Share This Page

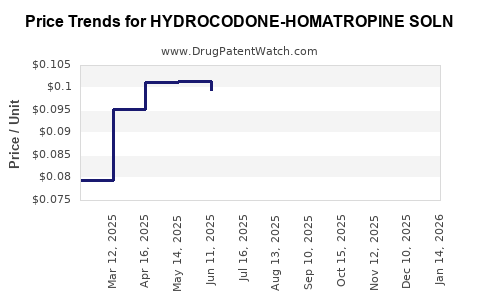

Drug Price Trends for HYDROCODONE-HOMATROPINE SOLN

✉ Email this page to a colleague

Average Pharmacy Cost for HYDROCODONE-HOMATROPINE SOLN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HYDROCODONE-HOMATROPINE SOLN | 10702-0150-16 | 0.09463 | ML | 2025-12-17 |

| HYDROCODONE-HOMATROPINE SOLN | 64950-0371-47 | 0.09463 | ML | 2025-12-17 |

| HYDROCODONE-HOMATROPINE SOLN | 10702-0150-16 | 0.09183 | ML | 2025-11-19 |

| HYDROCODONE-HOMATROPINE SOLN | 64950-0371-47 | 0.09183 | ML | 2025-11-19 |

| HYDROCODONE-HOMATROPINE SOLN | 10702-0150-16 | 0.09233 | ML | 2025-10-22 |

| HYDROCODONE-HOMATROPINE SOLN | 64950-0371-47 | 0.09233 | ML | 2025-10-22 |

| HYDROCODONE-HOMATROPINE SOLN | 10702-0150-16 | 0.09499 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Hydrocodone-Homatropine Solution

Introduction

Hydrocodone-Homatropine Solution, a combination opioid analgesic and anticholinergic, remains a critical component in managing severe pain, particularly in acute settings and for patients requiring liquid formulations. Its market dynamics are influenced by regulatory shifts, prescribing trends, patent statuses, and competitive landscape. This analysis provides a detailed overview of current market conditions, growth drivers, challenges, and price forecasts for Hydrocodone-Homatropine Solution over the upcoming five years.

Market Overview

Therapeutic Significance and Usage

Hydrocodone-Homatropine Solution primarily addresses moderate to severe pain, often in post-surgical or palliative care settings. Its formulation as a liquid allows for ease of administration in pediatric, geriatric, and patients with swallowing difficulties [1].

Regulatory Environment

Recent regulatory changes, including stringent crackdowns on opioid prescribing and stricter scheduling, predominantly controlled under the U.S. Drug Enforcement Administration (DEA), significantly impact market growth. The Drug Supply Chain Security Act (DSCSA) and amendments to the Controlled Substances Act have increased scrutiny, leading to possible supply chain disruptions and valuation shifts [2].

In addition, the FDA’s ongoing efforts to curb misuse—highlighted through REMs (Risk Evaluation and Mitigation Strategies)—might further restrict distribution and prescribing practices for combination opioids like Hydrocodone-Homatropine.

Market Players and Patent Status

Limited innovation slows the entry of new formulations. The patent landscape is mature; however, manufacturers are exploring abuse-deterrent formulations. Market dominance is currently held by brand-name products with limited generic competition, which influences pricing strategies.

Market Drivers

- Persistent medical need for effective pain management in varied clinical contexts.

- Liquid formulations preferred among specific populations, maintaining steady demand.

- Regulatory barriers reducing illicit diversion, potentially stabilizing the legal supply chain.

- Healthcare infrastructure expansions, especially in emerging economies, improving access.

Market Challenges

- Regulatory restrictions contracting the pool of prescribers and patients eligible for opioids.

- Public health concerns over opioid misuse leading to policy tightening.

- Market consolidations and genericization, which pressure pricing.

- Evolving treatment guidelines favoring non-opioid alternatives for pain management.

Pricing Landscape

Current Pricing Dynamics

As of 2023, Hydrocodone-Homatropine Solution prices exhibit considerable variation, driven by manufacturing costs, regulatory compliance, and market competition. In the U.S., brand-name formulations can range between $10 to $20 per 100 mL unit, whereas generics are often priced lower, approximately $8 to $15 per 100 mL [3].

Prices are further affected by insurance negotiations and pharmacy benefit managers (PBMs), with outpatient pharmacy reimbursement rates influencing retail prices. Specialty pharmacies may charge premium rates for compounded or abuse-deterrent formulations.

Cost Drivers

- Raw material costs associated with phenanthrene derivatives.

- Manufacturing expenses related to compliance, especially for abuse-deterrent features.

- Distribution costs, heavily impacted by regulatory hurdles.

- Marketing and reimbursement negotiations.

Future Price Projections (2024–2028)

Short-term Outlook (2024–2025)

Given political focus on opioid control and a possible tightening of prescribing guidelines, prices are anticipated to stabilize, with a modest decline in generic segments owing to increased supply. Brand-name prices may remain resilient due to established market dominance.

Projected average retail price:

- $8.50 to $13 per 100 mL

Medium-term Outlook (2026–2028)

Emerging abuse-deterrent formulations, potentially higher-priced, may gain market share, pushing the average price slightly upward. Regulatory policies that favor such formulations could boost development costs, translating into higher retail prices.

Projected average retail price:

- $9 to $15 per 100 mL

Factors Influencing Price Trends

- Regulatory Approvals: Faster clearance of abuse-deterrent variants could influence premium pricing.

- Patent Expirations: Increased generic competition could drive prices down, but market inertia may sustain higher rates.

- Epidemiological Trends: Rising chronic pain prevalence could sustain demand, supporting price stability.

- Pipeline Innovations: Introduction of non-opioid alternatives or combination therapies may diminish market shares, impacting pricing.

Market Opportunities and Risks

Opportunities:

- Expansion into emerging markets with increasing pain management needs.

- Development and commercialization of abuse-deterrent formulations.

- Formulation innovations catering to pediatric and geriatric populations.

Risks:

- Heightened regulatory barriers reducing market accessibility.

- Shifts toward non-opioid pain management strategies.

- Public health campaigns decreasing demand for opioids.

Conclusion

The Hydrocodone-Homatropine Solution market is characterized by a mature landscape, regulatory headwinds, and incremental innovation. Prices are projected to stabilize with slight upward pressures driven by abuse-deterrent formulations and market-specific factors. Stakeholders should monitor regulatory developments closely and consider diversification strategies within pain management therapeutics.

Key Takeaways

- The existing market for Hydrocodone-Homatropine Solution is largely driven by clinical necessity, with limited breakthrough innovations impacting pricing.

- Regulatory policies are critical determinants, with potential for both constrained supply and premium formulation development.

- Generic competition is expected to exert downward pressure, though brand loyalty may maintain premium prices in certain markets.

- Abuse-deterrent formulations and novel delivery methods could command higher prices but face uncertain regulatory and reimbursement pathways.

- Market expansion into emerging economies presents growth prospects but necessitates navigating diverse regulatory environments.

FAQs

1. How will regulatory changes impact Hydrocodone-Homatropine Solution prices?

Regulatory tightening, aimed at curbing opioid misuse, may increase manufacturing and compliance costs, potentially elevating prices. Conversely, restrictions on prescribing and supply could limit demand, exerting downward pressure.

2. Are generic versions expected to reduce prices significantly?

Yes. Increased generic availability typically lowers prevailing prices, especially as patents expire or for drugs with high manufacturing volumes.

3. What is the outlook for abuse-deterrent formulations?

They represent a niche with potential premium pricing. Regulatory support and clinical acceptance could help establish them as standard alternatives, impacting overall market dynamics.

4. How do international markets compare in terms of pricing?

Pricing varies globally based on regulatory environments, healthcare infrastructure, and market competition. In some emerging markets, prices are substantially lower due to cost of goods and regulatory policies.

5. What alternative therapies could undermine Hydrocondone-Homatropine?

Non-opioid analgesics, nerve blocks, and device-based pain management therapies are increasingly used, especially following guidelines favoring non-opioid options where suitable.

References

[1] U.S. Food and Drug Administration. Pain Management Pharmacology: Opioids. 2021.

[2] DEA. Drug Scheduling and Control Regulations. 2022.

[3] IQVIA. Market Data and Pricing Reports. 2023.

More… ↓