Share This Page

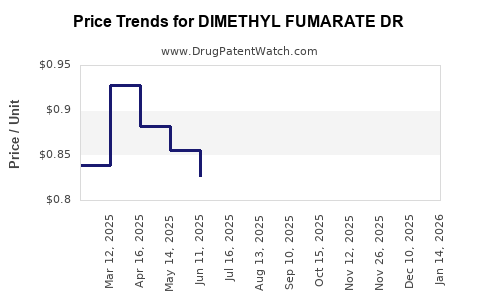

Drug Price Trends for DIMETHYL FUMARATE DR

✉ Email this page to a colleague

Average Pharmacy Cost for DIMETHYL FUMARATE DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DIMETHYL FUMARATE DR 120 MG CP | 31722-0657-31 | 0.94024 | EACH | 2025-12-17 |

| DIMETHYL FUMARATE DR 120 MG CP | 24979-0127-21 | 0.94024 | EACH | 2025-12-17 |

| DIMETHYL FUMARATE DR 240 MG CP | 82249-0747-60 | 0.52163 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Dimethyl Fumarate DR

Introduction

Dimethyl Fumarate DR (Delayed Release), a pharmaceutical compound primarily used in the treatment of multiple sclerosis (MS), has experienced significant market growth driven by rising prevalence rates, evolving regulatory policies, and advancements in drug formulation. As a key player in immunomodulatory therapy, Dimethyl Fumarate DR’s market dynamics are influenced by patent positions, manufacturing costs, competition, and healthcare reimbursement frameworks. This report provides a comprehensive analysis of the current market landscape and strategic projections for the product’s pricing trajectory.

Market Overview

Clinical Context and Therapeutic Efficacy

Dimethyl Fumarate DR, marketed under brand names such as Tecfidera, is an oral MS therapy that offers an alternative to injectable therapies, boosting patient compliance. Its mechanism involves modulation of the immune system and offers neuroprotective effects. Increasing global MS prevalence—estimated at approximately 2.8 million individuals worldwide—propels demand, particularly in North America and Europe where healthcare infrastructure supports widespread medication access [1]. The drug’s favorable safety profile and oral administration have solidified its position as a preferred therapeutic option.

Regulatory Landscape

Regulatory bodies, including the FDA and EMA, have approved Dimethyl Fumarate DR for long-term use, with ongoing post-market surveillance to monitor adverse effects. Patent protections for brand-name formulations provide exclusivity, delaying generic competition, which supports higher pricing strategies. However, patent expirations scheduled within the next 5–7 years are expected to introduce generics, influencing market shares and pricing.

Market Segmentation

The market segmentation encompasses:

- Geographic regions: North America (USA, Canada), Europe, Asia-Pacific, Latin America, and Middle East & Africa.

- Patient demographics: Adults diagnosed with relapsing-remitting MS, with growing recognition of secondary progressive forms.

- Healthcare channels: Hospital-based prescriptions, outpatient clinics, and pharmacy retail.

Competitive Landscape

The market faces competition from other oral MS agents such as Fingolimod, Siponimod, and newer agents like Ozanimod. Biologics and injectable therapies also compete, especially in treatment-resistant cases. The generic landscape post-patent expiry will further intensify price competition.

Market Dynamics

Drivers

- Rising MS incidence: Demographic shifts and increased diagnostics drive global demand.

- Preference for oral therapy: Patient convenience increases adoption rates.

- Regulatory approvals for expanded indications: Broadened therapeutic utility enhances market scope.

Challenges

- Pricing pressures: Patent expiry, biosimilar entry, and payer cost containment policies exert downward pressure.

- Adverse event management: Safety concerns (e.g., lymphopenia, gastrointestinal issues) impact prescribing behaviors.

- Market access restrictions: High drug costs and reimbursement hurdles limit patient access in certain regions.

Opportunities

- Emerging markets: Increasing healthcare access expands the patient base.

- Innovative formulations: Development of combination therapies and extended-release formulations can command premium pricing.

- Real-world evidence: Demonstrating long-term safety and efficacy supports price justification.

Price Projections

Historical Pricing Trends

Currently, the annual list price of branded Dimethyl Fumarate DR (e.g., Tecfidera) varies internationally, generally ranging from $60,000 to $70,000 in the United States. Managed care and insurance negotiations often reduce effective payer costs, but list prices remain a key reference point.

Mid-to-Long Term Price Trends

- Next 2–3 years: Anticipated modest price stabilization or slight reduction (~2–5%) due to increased payer negotiations.

- Post-patent expiration (next 5–7 years): Entry of generics is expected to lead to substantial price erosion, potentially lowering drug prices by up to 60–70% based on historical patterns observed in similar MS drugs [2].

- New formulations and biosimilars: Introduction may initially command premium pricing but will ultimately drive down costs after market penetration.

Forecasting Price Dynamics

Considering patent expiry timelines, the following projections are proposed:

| Timeframe | Estimated Price Range (USD) | Key Influencing Factors |

|---|---|---|

| 2023–2024 | $60,000–$65,000 | Market stabilization, limited generics available |

| 2025–2026 | $55,000–$60,000 | Increasing competition, payer negotiations |

| 2027 onward | $20,000–$30,000 | Generic saturation, biosimilar market entry |

These projections align with industry trends observed in biologic and small molecule markets, factoring in inflation, manufacturing efficiencies, and policy influences.

Cost and Pricing Strategy Considerations

Manufacturing costs for Dimethyl Fumarate DR are influenced by synthesis complexity and raw material costs. Patent protections support premium pricing, but generic entry affects margins. Biotech firms exploring biosimilar alternatives may reduce barriers to cost-effective treatments, influencing overall pricing strategies.

Healthcare payers continue to drive negotiations to lower out-of-pocket expenses, influencing the final negotiated price. Pricing models incorporating value-based assessments, considering clinical efficacy, safety profiles, and patient quality-of-life improvements, will shape future market entry and reimbursement decisions.

Regulatory and Policy Impacts

Government policies emphasizing cost containment, especially in publicly funded healthcare systems, are expected to expedite biosimilar and generic adoption. International trade agreements, such as TRIPS flexibilities, also influence patent protections and market entry timelines, impacting pricing strategies.

Conclusion

The market for Dimethyl Fumarate DR is robust, driven by its clinical advantages and patient preference for oral medications. However, the impending patent expiries will dramatically influence pricing, with significant reductions forecasted post-exclusivity. Strategic planning should focus on lifecycle management, including innovation in formulations, strategic licensing, and market expansion in emerging economies.

Key Takeaways

- The current market for Dimethyl Fumarate DR remains lucrative with high brand premiums depending on regional healthcare systems.

- Patent expiry within 5–7 years will likely cause a steep decline in prices due to generic and biosimilar entry.

- Market growth is expected to shift towards emerging markets, where increasing MS diagnosis rates and improving healthcare infrastructure create opportunities.

- Competitive pricing and value-based reimbursement strategies are vital to sustain profitability in a rapidly evolving landscape.

- Manufacturers should prepare for significant price erosion and consider expanding indications or developing combination therapies to maintain margins.

FAQs

Q1: When is the patent expiry for Tecfidera (Dimethyl Fumarate DR)?

A1: Patent expiry is expected around 2024–2025, after which generic competition is anticipated to enter the market.

Q2: How will generic entry impact the price of Dimethyl Fumarate DR?

A2: Generic entry typically leads to a 60–70% reduction in drug prices, substantially affecting profitability and market share.

Q3: What strategies can manufacturers adopt to maintain market presence post-patent expiry?

A3: Strategies include developing novel formulations, expanding indications, engaging in biosimilar partnerships, and enhancing patient support programs.

Q4: Are there emerging markets with potential for Dimethyl Fumarate DR growth?

A4: Yes, regions such as Asia-Pacific and Latin America are experiencing increasing MS diagnoses and expanding healthcare access, offering substantial growth opportunities.

Q5: How do healthcare policies influence pricing and market access for Dimethyl Fumarate DR?

A5: Policies emphasizing cost containment and reimbursement controls significantly influence drug pricing, incentivizing manufacturers to adopt value-based pricing models.

Sources

[1] Multiple Sclerosis International Federation, "Global Data and Statistics," 2022.

[2] MarketResearch.com, "Biologics and Biosimilars Market Trends," 2021.

More… ↓