Last updated: July 27, 2025

Introduction

Balsalazide Disodium is a prescription medication primarily used for the management of ulcerative colitis, a form of inflammatory bowel disease (IBD). As a prodrug that is converted into mesalamine (5-aminosalicylic acid) in the colon, it acts locally to reduce intestinal inflammation. With a growing burden of IBD globally, understanding market dynamics and price projections for Balsalazide Disodium is vital for pharmaceutical stakeholders, insurers, and healthcare providers. This analysis explores current market conditions, competitive landscape, regulatory considerations, and forecasts pricing trends over the next five years.

Market Overview

Global Incidence and Prevalence of Ulcerative Colitis

The global prevalence of ulcerative colitis (UC) has increased significantly over recent decades. According to the Crohn’s & Colitis Foundation, approximately 1.6 million Americans suffer from IBD, including UC, with global cases estimated to surpass 10 million [1]. The rising incidence correlates with urbanization, Western lifestyles, and improved disease awareness, fueling demand for targeted therapies like Balsalazide Disodium.

Therapeutic Landscape

The treatment of UC involves aminosalicylates (mesalamine derivatives), corticosteroids, immunomodulators, and biologics. Balsalazide Disodium is positioned as a second-generation aminosalicylate with a favorable topical efficacy profile and fewer systemic side effects. Its direct application to the colon distinguishes it from other oral options like Sulfasalazine or Mesalamine formulations.

Market Players & Competitive Positioning

Major pharmaceutical companies—including Takeda Pharmaceuticals (earlier marketed by Salix Pharmaceuticals before acquisition)—dominate with established aminosalicylates such as Mesalamine, Sulfasalazine, and early Balsalazide formulations. Balsalazide Disodium’s market share is comparatively modest but growing owing to targeted positioning, favorable safety profile, and recent regulatory approvals in expanding markets.

Regulatory Status and Approvals

Balsalazide Disodium holds approvals in the US (FDA), European Union, and other markets. Recent approvals in emerging markets, including parts of Asia and South America, are expanding its geographic footprint. Regulatory hurdles and patent protections significantly influence market exclusivity and pricing strategies.

Market Drivers & Restraints

Drivers

- Increasing IBD Prevalence: Epidemiological trends support steady demand.

- Patient Preference for Safer Alternatives: Balsalazide offers fewer systemic side effects compared to older therapies.

- Expanding Indications: Potential off-label uses or combination therapy approvals could further boost sales.

- Market Penetration in Emerging Economies: Growing healthcare infrastructure and increased disease awareness.

Restraints

- Generic Competition: Patent expirations and the availability of generic formulations constrain pricing power.

- Pricing Pressure: Payers' push for cost containment limits reimbursement prices.

- Limited Differentiation: Similar efficacy compared to other aminosalicylates reduces premium pricing potential.

Price Analysis and Projections

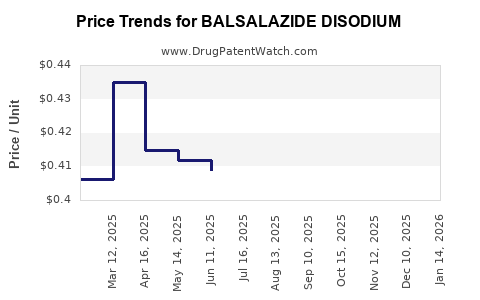

Historical Pricing Trends

Currently, Balsalazide Disodium remains a niche but clinically significant product. In primary markets like the US, the average wholesale price (AWP) for a typical 30-day supply ranges between $250 and $350, subject to insurance negotiations and discounts [2]. This is comparable to other delayed-release mesalamine products but maintains a slight premium in certain premium formulations or branded versions.

Market Price Determinants

- Patent and Exclusivity Periods: Patent protection in the US extends potentially up to 2030, allowing for sustained premium pricing.

- Manufacturing Costs: Advances in synthesis and formulation could reduce costs, influencing retail prices.

- Regulatory and Reimbursement Policies: Moves toward price transparency and value-based pricing influence achievable margins.

Projected Price Trends (2023–2028)

- Short-term (2023–2024): Prices will remain relatively stable, with slight reductions due to negotiated discounts and payer pressure. Branded formulations may retain premiums, typically around $250–$300/month.

- Mid-term (2025–2026): The introduction of generic Balsalazide Disodium in jurisdictions where patents expire could lead to a significant price decline, potentially reducing costs by 30–50%. Market saturation and increased competition will accelerate this trend.

- Long-term (2027–2028): Post-patent expiry, prices could fall to $100–$150/month for generic versions, with branded options maintaining a $200+ premium. Broader availability in emerging economies may also influence global price averages, often leading to affordability improvements in those markets.

Influencing Factors

- Patent Challenges and Litigation: Successful patent defenses will sustain higher prices longer.

- Market Penetration of Biosimilars or Alternative Therapies: Competition from newer biologics or innovator drugs can compress prices further.

- Regulatory Developments: Reimbursements linked to value-based assessments may favor cost-effective generics, pushing prices downward.

Future Market Trends

- Emerging Markets Growth: Countries like India, China, and Brazil will increasingly adopt Balsalazide Disodium, driven by evolving healthcare infrastructure and population aging.

- Combination Therapy and Line Extensions: Research into fixed-dose combinations could diversify offerings, potentially influencing pricing.

- Digital Health Integration: Use of adherence aids and telemedicine could influence drug utilization patterns, indirectly affecting market size and revenue.

Key Challenges & Opportunities

- Navigating Patent Expiry: Strategic patent litigation and lifecycle management are crucial for maintaining price premiums.

- Price Erosion Due to Generics: Quick adaptation to generic entry will be essential to sustain revenues.

- Product Differentiation: Enhanced formulations, such as sustained-release variants, could command higher prices.

- Global Expansion: Growing markets present opportunities for incremental revenue growth, especially in regions with rising UC prevalence.

Key Takeaways

- The market for Balsalazide Disodium is poised for stability over the short term, with moderate growth driven by increasing UC prevalence.

- Price projections suggest an erosion post-patent expiry, with generic versions potentially reducing per-unit prices by up to 50%.

- Competitive landscape and regulatory policies heavily influence pricing trajectories.

- Emerging markets offer avenues for expansion but often at lower price points, impacting overall profitability.

- Strategic intellectual property management and formulation innovation are vital to preserve market share and pricing power.

FAQs

Q1. What factors influence the pricing of Balsalazide Disodium?

Market exclusivity, patent protection, manufacturing costs, competitive dynamics, and payer negotiations primarily influence pricing.

Q2. How will patent expirations impact the market for Balsalazide Disodium?

Patent expirations typically lead to generic entry, resulting in significant price reductions and increased price competition.

Q3. Are there any emerging indications for Balsalazide Disodium that could affect its market?

Currently, its primary indication remains ulcerative colitis. Off-label or new clinical indications could expand its market if substantiated through research.

Q4. What are the main competitors for Balsalazide Disodium?

Key competitors include other mesalamine-based therapies such as Asacol, Lialda, and Apriso, as well as older agents like Sulfasalazine.

Q5. How does geographic expansion influence pricing strategies?

In emerging markets, lower healthcare budgets and different regulatory environments may lead to lower prices, impacting global revenue but expanding overall market size.

References

[1] Crohn’s & Colitis Foundation, “The Impact of Inflammatory Bowel Disease,” 2022.

[2] IQVIA, “Pharmaceutical Pricing Data,” 2022.