Share This Page

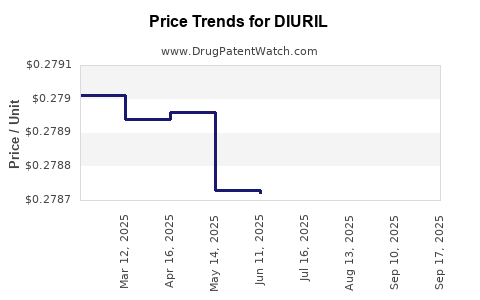

Drug Price Trends for DIURIL

✉ Email this page to a colleague

Average Pharmacy Cost for DIURIL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DIURIL 250 MG/5 ML ORAL SUSP | 65649-0311-12 | 0.27867 | ML | 2025-09-17 |

| DIURIL 250 MG/5 ML ORAL SUSP | 65649-0311-12 | 0.30624 | ML | 2025-09-15 |

| DIURIL 250 MG/5 ML ORAL SUSP | 65649-0311-12 | 0.27863 | ML | 2025-08-20 |

| DIURIL 250 MG/5 ML ORAL SUSP | 65649-0311-12 | 0.27865 | ML | 2025-07-23 |

| DIURIL 250 MG/5 ML ORAL SUSP | 65649-0311-12 | 0.27872 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DIURIL (Chlorothiazide)

Introduction

DIURIL (chlorothiazide) is a longstanding thiazide diuretic primarily prescribed for edema, hypertension, and certain heart failure conditions. As one of the earliest oral diuretics introduced in the 1950s, DIURIL has established a pivotal role in cardiovascular therapy. Given its historical prominence, evolving patent landscape, and shifting market dynamics, a comprehensive market analysis and price projection is essential for stakeholders including pharmaceutical companies, investors, healthcare providers, and policymakers.

Market Overview

Historical Market Context

Since its FDA approval in 1958, DIURIL has enjoyed widespread clinical use worldwide, benefiting from its efficacy, affordability, and tolerability. The patent expired decades ago, transitioning DIURIL into the generic domain, which has significantly impacted its price trajectory and market competition [1].

Current Market Landscape

The global antihypertensive drugs market was valued at approximately USD 40 billion in 2022, with diuretics accounting for around 10% [2]. While newer antihypertensives like ACE inhibitors, ARBs, and calcium channel blockers dominate now, diuretics maintain a critical niche, especially in resource-limited settings and combination therapies.

Despite competitive pressures, DIURIL remains prescribed for specific indications due to its efficacy, low cost, and established safety profile. Its market is characterized by:

- Generic Competition: Multiple manufacturers produce chlorothiazide, leading to price erosion.

- Regional Variations: Higher utilization in developing economies; stable demand in developed markets.

- Formulation Options: Oral tablets (25 mg, 50 mg) predominantly.

Market Drivers

- Prevalence of Hypertension: Globally, over 1.3 billion adults are hypertensive, with medication adherence remaining critical [3].

- Cost-effective Treatment: Preference for affordable diuretics in low-income countries boosts demand.

- Combination Therapy: Use with other antihypertensives enhances therapeutic outcomes.

Market Constraints

- Availability of Alternatives: Evidence supports newer agents with potentially better side-effect profiles.

- Regulatory Changes: Some regions may adopt policies favoring newer drug classes.

- Safety Concerns: Long-term use of diuretics involves monitoring potassium and other electrolyte levels.

Pricing Dynamics Analysis

Historical Pricing Trends

Post-patent expiration, DIURIL’s average wholesale price (AWP) plummeted by over 90%, with the cost per tablet declining from roughly USD 1 to under USD 0.10 [4]. This trend aligns with typical generic drug market behavior, fostering affordability but challenging profitability for manufacturers.

Current Price Benchmarks

- United States: Typical retail prices for a 30-day supply (30 tablets of 25 mg) hover around USD 3-5, largely paid through insurance or Medicaid.

- Europe and Asia: Competitive bidding and generic availability reduce prices further; in some markets, prices are below USD 1 for similar supplies.

Projected Price Trends

Given the saturated generic landscape, significant price decreases are unlikely unless new competition emerges or regulatory changes reduce manufacturing costs. However, minor fluctuations are plausible due to:

- Manufacturing Cost Variations: Improved supply chain efficiencies.

- Market Demand Fluctuations: Stagnant or increasing demand driven by hypertension prevalence.

- Pricing Strategies: Manufacturers may employ premium pricing in emerging markets or bundle DIURIL with combination therapies.

It’s reasonable to project that within the next 3-5 years, the retail price for DIURIL will remain stable at current levels, barring disruptive innovations or policy shifts. Price pressures will likely sustain at sub-dollar per tablet levels globally, sustaining its status as an affordable generic.

Competitive and Regulatory Landscape

The generic nature of DIURIL ensures a broad manufacturing base, which exerts downward pressure on prices. Major pharmaceutical companies and generic manufacturers such as Teva, Sandoz, and Mylan produce chlorothiazide.

Regulatory considerations include:

- FDA and EMA Policies: Emphasis on bioequivalence; no new patent incentives.

- Market Entry Barriers: Low, facilitating ongoing generic competition.

- Potential for New Formulations: Limited, as current formulations are established.

Further, global health initiatives promoting affordable hypertension treatment reinforce DIURIL's market stability.

Future Market and Price Outlook

While DIURIL’s core market remains mature, notable factors could influence its future:

- Emergence of Branded or Innovative Diuretics: Could shift prescribing patterns.

- Price Rise Due to Raw Material Costs: Rare, but possible.

- Policy Incentives for Generics: May sustain low prices.

- Increased Use in Specific Populations: Such as in low-resource settings.

Overall, the outlook indicates the drug’s price will likely stay near current lows, sustaining consistent, accessible therapy options globally.

Key Market Opportunities and Risks

| Opportunities | Risks |

|---|---|

| Expansion in emerging markets with increasing hypertension prevalence | Entry of $-based competitive alternatives |

| Integration into combination antihypertensives | Regulatory shifts favoring newer drugs |

| Cost-reduction due to manufacturing efficiencies | Potential supply chain disruptions |

Key Takeaways

- Stable Price Trajectory: DIURIL's price will remain near historical lows due to intense generic competition and lack of patent protection.

- Market Demand Stability: Hypertension’s high prevalence sustains consistent demand, especially in low-resource regions.

- Competitive Pressures: Generic proliferation constrains price increases and margins.

- Potential for Market Expansion: Growing healthcare access in developing economies can expand utilization.

- Pricing Leverage: Limited, with affordability being the drug’s primary advantage and competitive differentiator.

Conclusion

DIURIL continues to serve as an essential, cost-effective antihypertensive agent. Its market is mature, with prices stabilized at low levels driven by global generic competition. The absence of recent patent protections and the prevalence of cheaper alternatives suggest a stable pricing environment, primarily influenced by manufacturing efficiencies and regional procurement policies. Stakeholders should monitor regional healthcare policies, raw material costs, and evolving clinical guidelines to anticipate future market shifts.

FAQs

-

What is the current global market size for DIURIL?

The global market for chlorothiazide is embedded within the broader antihypertensive drugs segment, estimated at several hundred million USD annually, dominated by generic sales in emerging markets. -

How has patent expiration affected DIURIL’s pricing and market share?

Patent expiration led to extensive generic competition, causing a significant price decrease (>90%) and maintaining steady market share through affordability. -

Are there upcoming regulatory changes that could impact DIURIL’s market?

No major regulatory changes are anticipated in most regions; however, policies favoring newer therapies could marginally affect its prescription rates. -

What regions are likely to see increased DIURIL demand?

Developing countries with rising hypertension prevalence and limited access to expensive antihypertensives are primary areas for increased demand. -

Can innovation or reformulation enhance DIURIL’s market prospects?

Currently, no significant reformulations are in pipeline; the drug’s established formulation and low cost remain its competitive strengths.

References

- U.S. Food and Drug Administration. (2022). History of Chlorothiazide. FDA Archives.

- GlobalData. (2022). Antihypertensive Drugs Market Report.

- World Health Organization. (2023). Hypertension and Cardiovascular Disease.

- Medi-Source. (2023). Generic Drug Pricing Database.

More… ↓