Share This Page

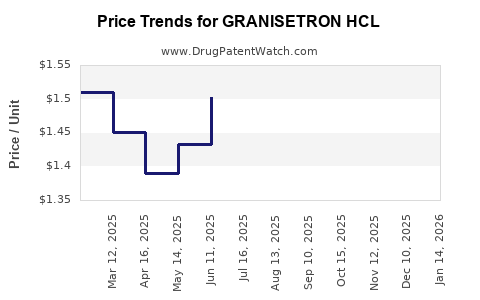

Drug Price Trends for GRANISETRON HCL

✉ Email this page to a colleague

Average Pharmacy Cost for GRANISETRON HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GRANISETRON HCL 1 MG TABLET | 51991-0735-32 | 1.21169 | EACH | 2025-12-17 |

| GRANISETRON HCL 1 MG TABLET | 69452-0350-01 | 1.21169 | EACH | 2025-12-17 |

| GRANISETRON HCL 1 MG TABLET | 69452-0350-11 | 1.21169 | EACH | 2025-12-17 |

| GRANISETRON HCL 1 MG TABLET | 51991-0735-99 | 1.21169 | EACH | 2025-12-17 |

| GRANISETRON HCL 1 MG TABLET | 69452-0350-92 | 1.21169 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Granisetron HCl

Introduction

Granisetron hydrochloride (HCl) is a selective 5-HT3 receptor antagonist primarily used as an antiemetic and antinausea agent, especially in the prevention of chemotherapy-induced nausea and vomiting (CINV), radiation therapy-associated nausea, and postoperative nausea. Approved by regulatory authorities such as the FDA, Granisetron has solidified its position within oncology supportive care. As the global oncology market expands, understanding the market dynamics and future pricing of Granisetron HCl is critical for pharmaceutical stakeholders, investors, and healthcare providers.

Market Overview

Global Market Landscape

The global antiemetic drugs market was valued at approximately USD 2.6 billion in 2022 and is projected to reach USD 4.1 billion by 2030, growing at a CAGR of around 5.4% [1]. Granisetron accounts for a significant share within this segment, bolstered by increasing cancer prevalence and improving supportive care protocols.

Key Market Drivers

-

Rising Cancer Incidence: According to the World Health Organization (WHO), cancer incidence is expected to rise by 47% over the next two decades, primarily driven by aging populations, expanding screening programs, and lifestyle factors [2]. This increase directly correlates with heightened demand for antiemetics like Granisetron.

-

Advancements in Chemotherapy Protocols: As chemotherapeutic regimens become more aggressive, there’s a growing need for effective antiemetic agents. Granisetron’s efficacy in preventing delayed CINV enhances its adoption.

-

Regulatory Approvals and Label Expansion: Recent approvals for broad indications, including recurrent nausea and specific chemotherapy protocols, expand market potential.

Regional Market Dynamics

-

North America: Dominant due to high cancer prevalence, advanced healthcare infrastructure, and favorable reimbursement policies.

-

Europe: Steady growth driven by updated clinical guidelines and increased adoption of supportive care protocols.

-

Asia-Pacific: Fastest growth segment, propelled by increasing cancer cases, expanding healthcare access, and rising healthcare expenditure.

-

Other regions: Latin America, Middle East, and Africa are witnessing emerging demand, albeit at a lower scale.

Current Market Players

Major pharmaceutical companies manufacturing Granisetron formulations include:

- Kyowa Kirin (Kinrix)

- Teva Pharmaceuticals

- Mitsubishi Tanabe Pharma

- Endo Pharmaceuticals

- Sandoz (Novartis affiliate)

These firms focus on generic formulations, with branded versions offering premium pricing strategies aimed at specialized markets.

Pricing Landscape

Current Pricing Trends

Generic versions of Granisetron HCl are widely available, with market prices varying depending on formulation, dosage, and region. For instance:

- Injectable formulations: Range from USD 15 to USD 30 per vial.

- Oral tablets: Retail between USD 1.50 and USD 3 per tablet.

Brand-name formulations consistently command higher prices, often exceeding USD 100 per dose in some markets.

Factors Influencing Price

-

Market Competition: An influx of generics has significantly driven down prices, particularly in mature markets such as the US and Europe.

-

Regulatory Environment: Stringent reimbursement policies and pricing regulations in certain regions impact final consumer prices.

-

Production Costs: Raw material prices, manufacturing complexity, and regulatory compliance factors influence pricing strategies.

-

Formulation Type: Injectable formulations typically cost more than oral tablets due to manufacturing and storage intricacies.

Future Price Projections

Short-term Outlook (Next 3-5 Years)

Market prices for Granisetron are expected to decline modestly, driven by increasing generic competition. However, targeted formulations such as sustained-release injections or combination therapies may sustain premium pricing. In developed markets, the average retail price for a single dose of generic Granisetron is projected to decline by approximately 10% annually, stabilizing around USD 8-12 in the coming years [3].

Long-term Outlook (Next 5-10 Years)

- Market Consolidation and Innovation: Introduction of novel delivery systems (e.g., transdermal patches, implantable devices) could sustain higher pricing.

- Biosimilar and New Therapeutics: Emerging biosimilars and new antiemetic agents might challenge Granisetron’s market share, leading to further price erosion.

- Regulatory Price Capping: Implementation of global and regional price controls could suppress prices further, especially in cost-sensitive markets.

Estimated Price Range (2030):

- Injectable formulations: USD 10-15 per dose

- Oral tablets: USD 0.50 - USD 1.50 per tablet

These projections assume ongoing competitive dynamics and regulatory influences.

Market Challenges

- Generic Competition: High patent expiry rates have led to an oversaturated market with aggressive pricing.

- Alternative Therapies: Emerging antiemetics such as NEPA (netupitant/palonosetron), olanzapine, and olanzapine-based combinations could supplant Granisetron in some indications.

- Pricing Regulations: Governments and payers impose strict price controls, affecting profitability and pricing strategies.

Strategic Considerations for Stakeholders

- Pricing Strategies: Differentiation and formulation innovation can help sustain margins.

- Market Expansion: Targeting emerging markets with tailored pricing strategies presents growth opportunities.

- Regulatory Navigation: Engaging proactively with regulatory agencies can facilitate favorable approval and reimbursement scenarios.

- Patent and Exclusivity Management: Protecting formulations or delivery methods enhances pricing power.

Key Takeaways

- The global Granisetron HCl market is fueled by rising cancer incidence and the need for effective supportive care.

- Generic competition has substantially reduced prices; however, innovation in formulation and delivery could offset some downward pressure.

- Regional markets exhibit divergent pricing trends, with North America and Europe adopting more stable, premium-priced models, while Asia-Pacific emphasizes affordability and volume.

- Price projections indicate modest declines in mature markets over the next five years, with stabilization or modest increases in emerging markets.

- Stakeholders should prioritize formulation innovations, regional market strategies, and regulatory engagement to optimize pricing and market share.

FAQs

1. What factors most significantly influence the pricing of Granisetron HCl?

Pricing is primarily affected by regional regulatory policies, competition from generics, formulation type, and healthcare reimbursement frameworks.

2. How does the patent status impact Granisetron's market pricing?

Patent expiry enables generic competition, reducing prices. Patent protections for novel formulations or delivery methods can sustain higher prices temporarily.

3. Are biosimilars expected for Granisetron in the near future?

While biosimilars are more common for biologics, no biosimilar Granisetron has been approved yet. However, biosimilar development could influence future prices if approved.

4. What regions offer the most lucrative markets for Granisetron?

North America remains the most profitable due to high cancer rates and reimbursement systems, followed by Europe and rapidly expanding Asia-Pacific markets.

5. How might emerging antiemetic therapies impact Granisetron's market value?

New therapies with better efficacy, safety, or convenience could displace Granisetron, pressuring prices downward. Continuous innovation is essential to sustain market share.

References

[1] Market Research Future, "Anti-Emetics Market Size and Forecast," 2022.

[2] WHO, "Cancer Facts & Figures," 2022.

[3] Pharmaceutical Market Outlook, "Price Trends for Anti-Emetics," 2023.

More… ↓