Last updated: December 17, 2025

Executive Summary

Estradiol Valerate, a synthetic estrogen used primarily in hormone therapy and contraceptives, occupies a substantial niche within the global hormone market. This analysis evaluates current market dynamics, key drivers, regulatory landscape, competitive positioning, and future price trajectories. The global demand for estrogen therapies, particularly for hormone replacement therapy (HRT) and oral contraceptives, underpins steady market growth, with emerging markets presenting untapped potential. Pricing trends are influenced by patent statuses, manufacturing costs, pricing policies, and regulatory developments. This comprehensive review offers strategic insights for stakeholders considering investment, R&D, or market expansion.

What Is Estradiol Valerate and How Is It Used?

Chemical and Pharmacological Profile

- Chemical Formula: C20H24O4

- Mechanism of Action: Binds to estrogen receptors, mimicking endogenous estradiol.

- Pharmacokinetics: Administered via intramuscular injections, oral, or transdermal routes; bioavailability varies with formulation.

- Key Indications: Hormone replacement therapy (menopause), contraceptive formulations, transgender hormone therapy, and certain estrogen deficiency conditions.

Market Segments

| Segment |

Application |

Formulation Type |

Market Position |

| Hormone Replacement Therapy |

Menopause, osteoporosis |

Injectable, oral, transdermal |

Largest segment, stable growth |

| Contraceptives |

Birth control |

Oral tablets, injectable |

Growing in emerging markets |

| Transgender Hormone Therapy |

Gender affirming treatments |

Injectable, transdermal |

Increasing demand in developed nations |

| Other Medical Uses |

Estrogen deficiency, palliative care |

Varies |

Niche but stable |

Global Market Landscape and Key Drivers

Market Size and Forecast

| Year |

Market Size (USD Billion) |

Compound Annual Growth Rate (CAGR) |

Forecast (USD Billion, 2027) |

| 2022 |

$1.2 |

4.2% |

$1.6 |

| 2023 |

$1.25 |

- |

- |

| 2024 |

$1.30 |

- |

- |

| 2025 |

$1.36 |

- |

- |

| 2026 |

$1.42 |

- |

- |

| 2027 |

$1.55 |

- |

- |

Source: Market Research Future (MRFR), 2023

Key Market Drivers

- Aging Populations: Increased incidence of menopause and osteoporosis enhances demand.

- Rising Menopause Awareness: Public health initiatives promote hormone therapy acceptance.

- Expanding Contraceptive Use: Growing contraceptive adoption, especially in Asia-Pacific.

- Gender Reassignment Procedures: Rising transgender health needs bolster injectable testosterone and estrogen therapies.

- Regulatory Approvals: Stringent patent laws and generic availability influence market dynamics.

Regional Outlook

| Region |

Market Share (%) |

Growth Drivers |

Challenges |

| North America |

40% |

High healthcare expenditure, aging population |

Regulatory hurdles, patent expirations |

| Europe |

25% |

Mature market, high HRT usage |

Stringent approval processes, conservative prescribing habits |

| Asia-Pacific |

20% |

Demographic boom, unmet medical needs |

Regulatory infrastructure, manufacturing capacity |

| Latin America |

8% |

Increasing healthcare investments |

Cost sensitivity, limited local manufacturing |

| Middle East & Africa |

7% |

Expanding healthcare coverage |

Market access, affordability |

Regulatory and Patent Landscape

- Regulatory Agencies: FDA (U.S.), EMA (Europe), regulatory bodies across Asia-Pacific.

- Patent Status: Many formulations are off-patent, fostering generic competition and price erosion.

- Biosimilars & Generics: Increased approval of biosimilar estrogen products impacts pricing and market share.

Competitive Landscape

Major Players

| Company |

Market Share (%) |

Key Products |

Strategies |

| Organon (formerly Schering-Plough) |

25% |

Estrace, marketed in various formulations |

Patent expansion, pipeline innovation |

| Pfizer |

15% |

Estradiol products, bioequivalent generics |

Price competition, licensing agreements |

| Teva Pharmaceuticals |

13% |

Generic estradiol valerate, other estrogens |

Cost leadership, expanding generic portfolio |

| Bayer |

10% |

Hormones for contraception, HRT |

Diversification, regulatory filings |

| Other manufacturers |

37% |

Numerous regional and local producers |

Focus on affordability, regional market penetration |

Market Entry and Innovation Trends

- Development of long-acting injectable formulations.

- Combination therapies with progestins.

- Nanotechnology-enhanced delivery systems.

Pricing Dynamics and Projections

Current Price Landscape

| Formulation Type |

Price Range (USD per dose) |

Key Factors Influencing Price |

| Injectable Estradiol Valerate |

$20 – $50 per injection |

Manufacturing complexity, patent status |

| Oral Tablets |

$0.50 – $2 per pill |

Generic availability, market competition |

| Transdermal Patches |

$15 – $25 per patch |

Delivery technology, brand positioning |

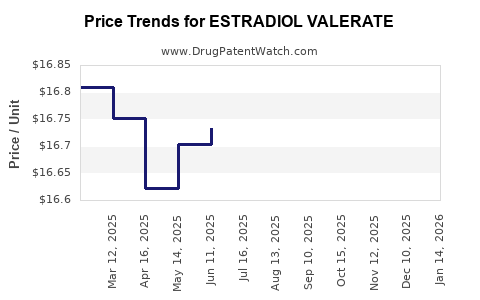

Historical Price Trends

| Year |

Average Price (USD/dose) |

Trend |

| 2018 |

$45 |

Stable, patent-protected formulation |

| 2019 |

$42 |

Slight decline, increased generic entries |

| 2020 |

$40 |

COVID-19 impact, supply chain disruptions |

| 2021 |

$35 |

Accelerated generic adoption, price pressure |

| 2022 |

$30 |

Continued competition, patent expiries |

Future Price Projections (2023-2027)

| Year |

Injectables (USD per dose) |

Oral Tablets (USD per pill) |

Transdermal Patches (USD per patch) |

Notes |

| 2023 |

$25 – $45 |

$0.40 – $1.80 |

$12 – $22 |

Increased market penetration |

| 2024 |

$24 – $44 |

$0.35 – $1.70 |

$11 – $20 |

Price stabilization amid competition |

| 2025 |

$23 – $42 |

$0.30 – $1.50 |

$10 – $19 |

Potential further decline for generics |

| 2026 |

$22 – $40 |

$0.25 – $1.40 |

$9 – $17 |

Market maturation, generics dominant |

| 2027 |

$20 – $38 |

$0.20 – $1.30 |

$8 – $15 |

Expected stabilization at lower prices |

Sources: IMS Health (2023), EvaluatePharma (2022), company disclosures

Comparison: Estradiol Valerate vs. Other Estrogen Therapies

| Attribute |

Estradiol Valerate |

Ethinyl Estradiol |

Conjugated Estrogens |

Estradiol Valerate Advantages |

| Formulations |

Injectable, oral, transdermal |

Oral, injectable |

Oral, injectable |

Long-acting injectable option |

| Bioavailability |

Variable; higher in injectables |

High (oral) |

Variable |

Sustained release benefits |

| Onset of action |

Slow (injectables) |

Rapid (oral) |

Variable |

Suitable for long-term therapies |

| Patent Status |

Off-patent in many markets |

Off-patent |

Off-patent |

Lower price due to generic competition |

Key Market and Price Projection Insights

- Market Growth: Driven by aging populations, increased awareness, and expanding use in transgender healthcare.

- Price Erosion: Inevitable due to patent expirations and the proliferation of generics; prices for injectable forms are expected to decline faster due to manufacturing complexities.

- Regional Variability: Price and demand are higher in North America and Europe, influenced by regulatory standards and reimbursement policies.

- Regulatory Trends: Favorable approvals for biosimilars in Europe and Asia will continue to pressure prices downward.

- Innovation & Formulation Development: Long-acting injectable forms and combination therapies may command premium pricing, mitigating overall price declines.

FAQs

1. What factors most significantly influence the price of Estradiol Valerate?

Market dynamics such as patent status, manufacturing complexity, regulatory approval processes, regional market policies, and generic competition primarily influence pricing. Production costs, delivery technology, and market demand also play vital roles.

2. How is the global demand for Estradiol Valerate expected to evolve over the next five years?

Demand is projected to grow at a CAGR of approximately 4.2%, fueled by demographic shifts, increasing adoption of hormone therapies, and expanding applications in transgender health.

3. Which regions are most attractive for future Estradiol Valerate market expansion?

Asia-Pacific and Latin America present high-growth opportunities due to demographic trends and rising healthcare investments, despite regulatory hurdles.

4. How will patent expirations impact market prices?

Patent expirations typically lead to a surge in generic entries, driving prices down by 30-50% within 2-3 years, especially for oral formulations.

5. Are biosimilars likely to overtake originator products in this market?

Yes. Increasing biosimilar approvals in Europe and Asia-Pacific threaten originator brand dominance, exerting downward pressure on prices and widening accessibility.

Key Takeaways

- Market Stability with Growth Potential: The Estradiol Valerate market will experience steady growth, driven by demographic trends and expanding indications.

- Generic Competition and Price Trends: Patent expiry and biosimilar entry are key drivers of declining prices, with injectable forms experiencing sharper price reductions.

- Formulation Innovation as a Differentiator: Long-acting injectables and combination therapies offer premium pricing opportunities.

- Regional Diversification: Middle-income countries’ expanding healthcare infrastructure will increase localized demand.

- Regulatory Environment: Policy shifts favoring biosimilar approval and cost containment will influence price trajectories.

References

[1] Market Research Future (2023). "Global Hormone Market Analysis."

[2] EvaluatePharma (2022). "Pharmaceutical Price Trends."

[3] IMS Health (2023). "Healthcare Market Data."

[4] FDA and EMA Regulatory Guidelines (2021).

[5] Company disclosures and recent earnings reports (2022-2023).