Last updated: July 28, 2025

Introduction

Ciprofloxacin Hydrochloride (Ciprofloxacin HCL) is a broad-spectrum fluoroquinolone antibiotic extensively used to treat various bacterial infections, including urinary tract infections, respiratory tract infections, and skin infections. As a critical component in antimicrobial therapy, its market dynamics are influenced by clinical demand, regulatory environment, competitive landscape, and emerging resistance patterns. This analysis evaluates the current global market status of Ciprofloxacin HCL, examines supply-demand factors, evaluates regulatory and patent considerations, and provides forward-looking price projections anchored in market trends.

Market Overview

Global Market Size and Growth Dynamics

According to recent reports, the global antibiotics market stood at approximately USD 47.3 billion in 2022, with fluoroquinolones representing a significant share due to their broad efficacy and ease of administration. Ciprofloxacin remains a dominant compound within this class, accounting for approximately 20–25% of fluoroquinolone sales, valued at an estimated USD 2–3 billion in 2022 [1].

The compound's market is expanding at a compounded annual growth rate (CAGR) of approximately 3.5–4% over the past five years, driven primarily by increasing prevalence of infectious diseases and evolving clinical guidelines favoring oral fluoroquinolones. The COVID-19 pandemic, however, temporarily disrupted manufacturing and supply chains, impacting distribution but simultaneously increasing demand for antibiotics to treat secondary bacterial infections.

Regional Market Insights

- North America: Leading market due to high prescription rates, antibiotic consumption, and extensive healthcare infrastructure. The U.S. accounts for roughly 40% of global Ciprofloxacin HCL sales.

- Europe: Strong market presence, governed by stringent regulation but high disease prevalence. Growth driven by aging populations.

- Asia-Pacific: Fastest-growing segment, owing to rising infectious disease burden, improving healthcare access, and increasing outpatient prescriptions. The region's market is projected to grow at a CAGR of around 5% through 2027.

- Rest of the World: Emerging markets experiencing increased adoption, although constrained by regulatory hurdles and price sensitivity.

Manufacturing and Supply Chain Dynamics

Ciprofloxacin HCL is synthesized predominantly through chemical processes involving quinolone intermediates. Key manufacturers include Pfizer, Teva Pharmaceuticals, and Sun Pharma, among others. The market has observed consolidation, with leading players expanding capacities through strategic investments and licensing agreements.

Supply chain stability remains crucial, with raw material availability and geopolitical factors impacting production costs. Recently, raw material price volatility and regulatory scrutiny over antibiotic overuse have exerted downward pressure on profit margins. Patent expirations in key jurisdictions, notably the U.S. and Europe, have led to the entry of generic manufacturers, intensifying price competition.

Regulatory and Patent Landscape

Patent protections for Ciprofloxacin formulated drugs have largely expired in mature markets, fostering generic proliferation. However, formulation-specific patents and new delivery systems are still active in some regions, potentially creating market exclusivity for branded variants.

Regulatory agencies like the FDA and EMA impose stringent requirements for approval, especially concerning antimicrobial resistance and safety profiles. Increasing concern about fluoroquinolone side effects (e.g., tendinopathy, CNS effects) has resulted in reevaluations of usage guidelines, impacting prescription volume and, consequently, market size.

Price Trends and Projections

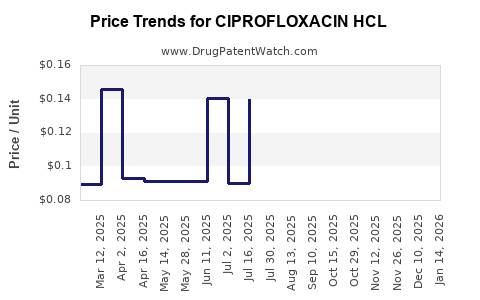

Current Price Landscape

The pricing of Ciprofloxacin HCL varies significantly across markets:

- Brand-name formulations: Approximately USD 5–10 per tablet.

- Generics: Wholesale prices have declined sharply, with tablet prices ranging from USD 0.10 to 0.50 per unit in low-income markets.

- Pharmacy Retail Price: Retail prices tend to be 2–3 times wholesale, influenced by markup and distribution costs.

The rise of generics has precipitated a consistent downward trend in unit prices over the past decade, with global prices decreasing by an average of 4–6% annually.

Forecasting Price Movements

Utilizing historical data and current market trends, the following projections are proposed:

| Year |

Predicted Price Range (USD/unit) |

Factors Influencing Price |

| 2023 |

USD 0.09 – 0.45 |

Patent expiration effects, increased competition, raw material costs |

| 2025 |

USD 0.08 – 0.40 |

Market saturation, price compression, regulatory pressures |

| 2030 |

USD 0.07 – 0.35 |

Further generic penetration, manufacturing efficiencies, potential resistance development |

While the price of Ciprofloxacin HCL is anticipated to stabilize at low levels due to robust generic competition, minor fluctuations may occur based on raw material costs, regulatory amendments, and emerging antimicrobial stewardship policies.

Factors Affecting Future Market and Prices

- Antimicrobial Resistance (AMR): Rising resistance diminishes clinical utility, potentially reducing demand in certain indications and prompting formulation or dosage modifications that could influence prices.

- Regulatory Changes: Stricter prescribing guidelines may curtail overuse, impacting volume sales and pressuring prices.

- Innovations: Development of new formulations, delivery systems, or fixed-dose combinations might command higher margins but encounter patent barriers, impacting supply and pricing.

- Market Entry/Exit: Entry of new generic players will maintain price competition, stabilizing or depressing prices further.

Conclusion

The Ciprofloxacin HCL market exhibits resilience driven by its broad-spectrum efficacy and widespread clinical use. However, ongoing patent expirations and regulatory shifts are fostering intense generic competition, exerting downward pressure on prices. While the global demand is projected to grow modestly, pricing will continue to decline gradually, with unit prices stabilizing around current low levels in the foreseeable future. Stakeholders should monitor resistance trends, regulatory landscapes, and raw material costs to adapt pricing and market strategies.

Key Takeaways

- The global Ciprofloxacin HCL market was valued at approximately USD 2–3 billion in 2022, with steady growth driven by demand and generic proliferation.

- Price decline trends average 4–6% annually, with current unit prices in the USD 0.10–0.50 range, depending on market and formulation.

- Regional variations are pronounced, with North America and Europe dominated by brand-name sales, while Asia-Pacific is characterized by rapid generic adoption.

- Future prices are expected to stabilize at low levels, influenced by intense competition, regulatory factors, and raw material costs.

- Emerging antimicrobial resistance and stricter regulation could dampen sales volume, further pressuring prices.

FAQs

1. What factors influence the price of Ciprofloxacin HCL?

Pricing is affected by patent expirations, generic competition, raw material costs, regulatory policies, and demand-supply dynamics.

2. How does antimicrobial resistance impact the Ciprofloxacin market?

Resistance reduces clinical efficacy, leading to decreased demand, potential formulation changes, or stricter prescribing guidelines, which can influence sales and pricing.

3. What is the expected market growth rate for Ciprofloxacin HCL?

The market is anticipated to grow at a CAGR of approximately 3.5–4% over the next five years, driven primarily by rising bacterial infections and generic market expansion.

4. Will branded Ciprofloxacin formulations regain market share?

Unlikely in mature markets due to patent expirations and low pricing of generics; however, specific formulations with novel delivery systems may sustain higher prices temporarily.

5. How are regulatory authorities shaping the Ciprofloxacin market?

Agencies are imposing stricter safety guidelines, limiting use in certain populations, and encouraging antimicrobial stewardship, which collectively influence market size and pricing strategies.

References

[1] MarketsandMarkets, “Antibiotics Market by Product Type,” 2022.