Share This Page

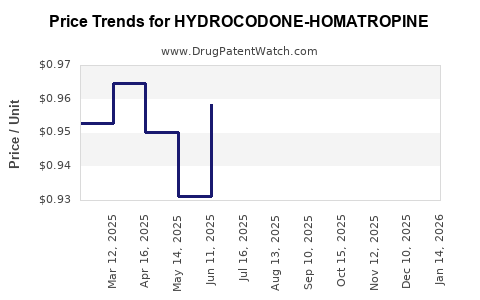

Drug Price Trends for HYDROCODONE-HOMATROPINE

✉ Email this page to a colleague

Average Pharmacy Cost for HYDROCODONE-HOMATROPINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HYDROCODONE-HOMATROPINE 5-1.5 MG TABLET | 64950-0206-03 | 0.94825 | EACH | 2025-12-17 |

| HYDROCODONE-HOMATROPINE 5-1.5 MG TABLET | 10702-0055-03 | 0.94825 | EACH | 2025-12-17 |

| HYDROCODONE-HOMATROPINE SOLN | 64950-0371-47 | 0.09463 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Hydrocodone-Homatropine

Introduction

Hydrocodone-Homatropine is a combination opioid analgesic primarily prescribed for moderate to severe pain management and cough suppression. This formulation combines hydrocodone, an opioid pain reliever, with homatropine methylbromide, an anticholinergic agent, intended to counteract some opioid side effects like excessive cough and mucus production. Understanding its market dynamics, regulatory landscape, and pricing trajectory is critical for pharmaceutical stakeholders, healthcare providers, and investors.

Market Overview

Hydrocodone-Homatropine, marketed under several brand and generic names globally, is integral in pain management and cough suppression. Despite competition from alternative opioids and combination products, Hydrocodone-Homatropine holds a niche owing to its dual-action approach and specific clinical indications.

Global Market Size and Trends

The global opioid analgesics market was valued at approximately USD 22 billion in 2022, growing at a CAGR of roughly 4%, reflecting increasing demand for pain management solutions amid aging populations and rising chronic pain prevalence [1].

Hydrocodone-based formulations constitute a significant segment within this market, especially in North America, which accounts for over 50% of the global opioid market, driven by extensive prescription patterns and advanced healthcare infrastructure [2].

In particular, the combination of hydrocodone with anticholinergic agents such as homatropine is less prevalent than other formulations (e.g., hydrocodone-acetaminophen), primarily due to evolving regulatory controls and shifts towards non-opioid pain therapies. Nonetheless, in regions with limited access to newer agents, Hydrocodone-Homatropine remains relevant.

Regulatory and Compliance Landscape

The opioid market faces stringent regulatory measures owing to abuse potential, side effects, and FDA scheduling classifications. Hydrocodone products are classified as Schedule II controlled substances in the U.S., affecting manufacturing, prescribing, and distribution.

Regulatory push for abuse-deterrent formulations and the opioid epidemic's impact have prompted manufacturers to innovate and reformulate existing drugs or develop alternative therapies [3].

Current Pricing Environment

Prices for Hydrocodone-Homatropine vary worldwide, influenced by formulation, brand versus generic status, regulatory restrictions, and regional healthcare policies.

Pricing in Major Markets

-

United States: Generic versions typically retail at approximately USD 0.20–0.50 per tablet, whereas branded formulations can reach USD 1.00–1.50. Patent exclusivity or market restrictions may temporarily inflate prices, but generic competition generally diminishes costs [4].

-

Europe: Pricing is largely regulated through national healthcare systems, with average retail prices around EUR 0.15–0.40 per tablet, though variability exists among member states.

-

Emerging Markets: Prices tend to be lower due to weaker patent protections and different healthcare budgets, often averaging USD 0.05–0.20 per tablet.

Market Drivers and Challenges

Drivers

-

Rising Chronic Pain and Cough Disorders: Increased prevalence of conditions requiring opioid analgesics sustains demand [5].

-

Prescription Trends: Physician prescribing habits, especially in countries with limited access to alternative therapies, continue to support market size.

-

Formulation Preference: Fans of combination drugs favor hydrocodone that offers both analgesic and antitussive effects.

Challenges

-

Regulatory Restrictions: Heightened controls and potential scheduling reclassification threaten supply chain stability.

-

Safety Concerns: The opioid epidemic has led to reduced prescription incentives, increased scrutiny, and heightened risk of misuse.

-

Market Competition: Emergence of non-opioid pain medications and abuse-deterrent formulations diminish Hydrocodone-Homatropine’s market share.

Future Price Projections (2023–2030)

Despite a mature market, typical industry projections anticipate slight price declines driven by generics proliferation and regulatory constraints.

-

Short to Medium Term (2023–2025): Prices may decline 10–15%, with stabilization around USD 0.20–0.40 per tablet in developed markets. Premium branded formulations might retain higher prices, subject to patent and market exclusivity.

-

Long Term (2026–2030): Potential further decrease of 20–25%, assuming increased market penetration for alternative therapies or stricter opioid regulations.

-

Impact of Biosimilars and New Formulations: The advent of abuse-deterrent and non-opioid alternatives may erode traditional pricing structures, pushing prices downward.

Market Entry and Investment Considerations

Investors and pharmaceutical companies must evaluate regulatory pathways, patent landscapes, and market receptivity to new formulations or derivatives of Hydrocodone-Homatropine. Known challenges include potential market contraction due to opioid misuse concerns and shifting healthcare policies emphasizing non-opioid pain management.

Innovative delivery systems, abuse-deterrent formulations, or combination therapies with novel mechanisms may influence future pricing and volume trends positively.

Conclusion

Hydrocodone-Homatropine continues to occupy a niche within pain and cough management, characterized by moderate demand, high regulatory hurdles, and competitive pressures. Price projections reflect a gradual decline influenced by market maturation, regulatory challenges, and alternative therapies entering the fray.

Stakeholders should focus on adaptable formulations, compliance strategies, and new therapeutic innovations to sustain or expand market valuation.

Key Takeaways

- Hydrocodone-Homatropine's global market remains stable but faces long-term decline prospects due to regulatory constraints and competition from non-opioid therapies.

- Pricing variations are primarily driven by regional regulations, patent protections, and market dynamics, with prices generally decreasing over time.

- The emerging landscape of abuse-deterrent formulations and alternative treatments could further compress prices and reduce market share.

- Companies should prioritize innovation in formulation and explore niche indications to prolong lifecycle and profitability.

- Strategic regulatory navigation and diversification into non-opioid pain management will be crucial for sustained market relevance.

FAQs

1. How does regulatory policy influence Hydrocodone-Homatropine pricing?

Strict regulations, including scheduling and prescribing limitations, can restrict supply and demand dynamics, often leading to price stability or increases in restricted markets. Conversely, deregulation or allowance for generic manufacturing can reduce prices over time.

2. What are the key risks for investors in the Hydrocodone-Homatropine market?

Regulatory crackdowns, rising public health concerns over opioid misuse, and market shifts towards non-opioid therapies pose significant risks. Additionally, patent expirations and market saturation threaten profitability.

3. Are there any recent innovations affecting Hydrocodone-Homatropine?

Development of abuse-deterrent formulations and combination therapies with novel mechanisms are ongoing, potentially impacting future market dynamics and pricing structures.

4. How does the global demand for Hydrocodone-Homatropine compare across regions?

Demand is highest in North America due to prescribing practices and healthcare infrastructure. Emerging markets show growing demand but at lower price points, influenced by healthcare access and regulatory environments.

5. What strategies should pharmaceutical companies adopt to remain competitive?

Focusing on formulation innovation, regulatory compliance, diversification into non-opioid pain solutions, and market tailoring to regional needs are essential strategies to maintain competitiveness and pricing power.

Sources

[1] MarketsandMarkets, "Opioid Drugs Market," 2022.

[2] IQVIA, "Global Opioid Market Data," 2022.

[3] FDA, "Regulation of Opioid Analgesics," 2022.

[4] GoodRx, "Hydrocodone Pricing Trends," 2023.

[5] CDC, "Chronic Pain and Opioid Use," 2022.

More… ↓