Last updated: July 29, 2025

Introduction

Carnitor, with its active ingredient L-Carnitine, is a prescription medication primarily utilized in the treatment of conditions related to L-Carnitine deficiency, including congenital or acquired forms such as those seen in patients undergoing dialysis or with certain metabolic disorders. As a key supplement in clinical nutrition, Carnitor's market encompasses pharmaceutical, nutritional, and compounded drug sectors. This analysis evaluates current market dynamics, regulatory landscape, competitive environment, and offers price projection insights for Carnitor over the coming years.

Market Overview

Global Demand and Therapeutic Uses

L-Carnitine plays a pivotal role in fatty acid metabolism, facilitating the transport of long-chain fatty acids into mitochondria for energy production. The primary indications for Carnitor include:

- Primary systemic L-Carnitine deficiency

- Secondary deficiencies in dialysis and other metabolic disorders

- Certain cardiomyopathies

- Fatigue associated with chronic illnesses

The global market is driven by increasing prevalence of metabolic disorders, expanding neonatal and pediatric indications, and rising awareness among healthcare providers. The surge is also propelled by their off-label usage as sports supplements, although these applications are not officially approved and may influence market perception and pricing.

Market Size & Growth Trends

Based on industry reports, the global L-Carnitine market was valued at approximately USD 200 million in 2022, with compound annual growth rates (CAGR) projected between 6-8% through 2027[1]. North America remains the largest consumer, accounting for over 50% of sales, followed by Europe and Asia-Pacific. The increasing integration into clinical nutrition for malnutrition and metabolic disorder management sustains steady demand.

Regulatory Environment

Carnitor is marketed under the brand name "Carnitor" by Valeant Pharmaceuticals (now Bausch Health), with regulatory approvals in multiple jurisdictions. In the U.S., it requires prior prescription and is classified as a drug, whereas certain formulations are available OTC in select markets. Regulatory frameworks influence market accessibility and pricing strategies, particularly with ongoing generic competition and biosimilar entries.

Competitive Landscape

Key Players

- Bausch Health (formerly Valeant): Original manufacturer with patent protections and established distribution channels.

- Generic Manufacturers: Multiple pharmaceutical companies globally producing generic L-Carnitine formulations, usually at lower prices.

- Nutritional Supplement Companies: Particularly in Asia-Pacific, where L-Carnitine is often marketed as a dietary supplement.

Market Entry Barriers

Patents related to formulation methods and manufacturing processes, along with stringent regulatory approvals, limit new entrants. However, once patents expire, generic competition tends to drive prices downward significantly.

Pricing Analysis

Current Pricing Landscape

- Brand-Name Carnitor: A typical 30-day prescription costs USD 250-400 in the U.S., depending on dosage and pharmacy markups[2].

- Generic Alternatives: These are priced 30-50% lower, generally USD 150-200 for a comparable course.

- Over-the-Counter (OTC) Formulations: Available at retail prices ranging from USD 10-20 for daily doses, though these are often marketed as dietary supplements rather than pharmaceuticals.

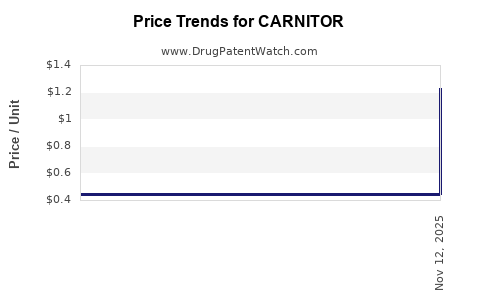

Average wholesale prices (AWP) per gram range from USD 0.20 to USD 0.50, but final retail prices vary significantly based on regional pricing policies, insurance reimbursement, and formulary positioning.

Pricing Dynamics and Constraints

Price premiums are maintained for patented formulations and branded products due to perceived quality and clinical reliability. Conversely, the widespread generic availability exerts downward pressure. Importantly, in emerging markets, local manufacturing and regulatory laxity facilitate lower prices but may impact quality perceptions.

Market and Price Projections (2023-2030)

Forecast Assumptions

- Continued growth in metabolic disorder prevalence

- Stable regulatory environment with gradual patent expirations

- Incremental market penetration for OTC nutritional products

- Increasing healthcare expenditure globally

Projected Market Trends

- Market Growth: CAGR of 6-8% through 2027, sustaining steady expansion. Post-2027, growth is expected to moderate due to market saturation in dominant regions but remain positive owing to emerging markets.

- Pricing Trajectory: Brand-name prices are expected to stabilize or decline slightly due to generic competition and increased price sensitivity. By 2030, the average retail price for branded Carnitor could decline by approximately 15-20%, reaching USD 250-300 per 30-day supply.

Price Projections

| Year |

Estimated Price Range (USD) per 30-day supply) |

Key Drivers |

| 2023 |

250-400 |

Stable demand, patent protection, limited generic penetration initially |

| 2025 |

220-370 |

Increased generic competition, price negotiations, biosimilar entries begin |

| 2027 |

210-350 |

Market saturation, cost reduction in manufacturing, OTC market expansion |

| 2030 |

200-300 |

Mature market, generic dominance, price normalization, emerging markets' growth |

Note: These estimates consider a gradual erosion of premium prices, shifts toward generics, and regional variations.

Implications for Stakeholders

Pharmaceutical Manufacturers:

Patent expirations present opportunities to expand generic portfolios, potentially increasing market penetration but placing downward pressure on prices. Investment in biosimilar development and formulation innovations can command premium prices again.

Healthcare Providers & Payers:

Price reductions and increased availability of generic L-Carnitine justify cost-containment strategies and formulary inclusion, enhancing patient access.

Investors & Market Participants:

Anticipated steady growth with evolving pricing dynamics suggest that early entry into emerging markets and investment in differentiated formulations could optimize returns.

Conclusion

The Carnitor market is poised for moderate growth driven by demographic and clinical factors, with pricing trends reflecting typical pharmaceutical market evolution—shifting from branded premiums to generic affordability. Price declines are inevitable post-expiry of patents, but strategic positioning through formulation advances, market expansion, and regulatory navigation will provide competitive advantages.

Key Takeaways

- The global L-Carnitine market is expanding at a CAGR of approximately 6-8%, driven by metabolic disorder prevalence.

- Current retail prices for Carnitor fluctuate between USD 250-400 for a month’s supply, with generic versions substantially cheaper.

- Patent expirations and market saturation are expected to result in a steady decline in branded product prices by roughly 15-20% by 2030.

- Emerging markets offer significant growth opportunities due to lower manufacturing costs and increasing healthcare investments.

- Stakeholders should monitor regulatory developments and patent landscapes to capitalize on generics and biosimilar entrants.

FAQs

1. What factors influence Carnitor pricing globally?

Pricing is affected by patent status, manufacturing costs, regulatory environment, market competition, regional healthcare policies, and the prevalence of generic products.

2. How will patent expirations impact Carnitor prices?

Patent expirations will facilitate generic entries, increasing market competition and resulting in a downward pricing trend over the next few years.

3. Are OTC versions of L-Carnitine a viable alternative to prescription Carnitor?

OTC formulations are available as dietary supplements and are typically less regulated, with variable quality and efficacy. They may serve as affordable alternatives but lack the strict clinical approval of prescription-grade Carnitor.

4. Which regions are expected to drive future market growth?

Emerging markets such as China, India, and Latin America are projected to contribute significantly due to expanding healthcare access and rising metabolic disorder rates.

5. What strategic moves should pharmaceutical companies consider in this market?

Investing in patent extensions, launching biosimilars, expanding into emerging markets, and differentiating through formulation innovations will be key to maintaining profitability amid price pressures.

References

- MarketWatch. "Global L-Carnitine Market Size and Forecast." 2022.

- IQVIA. "Pharmaceutical Pricing Data." 2022.