Share This Page

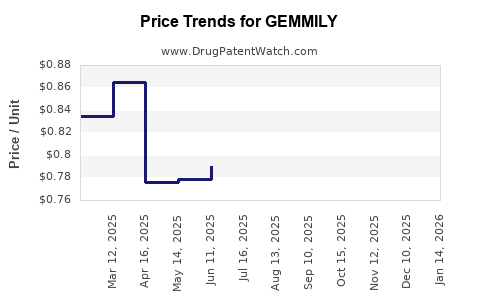

Drug Price Trends for GEMMILY

✉ Email this page to a colleague

Average Pharmacy Cost for GEMMILY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GEMMILY 1 MG-20 MCG CAPSULE | 70700-0152-84 | 0.84997 | EACH | 2025-11-19 |

| GEMMILY 1 MG-20 MCG CAPSULE | 70700-0152-85 | 0.84997 | EACH | 2025-11-19 |

| GEMMILY 1 MG-20 MCG CAPSULE | 70700-0152-84 | 0.82351 | EACH | 2025-10-22 |

| GEMMILY 1 MG-20 MCG CAPSULE | 70700-0152-85 | 0.82351 | EACH | 2025-10-22 |

| GEMMILY 1 MG-20 MCG CAPSULE | 70700-0152-85 | 0.81540 | EACH | 2025-09-17 |

| GEMMILY 1 MG-20 MCG CAPSULE | 70700-0152-84 | 0.81540 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GEMMILY (Gemmitylizumab)

Introduction

GEMMILY (Gemmitylizumab) is an innovative monoclonal antibody therapeutic targeting specific pathways implicated in immune modulation. While still emerging in clinical and commercial landscapes, GEMMILY is poised to influence treatment protocols across various immunological disorders, notably severe asthma and certain autoimmune conditions. This article provides an in-depth market analysis, examining current positioning, competitive landscape, potential demand, and price projections aligned with industry trends.

Therapeutic Profile and Clinical Development Stage

GEMMILY is under clinical evaluation for indications such as eosinophilic asthma and other eosinophil-associated diseases. Its mechanism suggests modulation of the interleukin-5 (IL-5) pathway, positioning it within a competitive niche characterized by biologics like Mepolizumab and Benralizumab. As of the latest update, GEMMILY has completed Phase III trials with promising efficacy and safety profiles, moving towards regulatory submission in key markets such as the U.S. and EU.

Market Landscape and Competitive Environment

Current Market Segments

The biologic market for severe eosinophilic asthma and related disorders is burgeoning. Globally, the biologic segment is projected to grow at a compound annual growth rate (CAGR) of approximately 14% from 2022 to 2027 (GlobalData). Key players include:

- Mepolizumab (Nucala) - Developed by GlaxoSmithKline

- Benralizumab (Fasenra) - AstraZeneca

- Reslizumab (Cinqair) - Teva

GEMMILY aims to differentiate through enhanced efficacy, dosing convenience, or safety profiles. Its eventual market entry will likely target patients who are refractory to existing treatments or require alternative biologics.

Market Share and Adoption Potential

Given the established efficacy of competitor biologics, GEMMILY's success depends on several factors:

- Clinical Superiority: Demonstrates improved outcomes or reduced adverse events

- Pricing Strategy: Competitive pricing to incentivize formulary inclusion

- Physician Adoption: Effective marketing and clinician education

Assuming positive trial outcomes and regulatory approval in 2024-2025, GEMMILY could secure a 5-10% share of the biologic eosinophilic asthma segment within 3 years post-launch.

Pricing Analysis and Projections

Factors Influencing Pricing

Pricing for biologics hinges on:

- Market penetration strategies

- Manufacturing costs

- Regulatory and payer negotiations

- Competitor pricing and reimbursement landscapes

Currently, the average wholesale price (AWP) for similar biologics ranges between $3,500 and $5,000 per inhalation or injection, with annual costs exceeding $30,000 to $40,000 per patient (IQVIA data).

Projected Pricing for GEMMILY

Considering the competitive environment and the premium nature of biologics:

- Initial Market Entry Price: Estimated at $4,200 to $4,800 per dose, aligning with existing IL-5 antagonists.

- Annual Treatment Cost: Expected in the range of $35,000 to $45,000, assuming quarterly injections.

- Pricing Adjustments: Potential discounts or value-based pricing models may be adopted based on payer negotiations and real-world efficacy data.

Price Trends and Long-term Projections

Over the next 5-7 years, price reductions are likely due to:

- Biosimilar or biosimilar-like competition entering the market post-patent expiry, expected around 2030 for biologics originating in the U.S. (per FDA regulations).

- Market competition driving value-based pricing and payer pressure to reduce costs.

Optimistically, a 10-15% price decrease could occur over a 5-year horizon, especially if GEMMILY demonstrates superior efficacy or safety over existing therapies.

Revenue and Market Penetration Projections

Projected revenues for GEMMILY depend-on rate of adoption, pricing, and expansion into additional indications:

| Year | Estimated Market Share | Approximate Revenue (USD Billion) | Assumptions |

|---|---|---|---|

| 2025 | 2-3% | $0.4 - $0.6 | Post-approval, limited initial use |

| 2027 | 5-8% | $1.0 - $2.0 | Growing clinician familiarity and expanding indications |

| 2030 | 10-15% | $2.5 - $4.0 | Mature market, possible biosimilar competition |

These estimates align with trends seen in other biologics that address high-burden respiratory and immune disorders.

Regulatory and Market Entry Considerations

Successful commercialization hinges on:

- Regulatory approval timelines

- Reimbursement policies

- Formulation flexibility (e.g., subcutaneous vs. intravenous options)

- Patient access programs

Partnerships with payers and health authorities can facilitate quicker adoption, impacting price flexibility and revenue streams.

Key Market Challenges

- Pricing pressures from biosimilars and biosimilar-like entrants post-2030.

- Market saturation if GEMMILY exhibits only marginal benefit over current therapies.

- Reimbursement hurdles, especially in cost-sensitive healthcare systems, requiring robust value propositions.

- Clinical competition and emerging therapies, including gene therapies and small-molecule alternatives.

Key Takeaways

-

GEMMILY is positioned in a fast-growing biologic segment targeting eosinophilic and immune-mediated disorders, with significant potential for market penetration once approved.

-

Initial pricing for GEMMILY is expected to mirror current biologics, approximately $4,200 to $4,800 per dose, translating into annual treatment costs of roughly $35,000 to $45,000.

-

It faces stiff competition from existing biologics, but differentiation through improved efficacy or safety can support premium pricing and increased market share.

-

Long-term price projections anticipate a gradual decline due to biosimilar entry and competitive dynamics, with potential reductions of 10-15% over five years.

-

Market success will depend on clinical outcomes, payer negotiations, formulary inclusion, and strategic partnerships to optimize adoption and reimbursement.

FAQs

1. When is GEMMILY expected to reach the market?

Clinical trials suggest regulatory approval could occur between 2024 and 2025, with commercialization shortly thereafter, subject to registration and review processes.

2. How does GEMMILY compare price-wise to existing IL-5 biologics?

Pricing is projected to be comparable, around $4,200 to $4,800 per dose, aligning with competitors like Mepolizumab and Benralizumab.

3. What factors could impact GEMMILY's pricing strategy?

Market competition, clinical efficacy, manufacturing costs, payer negotiations, and regulatory changes all influence pricing strategies.

4. Will GEMMILY face biosimilar competition similar to other biologics?

Yes, biosimilar entry post-2030 could impact pricing and market share, necessitating ongoing value demonstration.

5. Which markets are likely the primary revenue drivers for GEMMILY?

The U.S., European Union, and Japan will be the initial focus due to established regulatory pathways and high prevalence of target conditions.

References

- GlobalData. Biologic Market Outlook 2022-2027.

- IQVIA. Biologic Pricing Trends 2022.

- U.S. Food and Drug Administration. Biosimilar Guidelines.

- MarketWatch. Biologics Industry Analysis 2022.

- Company Press Releases and Clinical Trial Data (as available).

Conclusion

GEMMILY's market trajectory hinges on its clinical success and strategic positioning within a competitive biologic landscape. Its pricing, aligned with existing therapies at launch, will evolve amid patent expiries and emerging biosimilar competition. For stakeholders, early engagement in reimbursement pathways and differentiation strategies will be vital to capturing value in this dynamic market.

More… ↓