Last updated: July 27, 2025

Introduction

DYANAVEL XR (amphetamine sulfate extended-release) is a prescription medication primarily indicated for the treatment of Attention Deficit Hyperactivity Disorder (ADHD) in pediatric and adult populations. As a Schedule II controlled substance, its market presence is influenced by regulatory, clinical, and socioeconomic factors that frame its price trajectory and market potential. This analysis offers a comprehensive overview of DYANAVEL XR's current market landscape, competitive positioning, pricing strategies, and projections for future pricing trends.

Market Landscape for ADHD Medications

The ADHD therapeutics market has exhibited robust growth driven by increasing diagnosis rates and expanded awareness. According to IQVIA data, the ADHD medication market reached approximately $10 billion globally in 2022, with a compound annual growth rate (CAGR) of approximately 5% over the past five years [1]. The segment includes stimulants, such as methylphenidate and amphetamines, and non-stimulant alternatives.

Amphetamine-based formulations like DYANAVEL XR are distinguished by their extended-release technology, providing once-daily dosing and improved compliance. The segment's key competitors include Adderall XR, Vyvanse, Evekeo, and Mydayis, with DYANAVEL XR carving out a niche among pediatric populations and those requiring quick onset combined with sustained duration.

Product Profile and Market Positioning

DYANAVEL XR offers several advantages:

- Rapid Onset: Begins working within 30 minutes.

- Extended Duration: Lasts approximately 12 hours.

- Flexible Dosing: Available in multiple strengths from 12.5 mg to 50 mg.

- Pediatric Preference: Particularly favored for children requiring fine-tuning of dosing.

Its unique delivery system, combining an immediate-release component with extended-release beads, allows for flexible titration and preference among clinicians and patients.

Pricing Dynamics and Revenue Drivers

Current pricing landscape positions DYANAVEL XR as a premium stimulant, with average wholesale prices (AWP) ranging between $250 and $350 per 30-count container for various strengths, depending on the pharmacy and region [2].

Key factors influencing pricing include:

- Regulatory Status: As a Schedule II substance, DYANAVEL XR faces strict prescribing and dispensing regulations, influencing distribution costs and access.

- Patent and Exclusivity: Patent protections and market exclusivity periods shield DYANAVEL XR from direct generic competition, enabling premium pricing.

- Insurance Coverage: Reimbursement policies significantly impact patient out-of-pocket costs and product accessibility. Managed care plans often favor generics, but branded DYANAVEL XR benefits from formulary placement in specialized ADHD therapeutics lists.

- Market Penetration: Prescriber awareness and patient acceptance drive sales volume, ultimately impacting per-unit pricing strategies.

Competitive Analysis

Market share among stimulant ADHD medications is highly competitive. While Adderall XR remains dominant due to longstanding presence and generic availability, DYANAVEL XR advantages in onset and dosing flexibility position it well among certain patient subsets.

Pricing comparison:

| Product |

Approximate AWP (per 30-count) |

Duration |

Unique Features |

| DYANAVEL XR |

$250 - $350 |

~12 hrs |

Rapid onset, flexible dosing |

| Adderall XR |

~$173 (generic) / $290 (brand) |

~12 hrs |

Cost-effective, established market base |

| Vyvanse |

~$270 |

~14 hrs |

Longer duration, less abuse potential |

| Mydayis |

~$370 |

~16 hrs |

Longer-lasting, targeted for adults |

Implication: DYANAVEL XR's premium pricing reflects its positioning in a niche segment where rapid onset and flexible dosing are prioritized over cost savings.

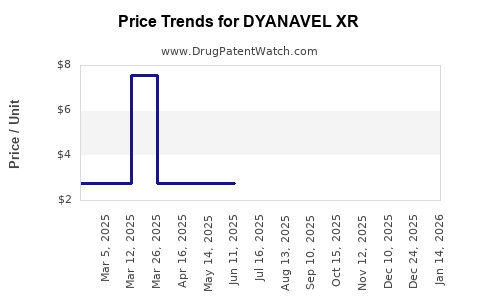

Price Projections: 2023–2028

Short-Term Outlook (2023–2025):

- Stability in Pricing: Current pricing levels are expected to remain relatively stable given patent protections and ongoing demand.

- Reimbursement Pressure: Payers may seek discounts or prefer generics where available; however, DYANAVEL XR’s differentiated profile buffers against significant price erosion.

- Market Penetration Growth: Adoption in pediatric and adolescent populations likely to support maintained pricing levels.

Long-Term Outlook (2026–2028):

- Patent Expiry and Generics: Patents for DYANAVEL XR are set to expire, with generic amphetamine extended-release products entering the market around 2026-2027. This will likely precipitate substantial price declines, potentially halving current net prices.

- Market Diversification: Post-patent, DYANAVEL XR may maintain a niche premium segment due to brand loyalty and prescriber preference, but broader market share will diminish.

- Potential for Formulation Innovations: Follow-on formulations aiming to improve onset, duration, or abuse-deterrent features could sustain higher price points.

- Regulatory and Policy Impact: Increased focus on controlled substance stewardship and prescribing restrictions may influence overall market volume and pricing trajectories.

Strategic Opportunities and Risks

Opportunities:

- Capitalize on rapid onset benefits in pediatric markets.

- Enhance formulary placement through clinical evidence and health economic studies.

- Develop combination therapies or extended formulations fostering premium pricing.

Risks:

- Entry of generics will pressure pricing and margins.

- Changes in regulatory landscape could limit prescribing volumes.

- Competitive advancements in non-stimulant ADHD therapies, such as Guanfacine, could reduce demand.

Conclusion

DYANAVEL XR’s current market shares projected to sustain moderate growth through 2025, driven by its unique dosing profile and targeted pediatric usage. However, approaching patent expiry around 2026 poses significant pricing risks, with potential halving of prices once generics enter the market. Strategic positioning emphasizing clinical benefits and differentiating features will be pivotal in maximizing revenue until patent expiration.

Key Takeaways

- Premium Positioning: DYANAVEL XR commands higher prices relative to many competitors, leveraging its rapid onset and flexible dosing.

- Market Risks: Patent expiry in 2026–2027 will precipitate significant price erosion absent proprietary advantages.

- Reimbursements: Payer policies significantly influence net pricing; securing favorable formulary placements remains critical.

- Long-term Strategy: Innovate formulations or expand indications to sustain value beyond patent expiry.

- Competitive Dynamics: Monitor both brand and generic entrants, alongside emerging therapies, to inform pricing and market strategies.

FAQs

1. When is DYANAVEL XR expected to lose patent protection?

Patent protection for DYANAVEL XR is anticipated to expire around 2026–2027, opening opportunities for generic competition.

2. How does DYANAVEL XR compare price-wise to its main competitors?

It is typically priced higher than generic formulations of Adderall XR but remains competitive within premium stimulant therapies like Vyvanse and Mydayis, with approximate prices from $250 to $350 per 30-count.

3. Will the entry of generics significantly reduce DYANAVEL XR’s market share?

Yes. Post-patent, generic amphetamine XR formulations are likely to dominate the market due to lower prices, potentially reducing DYANAVEL XR’s revenue by 50% or more.

4. Are there opportunities to extend DYANAVEL XR’s market exclusivity?

Potential avenues include developing new formulations, combination therapies, or securing additional clinical indications that may delay generic erosion.

5. How can manufacturers mitigate price erosion after patent expiry?

Through product innovation, expanding therapeutic indications, improving formulary positioning, and leveraging brand loyalty to maintain premium pricing segments.

References

- IQVIA, "Global ADHD Medications Market Report," 2022.

- Medispan, "Drug Pricing and AWPs," 2023.