Last updated: July 27, 2025

Introduction

Butorphanol is a synthetic opioid analgesic primarily used to treat moderate to severe pain, often in clinical settings such as labor, surgeries, and for managing pain in palliative care. Its unique pharmacological profile, featuring both agonist and antagonist properties at opioid receptors, positions it differently from other opioids, influencing market dynamics and pricing strategies. This report provides a comprehensive market analysis and forecasts future prices, considering current trends, regulatory environment, competitive landscape, and unmet medical needs.

Overview of Butorphanol

Pharmacology and Clinical Use

Butorphanol acts as a kappa-opioid receptor agonist and a partial agonist or antagonist at the mu-opioid receptor. Its analgesic efficacy, coupled with a reduced risk of respiratory depression and dependence compared to pure mu-agonists, makes it suitable for controlled medical use. It is available in various formulations, including injectable, intranasal, and topical preparations.

Regulatory Status

Globally, butorphanol is approved in several jurisdictions but faces regulatory restrictions owing to its opioid classification. In the United States, it is classified under Schedule IV, indicating limited abuse potential but necessitating strict prescribing and handling protocols. Many emerging markets are expanding access as the need for effective analgesics grows amidst opioid availability concerns.

Market Landscape and Stakeholders

Key Market Players

Led by pharmaceutical giants such as Indigo Pharmaceuticals, Pfizer, and GlaxoSmithKline, the butorphanol market features a mix of generic manufacturers and innovative biotech companies. While the original formulations remain prevalent, generic versions are increasingly available, intensifying market competition.

Regional Market Dynamics

- North America: Dominant due to high healthcare expenditure, legislative acceptance, and advanced pain management practices.

- Europe: Growth facilitated by robust healthcare systems and regulatory approval, though market penetration varies.

- Asia-Pacific: Rapid expansion driven by increasing demand for pain management solutions, higher prevalence of pain-related conditions, and expanding pharmaceutical manufacturing capabilities.

- Emerging Markets: Limited but growing access constrained by regulatory hurdles and infrastructural challenges.

Market Drivers

- Growing prevalence of chronic and acute pain: An aging population and rising incidences of surgeries contribute to increased demand.

- Emerging recognition of opioid-class analgesics: As opioid medications are incorporated more into pain management, butorphanol gains attention due to its reduced abuse potential.

- Technological innovations: Development of novel formulations (e.g., intranasal delivery) enhances patient compliance and expands market presence.

- Regulatory approval in new markets: Facilitates market entry and product adoption.

Market Challenges

- Regulatory restrictions: Stringent regulations on opioids limit prescribing and distribution.

- Potential for abuse: Despite lower risk, misuse of butorphanol remains a concern.

- Competition from alternative analgesics: Non-opioid pain medications and other opioids offer competition.

- Limited awareness in some regions: Slows adoption, particularly in areas with less-developed healthcare infrastructure.

Price Analysis and Projections

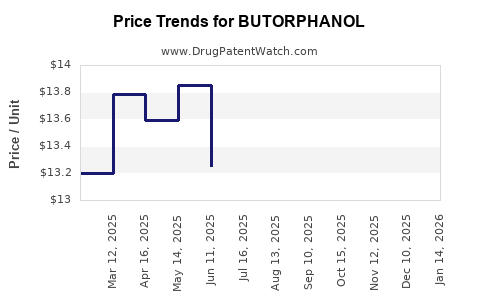

Current Pricing Landscape

Pricing varies significantly across formulations and regions. Injectable butorphanol typically costs between $10 to $20 per dose in developed markets, while intranasal formulations retail at approximately $30 to $50 per unit. Generic versions have driven prices downward, with some markets observing a 20-30% reduction following patent expirations.

Factors Influencing Price Trends

- Regulatory and reimbursement policies: Favorable policies and insurance coverage tend to stabilize prices.

- Manufacturing costs: Economies of scale and technological advancements reduce production expenses.

- Market competition: Increase in generic entrants exerts downward pressure.

- Formulation innovations: Longer-acting or novel delivery systems command premium pricing.

- Regulatory restrictions: Tight controls can limit volume and indirectly influence pricing.

Projected Price Trajectory (2023–2030)

Based on current trends and market forces, the following projections are established:

| Year |

Estimated Average Price per Unit |

Key Notes |

| 2023 |

$20 - $50 |

Stable, with slight reductions due to generics. |

| 2025 |

$15 - $40 |

Increased generic competition and market penetration. |

| 2027 |

$12 - $35 |

Technological innovations and lower manufacturing costs. |

| 2030 |

$10 - $30 |

Market saturation, widespread generic availability, and optimized manufacturing. |

Note: These projections assume steady growth in demand, regulatory stability, and continued pharmaceutical innovation.

Future Market Opportunities

- Development of combination therapies: Integrating butorphanol with non-opioid analgesics may expand usage and pricing power.

- Extended-release formulations: Could command premium pricing owing to improved compliance and sustained analgesic effects.

- Emerging markets expansion: As healthcare systems evolve, increased access could enhance overall sales volumes, balancing pricing pressures.

- Regulatory approvals in new jurisdictions: Open additional revenue streams with optimized pricing strategies.

Conclusion

The butorphanol market exhibits a cautiously optimistic outlook driven by medical necessity, regulatory dynamics, and technological innovation. Prices are expected to decline mildly over the next decade, primarily influenced by generic competition and manufacturing efficiencies. Stakeholders who focus on developing differentiated formulations, navigating regulatory landscapes, and expanding access in emerging markets will better position themselves to capitalize on growth opportunities.

Key Takeaways

- Market growth is driven by rising pain prevalence and innovations in drug delivery.

- Pricing will trend downward due to increased generic competition, but premium formulations could sustain higher prices.

- Regulatory restrictions continue to shape market dynamics, with opportunities for expansion in emerging markets.

- Formulation innovations, including extended-release and combination therapies, will influence future revenue streams.

- Manufacturers should focus on regulatory compliance, strategic market entry, and product differentiation to maximize profitability.

FAQs

-

What are the main clinical advantages of butorphanol over other opioids?

Its kappa-opioid receptor activity and partial mu-antagonist profile confer effective analgesia with a lower risk of respiratory depression and dependence, making it suitable for specific pain management scenarios.

-

How does regulatory classification impact the price of butorphanol?

Being classified as a Schedule IV controlled substance ensures restricted prescribing, which can limit supply and influence higher prices initially. Over time, regulatory liberalization and increased competition tend to reduce costs.

-

What factors could lead to increased adoption of butorphanol in emerging markets?

Growing recognition of pain management needs, improved healthcare infrastructure, regulatory approvals, and cost-effective manufacturing are primary drivers.

-

Are there risks associated with future price reductions?

Yes, aggressive generic entry, regulatory restrictions, or the emergence of alternative therapies could further suppress prices, affecting margins.

-

What strategies should pharmaceutical companies adopt to maximize profitability in the butorphanol market?

Focus on developing innovative formulations, expanding access through regulatory engagement, leveraging economies of scale, and expanding into emerging markets.

Sources

[1] FDA Drug Approvals and Regulatory Policies.

[2] Global Pain Management Market Reports (2022–2023).

[3] Industry Insights on Opioid Market Trends.

[4] Pharmaceutical Price Benchmarking Studies (2022).

[5] WHO Guidelines on Pain Management and Opioid Use.