Last updated: September 24, 2025

Introduction

BREO ELLIPTA (fluticasone furoate and vilanterol inhalation powder) is a once-daily inhaled therapy approved for the management of asthma and chronic obstructive pulmonary disease (COPD). Since its launch by GlaxoSmithKline (GSK) in 2013, BREO ELLIPTA has established itself as a key player in respiratory therapeutics. This analysis comprehensively evaluates the current market landscape, future demand drivers, competitive dynamics, regulatory trends, and price projections for BREO ELLIPTA.

Market Overview

Global Respiratory Therapeutics Landscape

The global respiratory therapeutics market was valued at approximately USD 25 billion in 2022, with a compound annual growth rate (CAGR) of 4-6% projected through 2030. The escalating prevalence of COPD and asthma, coupled with increasing awareness and technological advancements, continues to fuel market growth.

BREO ELLIPTA’s Market Position

BREO ELLIPTA has secured a significant market share owing to its convenience, efficacy, and once-daily dosing. As of 2022, GSK reported worldwide sales exceeding USD 2 billion annually, positioning BREO ELLIPTA among the top prescribed inhalation therapies for COPD and asthma in developed markets.

Target Demographics

- COPD Patients: Predominantly in North America and Europe, with an aging population driving demand.

- Asthma Patients: Largely in pediatric and adult populations in both developed and developing regions.

Market Drivers

Rising Prevalence of Respiratory Diseases

COPD affects over 300 million individuals globally[1], with incidence rising due to smoking, pollution, and aging demographics. Asthma impacts over 200 million people worldwide[2]. These trends underpin sustained demand for inhaled corticosteroid/long-acting beta-agonist (ICS/LABA) therapies like BREO ELLIPTA.

Enhanced Treatment Adherence and Convenience

BREO ELLIPTA’s once-daily regimen improves patient compliance over multi-dose therapies, expanding its appeal among clinicians and patients alike.

Broader Label Expansion and New Indications

Regulatory agencies have approved BREO ELLIPTA for additional indications, including asthma in adolescents and pediatrics, broadening its potential market.

Technological Advancements

Innovations in inhaler devices, coupled with digital health integration, improve efficacy and adherence, favoring BREO ELLIPTA's adoption.

Competitive Landscape

Major Competitors

- Dulera (mometasone fumarate and formoterol fumarate): Entry-level ICS/LABA inhaler.

- Symbicort (budesonide/formoterol): Market leader in both COPD and asthma.

- Advair (fluticasone/salmeterol): Former market leader, now facing declining sales due to generic competition.

- Trimbow (beclomethasone/formoterol/glycopyrronium): Emerging multiple-benefit inhaler.

Market Differentiators

- Device Design: BREO ELLIPTA’s Ellipta inhaler is praised for ease of use, adherence, and consistent delivery.

- Pharmacokinetics: Favorable safety and efficacy profiles support long-term management.

- Versatility: Approved for both COPD and asthma, providing cross-market coverage.

Competitive Challenges

- Patent expirations threaten market exclusivity, particularly in key markets like the U.S. and EU.

- The entry of generic versions can significantly reduce pricing power.

Regulatory and Reimbursement Trends

Regulatory Environment

Regulatory bodies have generally supported the development of fixed-dose combination inhalers, with BREO ELLIPTA’s approvals being extensions for pediatric asthma and other indications.

Reimbursement Policies

Coverage varies across regions, with nuanced differences in formulary inclusion and copay structures influencing market penetration.

- In the U.S., BREO ELLIPTA benefits from favorable formulary placement, driven by its clinical profile.

- Europe’s reimbursement landscape favors innovative therapies, but price ceilings in some countries constrain pricing.

Price Analysis and Projections

Current Pricing Dynamics

In developed markets:

- United States: The wholesale acquisition cost (WAC) for BREO ELLIPTA is approximately USD 350-400 per inhaler (30-dose pack, 30 days’ supply).

- Europe: Prices vary, typically ranging from EUR 250-350, influenced by country-specific regulations.

- Emerging Markets: Prices are substantially lower, often USD 150-250, due to economic disparities and different reimbursement structures.

Market Penetration and Pricing Strategy

GSK’s strategic positioning emphasizes premium pricing justified by supply convenience, clinical benefits, and brand loyalty. The inhaler’s single daily dose improves cost-effectiveness by reducing the total dose prescribed.

Price Projection (2023-2030)

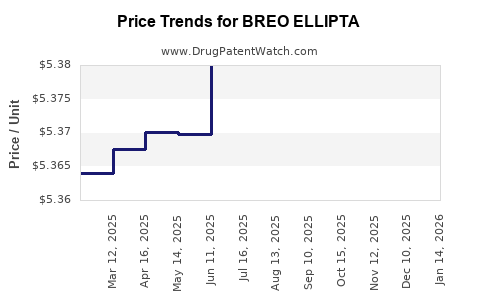

Considering market growth, patent expiries, and competitive pressures:

- Short-term (2023-2025): Prices are projected to stabilize or slightly increase (~2-3%), driven mainly by inflation, manufacturing costs, and value-based pricing models.

- Mid-term (2026-2028): Introduction of generics post-patent expiry could lead to price erosion of 25-40%, especially in the U.S. and Europe.

- Long-term (2029-2030): As patent protections expire globally, prices are expected to decline further, potentially reaching 50% below current levels in mature markets.

Factors influencing pricing include regulatory environment shifts toward value-based care, evolving competition, and healthcare payer policies emphasizing cost containment.

Impact of Patent Expiry and Biosimilar Entry

Patent protections for BREO ELLIPTA are set to expire between 2025 and 2026 in primary markets. The entrance of biosimilars or generic inhalers will intensify price competition, exerting downward pressure on retail prices and reimbursement rates.

Potential Price Optimization Strategies

GSK may leverage strategic alliances, patient assistance programs, and value demonstration to maintain market share amidst declining prices.

Future Market Opportunities

Emerging Markets

Growing healthcare infrastructure and increasing awareness in Asia-Pacific, Latin America, and Africa present lucrative expansion opportunities. Price sensitivity in these regions necessitates tiered pricing strategies.

Personalized Medicine Integration

Advances in pharmacogenomics could enable tailored therapies, potentially influencing future pricing and market segmentation.

Digital Health Integration

Smart inhalers and adherence monitoring tools can justify premium pricing due to added value and improved clinical outcomes.

Key Drivers and Risks

| Drivers |

Risks |

| Increasing global respiratory disease prevalence |

Patent expiry and generic competition |

| Ease of use and adherence benefits |

Market saturation in mature markets |

| Expansion into pediatric indications |

Regulatory hurdles in off-label uses |

| Technological innovations |

Pricing pressures from payers and governments |

Key Takeaways

- BREO ELLIPTA retains a leading position in the respiratory therapeutics space due to its convenience, efficacy, and broad approved indications.

- Market growth is driven by the rising global burden of COPD and asthma, particularly in aging populations.

- Competitive pressures, patent cliffs, and emerging generics will influence future pricing strategies, leading to substantial price erosion post-2025.

- Regions with emerging markets offer growth opportunities but require region-specific pricing approaches considering local affordability and regulatory landscapes.

- GSK’s focus on digital integration, personalized medicine, and expanding indications can sustain revenue streams despite impending price pressures.

FAQs

1. How does BREO ELLIPTA compare to its competitors in terms of pricing?

BREO ELLIPTA’s pricing in the U.S. and Europe positions it as a premium inhaler relative to generics and less established brands, justified by its clinical benefits and device ease of use.

2. What impact will patent expiration have on BREO ELLIPTA’s market share?

Patent expiries starting around 2025 will open opportunities for generic entrants, leading to downward pressure on prices and potentially reducing BREO’s market share unless supported by differentiation and new indications.

3. Are there emerging alternatives that could challenge BREO ELLIPTA’s dominance?

Yes, competing combination inhalers, novel delivery systems, and non-inhaled therapies like biologics could challenge BREO’s market position as innovation progresses.

4. How are reimbursement policies affecting BREO ELLIPTA’s pricing strategy?

Reimbursement policies influence access and pricing. Favorable coverage in developed markets sustains premium pricing, whereas stricter controls in some regions pressure prices downward.

5. What are the key strategies GSK might adopt to maintain profitability post-patent expiry?

GSK may focus on lifecycle management through line extensions, expanding indications, enhancing digital tools, and optimizing value-based pricing to sustain profitability.

Sources

[1] World Health Organization. "Global Surveillance, Prevention and Control of Chronic Respiratory Diseases." WHO Report, 2021.

[2] Global Initiative for Asthma (GINA). "Global Strategy for Asthma Management and Prevention," 2022.