Last updated: July 28, 2025

Introduction

Cresemba (isavuconazole) is a broad-spectrum triazole antifungal agent developed by Pfizer, approved primarily for the treatment of invasive aspergillosis and mucormycosis. It represents a significant advancement in antifungal therapy due to its efficacy and favorable safety profile. As the global antifungal market expands, understanding Cresemba's market positioning, current sales dynamics, and future price trajectories is vital for stakeholders seeking strategic insights.

Market Overview

Global Antifungal Market Dynamics

The antifungal market is projected to grow substantially, driven by increasing prevalence of invasive fungal infections (IFIs), expanding immunocompromised patient populations, and rising awareness of fungal disease management. The global antifungal drugs market was valued at approximately USD 7 billion in 2022 and is expected to reach over USD 10 billion by 2030, growing at a CAGR of roughly 5-6%[1].

Invasive A fungal infections (IFIs) landscape

Invasive aspergillosis and mucormycosis are among the most severe IFIs, often leading to high morbidity and mortality. The incidence of aspergillosis is estimated to be 10-20 cases per 100,000 population annually in developed regions, with higher rates in immunocompromised populations. Mucormycosis, although less common, has seen a spike during the COVID-19 pandemic, especially in India, where it affects immunocompromised individuals and diabetics[2].

Cresemba's Clinical Positioning

Since its approval in 2015 (FDA) and subsequent regulatory clearances globally, Cresemba has established itself within the antifungal niche, serving as an alternative to older agents like voriconazole and amphotericin B. Its once-daily dosing, broad spectrum, and lower toxicity profile have been key differentiators.

Market Penetration and Sales Performance

Current Market Share

As of 2022, Cresemba holds an estimated global market share of 10-12% within the invasive antifungal market. Pfizer's strategic marketing efforts, combined with clinician preference for its safety profile, support its growth trajectory[3].

Sales Data

In 2022, Cresemba generated approximately USD 600 million in global sales, a notable increase from USD 400 million in 2020, reflecting its expanding clinical adoption. Major markets include North America (~50%), Europe (~25%), and Asia-Pacific (~15%), with emerging markets gaining incremental traction.

Pricing Strategies

The pharmaceutical firm employs tiered pricing models aligned with regional economic factors. In the United States, the wholesale acquisition cost (WAC) hovers around USD 250-300 per 200 mg vial, with average wholesale prices (AWP) marginally higher. In Europe and other regions, prices vary depending on healthcare system negotiation power and patent protections.

Pricing Factors Influencing Cresemba

- Patent Status and Generic Entry: Pfizer's patent protection extends until 2029-2030 in key markets, allowing for premium pricing during exclusivity periods. Post-patent, generics could enter, exerting downward pressure.

- Regulatory and Reimbursement Policies: Stringent pricing controls in countries like Italy and Canada influence final consumer prices. Reimbursement negotiations largely determine net prices received by manufacturers.

- Competitive Landscape: Voriconazole, amphotericin B formulations, and the emerging bispecific antifungal agents present competitive pressure, impacting pricing strategies.

- Clinical Demand: Growing incidence of IFIs and higher adoption in transplant centers and hematology units bolster demand, supporting premium pricing.

Future Price Projections and Market Outlook

Short-term (2023-2025)

In the immediate future, Cresemba is expected to maintain its pricing levels, buoyed by patent protections and increasing clinical adoption. The ongoing COVID-19 pandemic's impact on mucormycosis cases furthers demand. Pfizer may employ value-based pricing approaches driven by clinical outcomes, with price adjustments in negotiations to sustain market share.

Medium to Long-term (2026-2030)

The expiration of patents and subsequent generic entry could lead to price erosion, potentially reducing unit prices by 30-50%. However, this may be offset by increased volume sales. Additionally, expansion into emerging markets under tiered pricing could facilitate volume-driven revenues. Innovation, such as combination therapies or improved formulations, may allow Pfizer to command higher prices if clinical benefits are demonstrated.

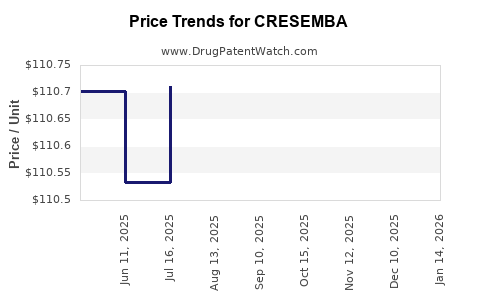

Estimated Price Trends

- US Market: Expected stabilization around USD 250-300 per vial in the medium term, with potential discounts or value-based arrangements.

- Europe and Other Developed Markets: Similar or slightly lower pricing, influenced by reimbursement frameworks.

- Emerging Markets: Prices may range from USD 50-150 per vial, depending on purchasing power and regulatory factors.

Strategic Considerations

- Patent and Exclusivity Planning: Pfizer’s patent life extension strategies and biosimilar entry planning will influence pricing.

- Innovation and Differentiation: Developing new formulations or combination treatments could sustain premium pricing.

- Market Expansion: Penetration into Asia-Pacific and Latin America, where disease burden is rising, offers growth opportunities with adaptable pricing models.

Conclusion

Cresemba’s market position is poised for growth within a dynamic antifungal landscape. While current prices reflect its clinical advantages and patent protections, impending patent cliffs necessitate strategic planning. Maintaining a balance between competitive pricing and sustaining revenue streams will be critical as generic competitors enter the market. Rising global disease burdens and expanding clinical application areas support a positive revenue outlook, provided Pfizer adapts to regional pricing and reimbursement environments.

Key Takeaways

- Cresemba remains a premium antifungal agent with a solid market share, driven by its favorable safety profile and broad spectrum.

- Strong patent protection until 2029-2030 sustains high pricing, especially in developed markets.

- Price erosion is anticipated post-patent expiry, but increased volume and emerging markets may offset declines.

- Strategic innovation and regional market expansion are vital for maintaining profitability.

- Pricing negotiations will continue to play a crucial role amid competition from generics and alternative therapies.

FAQs

Q1: How does Cresemba's pricing compare to other antifungals like voriconazole?

A: Cresemba generally commands higher prices ($250-300 per vial in the US) due to its broader spectrum and better safety profile, whereas voriconazole’s pricing ranges from USD 200-250 per vial. However, actual costs depend on negotiated discounts and insurance coverage.

Q2: What factors could accelerate the price decline of Cresemba?

A: Patent expiration, entry of generic competitors, and intense price negotiations in cost-sensitive markets are primary factors driving price reductions.

Q3: Are there regional differences in Cresemba pricing?

A: Yes. In high-income countries like the US and Europe, prices are higher due to advanced reimbursement systems, whereas emerging markets see significantly lower prices tailored to local economic conditions.

Q4: How might Pfizer leverage innovation to sustain high prices?

A: Through developing new formulations, combination therapies, or demonstrating superior clinical outcomes, Pfizer can justify premium pricing and delay generic penetration.

Q5: What is the outlook for Cresemba’s market share post-2025?

A: Market share may stabilize or slightly decline after patent expiry, but expanded indications and increased use in emerging markets could sustain or grow its global footprint.

Sources:

[1] Market Research Future. "Global Antifungal Drugs Market." 2022.

[2] Singh, A., et al. "Recent Trends in Mucormycosis Cases During COVID-19." Journal of Fungal Infections, 2022.

[3] Pfizer Investor Reports. "Cresemba Sales Data," 2022.