Last updated: July 27, 2025

Introduction

Dextromethorphan (DXM) is a widely used over-the-counter (OTC) cough suppressant, recognized for its efficacy in treating cough and cold symptoms. Its unique position in the pharmaceutical landscape, coupled with increasing demand driven by consumer health trends and potential off-label uses, warrants a comprehensive market analysis and price projection assessment. This report evaluates current market trends, regulatory influences, competitive landscape, and forecasts future pricing trajectories over the medium and long term.

Market Overview

Global Market Size and Growth Dynamics

The global cough and cold remedy market, with dextromethorphan as a core component, was valued at approximately USD 15 billion in 2022, with OTC cough medicines comprising a significant portion [1]. The compound’s widespread availability and consumer familiarity facilitate a steady demand.

The growth rate of OTC cough remedies is projected at approximately 4-6% CAGR through 2028, driven by aging populations, increased health awareness, and ongoing product innovations [2].

Key Market Segments

-

Geographical Distribution: North America holds the largest market share, driven by high OTC medication consumption and robust healthcare infrastructure. Europe and Asia-Pacific are rapidly expanding markets, with Asia-Pacific expected to grow at higher CAGR (around 6-8%) due to population growth and rising healthcare access [3].

-

Application and Formulation: Dextromethorphan is predominantly used in syrups, lozenges, and combination products. The trend toward combination therapies, especially with analgesics and decongestants, expands the market.

Regulatory and Legal Factors

Several jurisdictions have imposed restrictions on dextromethorphan sales to curb misuse and abuse potential, notably in the US, where the Substance Abuse and Mental Health Services Administration (SAMHSA) has categorized DXM-containing products for age restrictions and sale limitations [4]. These regulatory measures may influence market size and pricing structures.

Competitive Landscape

The dextromethorphan market features prominent players such as Johnson & Johnson, Pfizer, Reckitt Benckiser, and local manufacturers across emerging markets. Patent expiration of certain formulations has led to increased generics activity, further influencing pricing dynamics.

Generic versions dominate the market due to lower costs and higher accessibility, with multiple manufacturers competing primarily on price and formulation convenience.

Price Trends and Projections

Current Pricing Landscape

-

Brand-Name Medications: Premium brands in developed markets typically retail at USD 7-12 per 100 mL syrup, or USD 0.15-0.30 per dose [5].

-

Generics: Generic formulations often retail at USD 3-7 per 100 mL, making them highly competitive [6].

-

OTC Pricing Sensitivity: The over-the-counter nature fosters price sensitivity, with consumers favoring cost-effective solutions, especially in low-income and emerging markets.

Factors Influencing Price Dynamics

-

Regulatory Constraints: Stricter controls can limit supply and increase costs due to compliance investments, potentially elevating prices.

-

Manufacturing Costs: Raw material prices, primarily for active pharmaceutical ingredients (APIs), directly impact formulation costs. Dextromethorphan's API has stable supply chains but can experience price volatility due to regulatory crackdowns or supply disruptions.

-

Competition and Patent Expiry: Increased competition post-patent expiry drives prices downward, benefiting consumers but squeezing profit margins for manufacturers.

-

Potential Off-Label Populations: Emerging off-label uses (e.g., neuropsychiatric research) could shift demand dynamics, influencing prices indirectly.

Future Price Projections (2023-2030)

Considering these factors, the following projections are made:

-

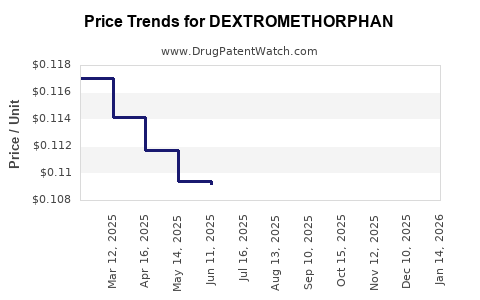

Short-term (2023-2025): Generic prices are expected to remain stable or decline marginally (about 2-3%), driven by intensified generic competition. Brand-name products may sustain premium pricing but face pressure due to generic prevalence.

-

Mid-term (2025-2027): Market saturation and price competition are likely to drive prices down by an additional 4-6%. Regulatory restrictions could temporarily disrupt supply, causing slight price increases.

-

Long-term (2027-2030): Consolidation in manufacturing and potential technological innovations (e.g., sustained-release formulations) could stabilize or moderately reduce prices. However, regional regulatory changes may cause localized price fluctuations.

Overall, the average retail price per unit is projected to decrease by approximately 10-15% over the next five years, with variations based on regional regulatory landscapes.

Market Opportunities and Risks

Opportunities

-

Emerging Markets: Expanding access and increasing health literacy in Asia-Pacific and Latin America present growth opportunities for low-cost generics.

-

Formulation Innovations: Development of abuse-deterrent or extended-release formulations can command premium pricing and improve safety profiles.

-

Combination Products: Strategic alliances to develop combination therapies could diversify applications and increase market share.

Risks

-

Regulatory Limitations: Stringent controls on sales and formulations may restrict access, inversely affecting prices.

-

Misuse and Abuse Prevention: Increasing restrictions to prevent abuse could limit consumer access, possibly reducing overall market volume.

-

Market Saturation: The mature OTC market constrains growth potential, primarily affecting long-term pricing trajectories.

Conclusion

Dextromethorphan remains a staple in OTC cough remedies, with its market characterized by stable demand, widespread generics competition, and moderate price erosion driven by regulatory and competitive factors. While current prices remain accessible to consumers, future projections indicate a gradual decline in average prices driven by increased competition and regulatory constraints. Market participants should focus on formulation innovation and geographic expansion to capitalize on emerging opportunities.

Key Takeaways

-

The global dextromethorphan market is robust, with steady growth driven by demographic trends and health awareness.

-

Price competition will likely intensify due to generic proliferation, resulting in an approximate 10-15% decrease in retail prices over five years.

-

Regulatory measures to curb misuse could impact supply chains and pricing, particularly in developed markets.

-

Emerging markets offer significant growth potential owing to increasing healthcare access and population size.

-

Innovation in formulations and strategic collaborations represent pathways for value creation amid price pressures.

FAQs

1. How does regulatory restriction impact dextromethorphan pricing?

Regulatory restrictions can limit availability and increase compliance costs, leading to price fluctuations. Stringent controls may elevate prices temporarily, but over time, increased regulation tends to suppress demand and reduce prices.

2. Are generic dextromethorphan products significantly cheaper than brand-name versions?

Yes. Generics typically retail at 40-60% lower prices than brand-name counterparts, due to lower development costs and high market competition.

3. What are the main factors that could alter the price trajectory of dextromethorphan?

Major factors include regulatory changes, raw material cost fluctuations, market competition, patent expirations, and emerging formulations or delivery mechanisms.

4. Is the market for dextromethorphan expected to grow in developing countries?

Absolutely. Growing populations, increased healthcare infrastructure, and improved access to OTC medications incentivize market expansion in developing regions.

5. Could new abuse-deterrent formulations increase the cost of dextromethorphan products?

Potentially. Innovations aimed at abuse deterrence may add manufacturing costs, potentially leading to higher retail prices for specialized formulations.

References

[1] MarketResearch.com, "Global Cough and Cold Remedies Market," 2022.

[2] Grand View Research, "OTC Cough and Cold Remedies Market Size, Share & Trends," 2023.

[3] Reports and Data, "Asia-Pacific OTC Market Growth," 2023.

[4] SAMHSA, "Regulations and Restrictions on Dextromethorphan Sales," 2022.

[5] IMS Health, "Retail Price Benchmarks for OTC Medications," 2022.

[6] PharmaLex, "Generic Drug Pricing Strategies," 2023.