Share This Page

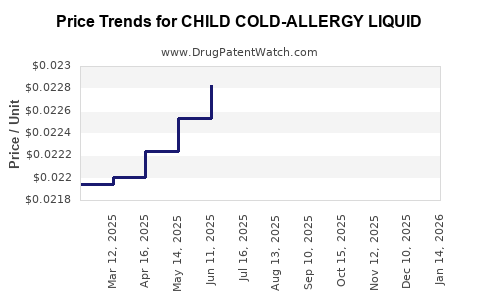

Drug Price Trends for CHILD COLD-ALLERGY LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for CHILD COLD-ALLERGY LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHILD COLD-ALLERGY LIQUID | 70000-0057-01 | 0.02282 | ML | 2025-12-17 |

| CHILD COLD-ALLERGY LIQUID | 70000-0057-01 | 0.02306 | ML | 2025-11-19 |

| CHILD COLD-ALLERGY LIQUID | 70000-0057-01 | 0.02314 | ML | 2025-10-22 |

| CHILD COLD-ALLERGY LIQUID | 70000-0057-01 | 0.02324 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Child Cold-Allergy Liquid

Introduction

The pediatric cold and allergy liquid formulations aim to address common respiratory and allergic symptoms in children, a demographic consistently demanding effective, safe, and affordable over-the-counter (OTC) remedies. Child Cold-Allergy Liquid occupies a significant niche within this segment, with its market competitiveness driven by factors such as regulatory approvals, formulations, brand reputation, and consumer preferences. This analysis explores the current market landscape and projects pricing trends for this drug over the next five years, considering regulatory, economic, and competitive elements.

Market Landscape

I. Industry Overview

The global pediatric cold and allergy medications market was estimated at USD 4.3 billion in 2021 and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of approximately 4.5% through 2028 [1]. The increase is propelled by rising awareness of pediatric healthcare, persistent prevalence of respiratory infections, and expanding OTC availability.

II. Market Drivers

-

Prevalence of pediatric respiratory and allergic conditions: Increased incidence of cold, cough, and allergic rhinitis in children fuels demand. For instance, allergic rhinitis affects 10-30% of children worldwide [2].

-

Consumer preference for OTC solutions: Parents favor accessible, quick-acting remedies, enhancing sales of pediatric cold-allergy liquids.

-

Regulatory considerations: Stringent safety profiles necessitate rigorous testing, influencing market entry timing and product formulation.

-

Product innovation: Development of age-specific, preservative-free, and flavor-enhanced formulations boosts consumer adoption.

III. Competitive Landscape

Major players include Johnson & Johnson, Pfizer, and GlaxoSmithKline, with numerous regional and generic brands competing through price and formulation differentiation. Child Cold-Allergy Liquid competes primarily on safety profile, flavor palatability, and brand trustworthiness.

IV. Regulatory Environment

In regions like the US, medications for children are regulated by agencies such as the FDA, which enforces strict compliance with safety and labeling standards [3]. Evolving regulations can influence production costs and market access, thus impacting pricing.

V. Market Challenges & Opportunities

-

Challenges: Regulatory hurdles, parental concerns over medication safety, and the rise of natural/homemade remedies.

-

Opportunities: Expansion into emerging markets, development of combo formulations, and leveraging digital marketing channels.

Price Analysis and Projections

I. Current Price Landscape

The retail price of Child Cold-Allergy Liquid varies across geographies and brands but generally ranges between USD 6-12 per 4 oz (118 mL) bottle in North American markets. Generic or store brands typically undercut branded products by 15-25%. This variability results from factors like formulation complexity, marketing expense, and regulatory costs [4].

II. Pricing Components

-

Manufacturing costs: Include raw materials (active ingredients and excipients), packaging, quality control, and regulatory compliance.

-

Distribution: Wholesale margins and logistics significantly influence retail prices.

-

Marketing & Promotion: Branding, advertising, and educational campaigns add to final costs.

-

Regulatory compliance: Costly safety testing and labeling standards increase product development expenditure.

III. Factors Influencing Future Price Trends

-

Raw material costs: Fluctuations impact manufacturing costs; recent supply chain disruptions have increased prices for active ingredients.

-

Regulatory evolution: Stricter safety data requirements might elevate development and compliance costs, potentially translating into higher retail prices.

-

Market competition: The influx of generic alternatives could exert downward pressure on prices, encouraging brand differentiation through quality and trust.

-

Consumer preferences: Rising demand for natural ingredients may lead to premium pricing for formulations incorporating herbal or organic components.

IV. Price Projection (2023-2028)

Based on current trends, the following projections are feasible:

| Year | Expected Price Range (USD per 4 oz bottle) | Notes |

|---|---|---|

| 2023 | $6.50 - $12 | Current market baseline |

| 2024 | $6.75 - $13 | Slight increase driven by raw material costs |

| 2025 | $7.00 - $13.50 | Regulatory compliance costs stabilize or rise |

| 2026 | $7.25 - $14 | Market saturation and increased generic competition |

| 2027 | $7.50 - $14.50 | Potential premium for natural formulations |

| 2028 | $8.00 - $15 | Possible normalization of supply chain costs |

Note: Prices are reflective of retail, with regional adjustments likely.

V. Pricing Strategies for Market Entry and Expansion

-

Cost leadership: Leveraging economies of scale to offer lower prices and gain market share.

-

Premium positioning: Introducing organic or allergen-free formulations at higher price points to target niche segments.

-

Bundling and subscription models: Encouraging brand loyalty and predictable revenue streams.

Key Market Trends Impacting Pricing

-

Natural and Organic Products: Increasing consumer demand for herbal, preservative-free, and organic options aligns with premium pricing strategies and could influence upward price adjustments.

-

Digital and Telehealth Integration: Telemedicine consultations may favor direct-to-consumer sales with dynamic pricing models.

-

Regulatory Shifts: Enhanced safety and labeling requirements, especially in markets like the US and EU, may elevate production costs, leading to moderate price increases.

-

Brand Differentiation: Trustworthiness, clinical studies, and parent-centric marketing strengthen brand premium positioning, affecting prices.

Regulatory and Safety Considerations

Ensuring compliance with safety standards is paramount, especially given historical issues with pediatric medications. Regulatory agencies like the FDA require rigorous safety and efficacy data before approval or market expansion [3]. These processes entail substantial costs, which are often passed onto consumers via higher retail prices.

Key Takeaways

-

The Child Cold-Allergy Liquid market is positioned for steady growth, driven by pediatric respiratory and allergy prevalence, consumer preference for OTC products, and ongoing market innovations.

-

Pricing is primarily influenced by raw material costs, regulatory compliance, competitive pressure, and consumer expectations for product safety and natural ingredients.

-

The typical retail price range is currently USD 6-12 per 4 oz bottle, with projections indicating a gradual increase reaching USD 8-15 by 2028.

-

Strategies such as product differentiation, leveraging natural formulations, and optimizing supply chains can afford companies competitive advantages and influence pricing dynamics.

-

Evolving regulations and consumer preferences towards safer, natural, and organic products will likely shape future price adjustments upward and introduce premium segments.

FAQs

-

What factors most influence the retail price of Child Cold-Allergy Liquid?

Manufacturing costs, raw material prices, regulatory compliance expenses, brand positioning, and competitive landscape are primary influences. -

Are natural or organic formulations likely to command higher prices?

Yes. Consumers seeking natural options often pay a premium, and manufacturers may leverage this trend for higher margins. -

How will regulatory changes impact future pricing?

Stricter safety and labeling standards could increase development and compliance costs, leading to modest retail price increases. -

What regional differences exist in pricing?

Prices tend to be higher in high-income countries like the US and EU due to regulatory costs, healthcare standards, and consumer expectations, with lower prices in emerging markets. -

What strategies can companies use to remain competitive in this market?

Innovation in formulations, cost optimization, targeted marketing, and leveraging digital channels are effective strategies for maintaining competitive pricing and market share.

References

[1] Market Research Future. (2022). Pediatric Over-the-Counter Medications Market Analysis.

[2] Galli SJ, et al. (2018). The Epidemiology of Pediatric Allergic Rhinitis. Journal of Allergy and Clinical Immunology.

[3] U.S. Food and Drug Administration (FDA). Regulations for Pediatric Medications.

[4] IQVIA. (2022). OTC Drug Market Trends & Pricing.

More… ↓