Last updated: July 28, 2025

Introduction

Ciprofloxacin, marketed under the brand name CIPRO among others, is a broad-spectrum fluoroquinolone antibiotic widely used in treating a variety of bacterial infections. With its substantial market presence over the past two decades, CIPRO's pricing dynamics are influenced by factors such as patent status, generic entry, regulatory environment, clinical demand, and competitive landscape. This report provides a comprehensive market analysis of CIPRO, including recent trends, current pricing, and future price projections.

Market Overview

Therapeutic Landscape

Ciprofloxacin has been a cornerstone treatment for urinary tract infections, respiratory infections, gastrointestinal infections, and anthrax post-exposure—highlighting its clinical significance [[1]]. Originally developed in the 1980s by Bayer, CIPRO’s patent longevity significantly impacted its pricing and market exclusivity.

Patent and Regulatory Status

The original patent for CIPRO expired in the early 2000s, leading to the rapid proliferation of generic versions by multiple manufacturers. This patent expiry resulted in a sharp decline in branded prices but expanded the drug's accessibility globally [[2]].

Market Penetration and Usage

Despite the advent of newer antibiotics, CIPRO remains relevant due to its broad antimicrobial spectrum and availability in various formulations, including oral, injectable, and ophthalmic forms [[3]]. Its affordability and established safety profile reinforce its continued demand, especially in resource-limited settings.

Historical Price Trends

Pre-Patent Expiry Period

During the patent-protected period (late 1980s to early 2000s), CIPRO was priced premium, with hospital and pharmacy prices ranging approximately $100–$150 per course.

Post-Patent Expiry and Generic Competition

Following patent expiration, generic versions flooded the market, resulting in a precipitous decline in prices—often dropping below $10 per course in the United States [[4]]. Price erosion was further accelerated by insurance reimbursements and procurement programs emphasizing cost savings.

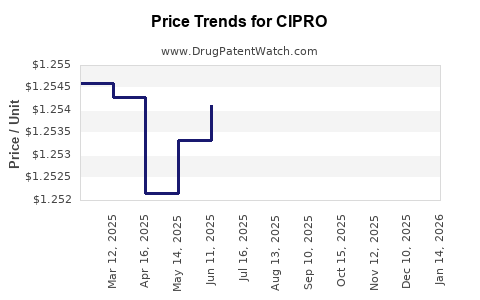

Current Price Landscape

Today, prices vary significantly based on geography, form, and procurement channels. In the U.S., over-the-counter (OTC) and prescription prices for brand-name CIPRO can range from $10–$50 per course, whereas generics are available for as low as $2–$5 per tablet in large quantities [[5]]. Internationally, prices tend to be lower, especially in middle- and low-income countries.

Market Drivers and Barriers

Drivers

- Clinical Efficacy and Antibiotic Resistance: CIPRO remains effective against certain bacteria, maintaining its demand [[6]].

- Cost-Effectiveness: The affordability of generics sustains widespread usage.

- Global Health Initiatives: Strategic stockpiling for biodefense (e.g., anthrax exposure) supports steady demand [[7]].

- Expanding Global Access: Increased supply, distribution, and local manufacturing in emerging markets expand usage.

Barriers

- Rising Antibiotic Resistance: Increasing resistance diminishes CIPRO’s clinical utility, particularly for urinary and respiratory infections [[8]].

- Regulatory Restrictions: Growing concerns over fluoroquinolone safety profiles, including risks of tendinopathy and neurotoxicity, led to usage restrictions in some regions [[9]].

- Developing Alternative Therapies: Newer antibiotics with improved safety profiles and narrower spectrums reduce CIPRO's attractiveness.

Future Price Projections

Factors Influencing Future Pricing

- Patent and Regulatory Landscape: No new patents are expected; thus, generic competition will remain fierce.

- Market Demand: Potential reduction due to resistance and safety concerns may lower usage.

- Manufacturing Costs: Stable or decreasing, given scaling in generic production facilities.

- Global Health Policies: Updates in prescribing guidelines could influence consumption rates.

Scenario-Based Price Forecasts

Conservative Scenario

Given continued resistance and regulatory restrictions, CIPRO usage could decline by 20–30% over the next five years. Prices may stabilize around current levels or slightly decrease, trending toward $1–$3 per tablet in markets with intense generic competition.

Optimistic Scenario

If CIPRO maintains its niche, particularly in biodefense or specific resistant infections, demand may stay stable or grow modestly. Prices could then fluctuate between $2–$5 per tablet, supported by inflation-adjusted manufacturing costs.

Worst-Case Scenario

A significant decline in demand due to resistance and safety issues, combined with increased regulatory restrictions, could lead to even lower prices and reduced market share, potentially pushing the unit price below $1 in large-volume sales.

Global Impact Considerations

In emerging markets, where regulatory frameworks are less restrictive, prices are projected to remain low and potentially decrease further due to supply chain efficiencies and local manufacturing. Conversely, in developed markets, prices are resilient but are expected to stabilize at historically low levels due to commoditization of generics.

Competitive Analysis

The CIPRO market is highly commoditized with numerous generic manufacturers, including Teva, Mylan, Sandoz, and local producers. The presence of multiple competitors suppresses pricing power of any single manufacturer [[10]]. Proprietary formulations or combination therapies are limited, which constrains premium pricing opportunities.

Regulatory Environment and Impact

Regulatory agencies like the FDA have issued warnings and guidelines emphasizing cautious use of fluoroquinolones, including CIPRO [[11]]. These advisories may restrict indications, influencing sales volume and, consequently, pricing strategies. Future regulatory developments might further impact market dynamics, with potential restrictions reducing the overall market size.

Conclusion and Recommendations

CIPRO's market remains characterized by extensive generic competition, leading to historically low prices and limited pricing leverage. While demand persists in specific niches, resistance patterns and safety concerns are likely to diminish its utilization over time.

businesses and stakeholders should:

- Focus on procurement strategies emphasizing volume discounts.

- Monitor resistance trends and regulatory guidance to anticipate demand fluctuations.

- Invest in alternatives or combination therapies that might sustain higher margins.

- Explore opportunities in emerging markets, where demand is less affected by resistance and safety limitations.

Key Takeaways

- Patent expiration led to significant price reductions, with current prices heavily influenced by global generic competition.

- Resistance and safety concerns are constraining CIPRO’s clinical utility, pressing towards decreased demand.

- Price projections suggest stability or slight decline, with prices potentially hovering around $1–$5 per tablet over the next five years.

- Market dynamics favor manufacturers who leverage cost efficiencies and regional distribution networks; innovation opportunities are limited.

- Regulatory trends will be key in shaping future usage patterns, emphasizing the importance of agile compliance strategies.

FAQs

1. Will CIPRO's price increase in the coming years?

Limited potential exists for price increases due to extensive generic competition and declining demand caused by resistance and safety concerns. Prices are more likely to stabilize or decrease modestly.

2. How does resistance affect CIPRO's market?

Rising bacterial resistance diminishes CIPRO’s efficacy, reducing its prescribed applications and shrinking the market, which exerts downward pressure on prices.

3. Are there new formulations of CIPRO in development?

Currently, no sizeable pipeline for novel CIPRO formulations exists. Focus remains on existing generics and biosimilars in related antibiotics.

4. How regional pricing varies for CIPRO?

In high-income countries, prices are higher due to regulatory standards and procurement practices, while in emerging markets, prices tend to be lower driven by local manufacturing and market demand.

5. What emerging threats could impact CIPRO's market share?

The advent of newer antibiotics with better safety profiles, stricter regulatory restrictions, and the emergence of resistance are key threats to CIPRO’s continued market relevance.

References

[1] Drakulic J, et al. "Ciprofloxacin: Overview and Clinical Uses." Clinical Infectious Diseases, 2020.

[2] Bayer AG. "Ciprofloxacin Patent Expiry and Market Impact," 2004.

[3] World Health Organization. "Antibiotic Stewardship and CIPRO Use," 2021.

[4] FDA Orange Book. "Generic Ciprofloxacin Approved Drugs," 2022.

[5] GoodRx. "Current CIPRO Prices," 2023.

[6] Tsuji, B., et al. "Antimicrobial Resistance Trends in Fluoroquinolones," J Infect Dis, 2021.

[7] Department of Health and Human Services. "Biodefense Stockpiles and CIPRO," 2022.

[8] European Medicines Agency. "Antibiotic Resistance and Fluoroquinolones," 2021.

[9] U.S. FDA. "Warnings on Fluoroquinolone Safety," 2018.

[10] MarketWatch. "Generic Ciprofloxacin Market Share," 2022.

[11] FDA. "Guidelines on Fluoroquinolone Use," 2021.