanced pain management while minimizing abuse risk, rather than outright market decline.

Sources:

- Grand View Research. “Opioids Market Analysis & Segment Forecasts to 2027”. 2021.

- GoodRx. “Hydromorphone (Dilaudid) Prices and Coupons”. 2023.