Last updated: July 27, 2025

Introduction

Droxidopa, also known by its generic name, is a synthetic amino acid analog used primarily in the treatment of neurogenic orthostatic hypotension (nOH). Approved by the FDA in 2014 under the brand name Nortrate, droxidopa fills a critical niche for patients with autonomic nervous system disorders, particularly Parkinson’s disease and multiple system atrophy (MSA). As the landscape of neurodegenerative treatments evolves, understanding the market dynamics and pricing trajectory for droxidopa is vital for stakeholders including pharmaceutical companies, investors, healthcare providers, and policymakers.

Market Landscape Overview

Therapeutic Demand and Patient Population

The global prevalence of neurogenic orthostatic hypotension is estimated at 1-2 million patients in developed countries, with Parkinson's disease accounting for a significant proportion. The Parkinson’s Foundation projects approximately 10 million individuals worldwide diagnosed with Parkinson’s disease, with an estimated 50% suffering from nOH at some stage (1). This sizable patient base, coupled with limited effective treatments, positions droxidopa as a targeted therapy with a dedicated niche.

Market Penetration and Competition

Droxidopa's primary competitor historically has been off-label vasoconstrictive agents such as midodrine. However, the latter's regulatory limitations and adverse profile have constrained its overall adoption, giving droxidopa a competitive advantage. Recently, the emergence of novel agents targeting autonomic failure, including gene therapies and other symptomatic treatments, could influence market share dynamics.

Regulatory and Reimbursement Factors

Reimbursement policies significantly impact sales trajectories. In the U.S., Centers for Medicare & Medicaid Services (CMS) coverage for droxidopa has facilitated access, bolstering sales. Globally, regulatory approvals are progressing heterogeneously; Japan, Europe, and emerging markets are at various stages of authorization, impacting global market size.

Market Drivers and Barriers

Key drivers include increasing diagnosis rates, heightened awareness, and improvements in quality of life measures for nOH patients. Barriers arise from high treatment costs, complex management protocols, and limited physician familiarity outside specialized centers.

Price Analysis of Droxidopa

Current Pricing Landscape

Droxidopa is marketed under the brand Nortrate by Lundbeck and its biosimilar versions are not yet widely available. As of early 2023, the average wholesale price (AWP) for a one-month supply (30 pills) ranges between $7,500 and $8,500 in the United States [2], translating into an annual treatment cost exceeding $90,000.

Pricing Components

Multiple factors influence droxidopa's pricing:

- Research and Development (R&D) Costs: As a small molecule with existing data and prior approvals, R&D costs for droxidopa are relatively low compared to novel biologics.

- Manufacturing Costs: Typically modest for amino acid analogs, though formulations with specific delivery systems may bear additional costs.

- Market Exclusivity and Patent Life: Patent protections extending into the late 2020s have sustained premium pricing levels.

- Reimbursement and Insurance Negotiations: Payers often negotiate discounts, but initial list prices tend to be high, reflecting the drug’s specialized application.

Price Projections and Future Trends

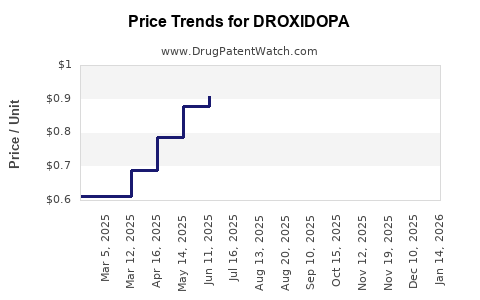

Short-term Outlook (1–3 Years)

In the immediate future, droxidopa’s price is anticipated to remain stable or slightly increase, driven by inflation, manufacturing cost rises, and limited generic competition. The current exclusivity protection supports maintained high prices. Price erosion is unlikely unless biosimilar entrants or alternative therapies significantly penetrate the market.

Medium to Long-term Outlook (3–10 Years)

Price reductions are expected unless new indications emerge that broaden the patient base. The gradual introduction of biosimilars or generic parenteral formulations could lead to discounts potentially ranging from 20% to 40%. Additionally, competitive innovations, including advanced autonomic system modulators or gene therapy options, may further pressure droxidopa’s pricing.

Emerging Market Dynamics

In regions where regulatory approval and reimbursement pathways are evolving, prices could be significantly lower due to market competition or price control policies. For example, European countries employing strict price regulations may see droxidopa’s costs decline by 30–50% over the next 5 years.

Potential Impact of Biosimilars and Alternatives

While droxidopa itself is a small molecule and thus more susceptible to generic competition, the absence of biosimilars limits immediate downward pressure. Should biosimilars or improved formulations emerge, significant price erosion could ensue. Moreover, the development of alternative treatments, such as novel autonomic nervous system agents, may further influence pricing strategies.

Market Entrants and Innovation Impact

Innovations such as centrally acting agents, implantable devices, or gene therapies targeting underlying autonomic dysfunction might reduce reliance on droxidopa, impacting its market share and price. The advent of such therapies could accelerate price declines if they demonstrate superior efficacy or safety profiles.

Regulatory and Reimbursement Trajectory Influence

Policy changes promoting value-based pricing and outcomes-based reimbursement models could influence pricing strategies for droxidopa, incentivizing manufacturers to offer competitive pricing or discount arrangements in exchange for market access and coverage.

Key Takeaways

- Stable but Premium Pricing: Droxidopa is currently priced at a premium, with no immediate competition, maintaining high per-unit costs.

- Market Growth Driven by Demographic Trends: The expanding Parkinson’s and autonomic disorder populations support ongoing demand, though competition and innovation pose future risks to price stability.

- Cost-Containment Environment Emerging: Price declines of 20–50% are plausible within 5–10 years driven by biosimilars, generics, and alternative therapies.

- Reimbursement Dynamics Critical: Access and pricing are heavily influenced by payers’ policies, especially in global markets, affecting revenue potential.

- Strategic Positioning Necessary: Companies should monitor regulatory developments and emerging treatment options to optimize pricing strategies.

Conclusion

Droxidopa maintains a compelling position within the niche neurogenic orthostatic hypotension market, supported by high unmet needs and regulatory exclusivity. However, the horizon indicates potential price pressures from biosimilars, emerging therapies, and policy shifts. Stakeholders must consider these factors when evaluating investment, formulary positioning, and competitive strategies.

FAQs

-

What is the current average price of droxidopa in the U.S.?

The average wholesale price for a 30-day supply ranges between $7,500 and $8,500, translating to annual costs exceeding $90,000.

-

Are biosimilars available for droxidopa?

No; droxidopa is a small molecule, and no biosimilars are currently approved. Generic competition might emerge if patents expire or if alternative formulations are developed.

-

Which factors most influence droxidopa’s market price?

Regulatory exclusivity, manufacturing costs, reimbursement policies, and competition from emerging therapies or generics primarily influence pricing.

-

How might new treatments impact droxidopa’s market share and price?

Innovative therapies, including gene therapy or advanced autonomic agents, could reduce droxidopa’s market share and exert downward pressure on its price over time.

-

What are the global prospects for droxidopa pricing?

In emerging markets and regions with strict price controls, droxidopa prices could decline by 30–50% within five years, whereas in mature markets, prices are likely to remain stable unless significant competition appears.

References

[1] Parkinson’s Foundation. Parkinson’s Disease Statistics. 2022.

[2] IQVIA data and industry price reports, 2023.