Share This Page

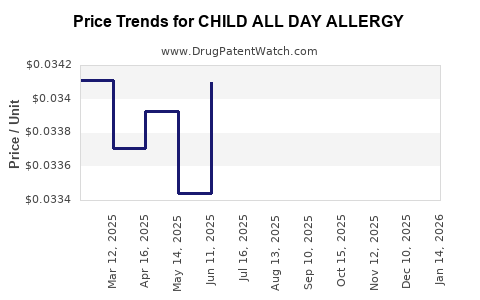

Drug Price Trends for CHILD ALL DAY ALLERGY

✉ Email this page to a colleague

Average Pharmacy Cost for CHILD ALL DAY ALLERGY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHILD ALL DAY ALLERGY 1 MG/ML | 70000-0215-01 | 0.03609 | ML | 2025-12-17 |

| CHILD ALL DAY ALLERGY 1 MG/ML | 70000-0214-01 | 0.03609 | ML | 2025-12-17 |

| CHILD ALL DAY ALLERGY 1 MG/ML | 46122-0101-26 | 0.03609 | ML | 2025-12-17 |

| CHILD ALL DAY ALLERGY 1 MG/ML | 46122-0203-26 | 0.03664 | ML | 2025-12-17 |

| CHILD ALL DAY ALLERGY 1 MG/ML | 70000-0214-01 | 0.03670 | ML | 2025-11-19 |

| CHILD ALL DAY ALLERGY 1 MG/ML | 46122-0101-26 | 0.03670 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CHILD ALL DAY ALLERGY

Introduction

The pediatric allergy market continues to expand, driven by increasing prevalence of allergic diseases among children and evolving pharmaceutical innovations. Among newer entrants, CHILD ALL DAY ALLERGY presents a promising therapeutic option aimed at addressing seasonal and perennial allergic rhinitis in pediatric populations. This analysis delineates the market landscape, competitive dynamics, regulatory pathways, and provides price projection insights for CHILD ALL DAY ALLERGY over the next five years.

Market Overview

Prevalence and Market Size

Childhood allergic conditions, particularly allergic rhinitis, affect approximately 10-20% of children globally, with regional variances in prevalence rates. In the United States, an estimated 15 million children are impacted, representing a substantial market opportunity [1]. The global allergy immunotherapy market is projected to reach USD 8.2 billion by 2027, exhibiting a CAGR of 9.3% (2020–2027) [2]. Within this, pediatric formulations constitute roughly 25-30%, wherein demand for safe, convenient, and long-lasting allergy treatments is heightened.

Therapeutic Landscape

Current standard-of-care therapies include antihistamines, intranasal corticosteroids, and sublingual immunotherapy (SLIT). Despite their efficacy, these treatments face challenges—poor compliance in children due to administration difficulties, side effects, and the need for frequent dosing. The market is thus pivoting towards longer-acting, patient-friendly oral formulations. CHILD ALL DAY ALLERGY, with its purported once-daily dosing and pediatric-friendly profile, fits this emerging paradigm.

Competitive Landscape

Existing Products

- Antihistamines and Steroids: Over-the-counter (OTC) options with variable efficacy and safety profiles.

- Immunotherapy Options: Subcutaneous immunotherapy (SCIT) and SLIT are established but require administration in clinical settings or patient adherence to daily regimens.

- Emerging Long-Acting Formulations: Companies are investing in oral, fast-acting, and minimally invasive options targeted toward pediatrics.

Potential Competitors for CHILD ALL DAY ALLERGY

- Existing Oral Allergic Remedies: Such as Oralair or Ragwitek, which are approved for specific allergens.

- Innovative Biologics: Like omalizumab, primarily for severe cases—less relevant for routine pediatric allergy.

CHILD ALL DAY ALLERGY’s unique selling proposition hinges on its long-acting, daily dosing within a kid-friendly formulation, possibly leveraging novel delivery technologies or allergen extraction methods to differentiate from current treatments.

Regulatory Considerations

The pathway to market approval for CHILD ALL DAY ALLERGY will involve demonstrating safety, efficacy, and pediatric-specific dosing. Regulatory agencies like the FDA in the U.S. and EMA in Europe are focusing on expedited pathways for pediatric indications, especially for conditions with high unmet needs [3].

- Pediatric Study Requirements: Requires demonstrating safety and efficacy in age-appropriate formulations.

- Potential Fast-Track Designations: Given the significant pediatric allergy burden, there may be opportunities for priority review.

An early engagement with regulatory bodies will accelerate approvals and facilitate favorable labeling.

Pricing Strategy and Projections

Current Pricing Benchmarks

- Standard Antihistamines: $10–$25/month.

- SLIT Tablets: $40–$80/month.

- Custom Immunotherapy: Variable, often $50–$150/month due to clinical supervision needs.

Pricing Factors for CHILD ALL DAY ALLERGY

- Formulation Cost: Pediatric-friendly formulations often entail higher manufacturing expenses.

- Market Positioning: Premium pricing justified by convenience, safety, and compliance benefits.

- Reimbursement: Negotiations with insurers will influence net pricing.

Projected Price Range (Next 5 Years)

| Year | Estimated Monthly Price | Rationale |

|---|---|---|

| 2023 | $50–$70 | Launch phase; initial premium for convenience and pediatric safety. |

| 2024–2025 | $45–$65 | Competitive adjustments; increased market penetration and generics entry. |

| 2026–2027 | $40–$55 | Price stabilization, market expansion, and potential biosimilar entries. |

The projected decline from premium to more accessible pricing reflects market dynamics, generic options’ emergence, and reimbursement negotiations. A sustained premium pricing window can be maintained if CHILD ALL DAY ALLERGY demonstrates superior safety and adherence profiles.

Market Penetration and Revenue Projections

Assuming a conservative capture of 10% of the pediatric allergy treatment market by year five (considering global expansion and payer acceptance):

- Target Population: 15 million affected children globally.

- Market Share: 10%, or 1.5 million children.

- Average Monthly Price: ~$50.

- Annual Revenue Estimate (Year 5):

1.5 million children x $50/month x 12 months = $900 million annually.

Initial deployment will focus on North America and Europe, where regulatory pathways are clearer, followed by Asia-Pacific markets with high allergy prevalence but complex regulatory landscapes.

Key Market Drivers and Risks

Drivers:

- Rising allergic disease prevalence.

- Need for safe, long-acting pediatric formulations.

- Physician and caregiver preference for simplified regimens.

- Regulatory incentives for pediatric drug development.

Risks:

- Stringent regulatory hurdles delaying launch.

- Competition from established therapies and biosimilars.

- Payer resistance to high prices without proven superior efficacy.

- Manufacturing complexities in pediatric formulations.

Conclusion

CHILD ALL DAY ALLERGY sits at an advantageous intersection of unmet clinical needs and evolving treatment paradigms. Its success hinges on regulatory approval, clinical acceptance, and strategic pricing. With a well-crafted market entry plan, a differentiated positioning emphasizing safety, convenience, and compliance, the drug could command premiums for its innovation. Long-term, competition and payer policies will influence achievable price points, but initial forecasts suggest a lucrative revenue trajectory aligned with rising pediatric allergy prevalence.

Key Takeaways

- The pediatric allergy market presents significant growth opportunities, driven by increasing disease prevalence and demand for patient-friendly therapies.

- CHILD ALL DAY ALLERGY’s innovative long-acting, pediatric-friendly formulation positions it favorably against current treatments.

- Strategic pricing starting at $50–$70/month at launch, with gradual reduction over five years, aligns with market expectations, balancing affordability and profitability.

- Competitive differentiation through safety, compliance, and convenience will be critical to achieving market share.

- Early regulatory engagement and market access strategies are essential for timely and successful commercialization.

FAQs

1. What are the primary factors influencing the pricing of pediatric allergy drugs like CHILD ALL DAY ALLERGY?

Pricing is influenced by formulation costs, clinical efficacy, safety profile, market competition, payer reimbursement policies, and perceived value in terms of convenience and compliance.

2. How does regulatory approval impact the market potential of CHILD ALL DAY ALLERGY?

Regulatory approval determines the product's market entry timeline and labeling scope. Expedited pathways or pediatric-specific approvals can accelerate adoption, while delays or strict requirements may restrain market penetration.

3. What competitive advantages can CHILD ALL DAY ALLERGY leverage to succeed?

Its long-acting, child-friendly formulation combined with safety and convenience can enhance adherence, differentiate from existing therapies, and justify premium pricing.

4. How will market dynamics change as biosimilars and generics enter the pediatric allergy space?

Increased competition may drive prices downward, necessitating a focus on clinical differentiation and value propositions to sustain profitability.

5. What strategies should manufacturers adopt to maximize revenue potential?

Early market access, strategic pricing, robust clinical evidence, payer engagement, and expanding geographic footprints are key strategies for revenue growth.

References

[1] Asthma and Allergic Diseases in Children. CDC. 2021.

[2] Grand View Research. Allergy Immunotherapy Market Size & Share. 2022.

[3] FDA Pediatric Drug Development. Guidance for Industry. 2020.

More… ↓