Share This Page

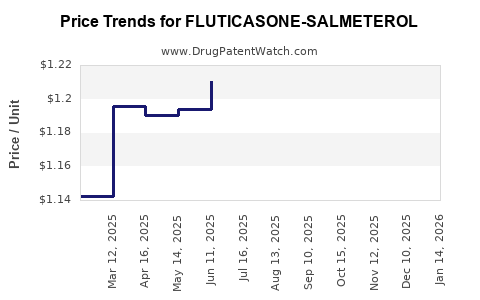

Drug Price Trends for FLUTICASONE-SALMETEROL

✉ Email this page to a colleague

Average Pharmacy Cost for FLUTICASONE-SALMETEROL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FLUTICASONE-SALMETEROL 55-14 | 00093-3607-82 | 109.00144 | EACH | 2025-12-17 |

| FLUTICASONE-SALMETEROL 100-50 | 00054-0326-56 | 1.16467 | EACH | 2025-12-17 |

| FLUTICASONE-SALMETEROL 100-50 | 00093-7517-31 | 1.16467 | EACH | 2025-12-17 |

| FLUTICASONE-SALMETEROL 113-14 | 00093-3608-82 | 106.37594 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Fluticasone-Salmeterol

Introduction

Fluticasone-Salmeterol, a combination inhaler used primarily in the management of asthma and Chronic Obstructive Pulmonary Disease (COPD), continues to demonstrate significant market presence. Its dual mechanism—combining fluticasone, an inhaled corticosteroid, with salmeterol, a long-acting beta-agonist—addresses both inflammation and bronchoconstriction, making it a cornerstone therapy for respiratory conditions. This analysis explores the current market landscape, competitive dynamics, regulatory environment, and projects future pricing trends.

Market Landscape

Global Market Size and Growth Trajectory

The global respiratory drug market, valued at approximately USD 20 billion in 2022, is poised for compounded annual growth rates (CAGRs) of around 5% through 2030, driven chiefly by rising prevalence of asthma and COPD, particularly in aging populations and emerging markets. According to IQVIA data, inhaled corticosteroid-long acting beta-agonist (ICS-LABA) combinations, including Fluticasone-Salmeterol, constitute over 40% of the respiratory medication market.

Key Markets and Adoption Dynamics

- United States: The U.S. commands the largest share, with a mature market driven by high prevalence rates—over 25 million Americans affected by asthma and 16 million with COPD. Reimbursement policies favor branded therapies, although generic options are increasing.

- Europe: The European market mirrors U.S. trends but exhibits greater variability due to different national reimbursement policies and high reliance on generics.

- Emerging Markets: Markets such as China, India, and Brazil are experiencing rapid growth, propelled by urbanization, pollution, and increased healthcare access, although affordability remains a challenge.

Competitive Landscape

Major players include GlaxoSmithKline (GSK), AstraZeneca, and Teva, with GSK’s Advair Diskus (another Fluticasone-Salmeterol formulation) dominating the market. Recently, Mylan (now part of Viatris) and Sun Pharmaceutical have launched generic versions, intensifying competition and exerting downward pressure on prices.

Regulatory Developments

Regulatory agencies like the FDA and EMA have approved various formulations, with subsidies and policies influencing market entry and pricing strategies (e.g., generic approvals reducing prices).

Price Dynamics and Drivers

Historical Pricing Trends

Brand-name Fluticasone-Salmeterol inhalers have historically ranged between USD 300– USD 500 per inhaler, varying by formulation and region. Generic versions introduced in the last five years have reduced prices by approximately 30–50%, boosting accessibility but pressuring revenue margins.

Pricing Factors

- Patent Status: GSK’s patents for Advair operated until 2019 in key markets. Patent cliffs lead to generic entry and price erosion.

- Reimbursement Policies: Insurance coverage, formularies, and medical subsidies significantly influence out-of-pocket costs.

- Manufacturing Costs: Raw material prices, regulatory compliance, and manufacturing scale affect profit margins.

- Market Penetration: Increased adoption in emerging markets, despite lower prices, enhances volume sales, offsetting unit price declines.

Price Projections (2023–2030)

Short-Term Outlook (2023–2025)

The immediate future forecasts moderate price declines (5–10% annually) due to rising generic competition and price regulation initiatives. However, brand-name inhalers may maintain premium pricing through innovation, formulation improvements, and targeted marketing.

Medium to Long-Term Outlook (2026–2030)

- Market Saturation and Competition: As generics fully penetrate, average prices are expected to stabilize or decline marginally further—approximately 3–7% per year.

- Emerging Market Growth: Increased rollout in developing countries could boost volumes, partially offsetting price reductions.

- Innovations and Formulation Advances: New inhaler delivery systems or combination regimens may command premium prices, expanding the market’s upper bounds.

Pricing Scenario Summary

| Year | Predicted Average Price (USD) | Factors Influencing Price |

|---|---|---|

| 2023 | 200–350 (generic & brand) | Increased generic competition, price regulation |

| 2025 | 180–330 | Market saturation, emerging markets’ growth |

| 2030 | 150–300 | Continued generic availability, innovation-driven premiums |

Market Opportunities and Risks

Opportunities

- Biologics and Digital Health Integration: Development of advanced inhalers with digital monitoring may drive premium pricing.

- Expanding Access: Strategies targeting underserved markets could expand volume sales.

- Formulation Innovations: Fixed-dose combinations with extended-release properties may attract premium pricing.

Risks

- Patent Expirations and Generics: Lead to commoditization and price erosion.

- Regulatory Barriers: Stringent approval processes or pricing controls could limit revenue growth.

- Pricing Pressures: Cost containment measures by insurers and governments.

Conclusion

The Fluticasone-Salmeterol market remains robust, driven by escalating respiratory disease prevalence and established clinical efficacy. While imminent patent expirations signal impending price competition, opportunities exist in innovation and emerging markets. Developers and investors must balance patent strategy, regulatory navigation, and market expansion to optimize profitability.

Key Takeaways

- The global respiratory therapy market, including Fluticasone-Salmeterol, is projected to grow at approximately 5% annually through 2030.

- Price declines of 5–10% are anticipated in the short term due to generic competition, with stabilization expected mid-to-long term.

- Emerging markets present high-growth opportunities despite pricing and reimbursement challenges.

- Innovation in inhaler technology and formulation can maintain premium pricing and market share.

- Strategic patent management and market diversification are critical for sustainable profitability.

FAQs

1. How does patent expiration affect Fluticasone-Salmeterol pricing?

Patent expirations allow generic manufacturers to enter the market, significantly reducing prices—often by 30–50%. This leads to increased competition and decreased margins for brand-name products.

2. What regulatory factors influence the pricing of Fluticasone-Salmeterol?

Regulatory agencies may impose price caps or reimbursement restrictions, especially in publicly funded healthcare systems, affecting final consumer prices and profitability.

3. Are there any upcoming innovations that could reshape the Fluticasone-Salmeterol market?

Yes. Developments include smart inhalers with digital adherence tracking, combination therapies with improved delivery mechanisms, and extended-release formulations that can command higher prices.

4. How do geographic factors influence the price of Fluticasone-Salmeterol?

Pricing varies based on regional healthcare policies, patent status, market maturity, and income levels. Developed markets typically have higher prices, while emerging markets see lower prices but higher volume growth.

5. What is the potential impact of biosimilars and generics on future prices?

Widespread availability of biosimilars and generics will likely lead to sustained downward pressure on prices, emphasizing the importance of innovation and brand differentiation for future profitability.

Sources

[1] IQVIA, "Global Respiratory Disease Market Analysis," 2022.

[2] GSK Annual Report, 2022.

[3] EMA Public Assessment Reports on ICS-LABA inhalers, 2022.

[4] FDA Drug Approvals Database, 2022.

More… ↓