Share This Page

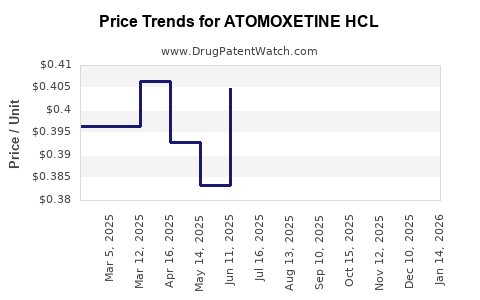

Drug Price Trends for ATOMOXETINE HCL

✉ Email this page to a colleague

Average Pharmacy Cost for ATOMOXETINE HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ATOMOXETINE HCL 10 MG CAPSULE | 64980-0373-03 | 0.41948 | EACH | 2025-12-17 |

| ATOMOXETINE HCL 10 MG CAPSULE | 55111-0519-30 | 0.41948 | EACH | 2025-12-17 |

| ATOMOXETINE HCL 10 MG CAPSULE | 64380-0472-01 | 0.41948 | EACH | 2025-12-17 |

| ATOMOXETINE HCL 10 MG CAPSULE | 00093-3542-56 | 0.41948 | EACH | 2025-12-17 |

| ATOMOXETINE HCL 10 MG CAPSULE | 60505-2830-03 | 0.41948 | EACH | 2025-12-17 |

| ATOMOXETINE HCL 10 MG CAPSULE | 16714-0755-01 | 0.41948 | EACH | 2025-12-17 |

| ATOMOXETINE HCL 10 MG CAPSULE | 31722-0714-30 | 0.41948 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Atomoxetine HCL

Introduction

Atomoxetine hydrochloride (HCl) is a non-stimulant medication primarily prescribed for Attention Deficit Hyperactivity Disorder (ADHD). Known commercially as Strattera, it has gained substantial market share since its approval due to its unique mechanism of action and distinctive positioning within ADHD pharmacotherapy. This analysis evaluates the current market landscape, key drivers, competitive dynamics, and offers pricing projections grounded in global pharmaceutical trends.

Market Overview

Global Market Size & Growth

The global ADHD market, incorporating medications like stimulants and non-stimulants, was valued at approximately USD 9 billion in 2022, with estimated compound annual growth rate (CAGR) of around 6% over the previous five years [1]. Atomoxetine, representing a significant share of non-stimulant therapies, is projected to sustain its growth trajectory driven by increased diagnosis rates and a rising preference for non-stimulant options, especially in pediatric and adult populations.

Regions & Market Penetration

- North America: Leading market with high prescription rates, driven by robust ADHD awareness, insurance coverage, and clinical acceptance.

- Europe: Growing, with European Medicines Agency (EMA) approval and expanding awareness.

- Asia-Pacific: Notable emerging market, with increasing ADHD diagnosis and expanding healthcare infrastructure.

Competitive Landscape

Atomoxetine faces competition primarily from stimulant medications like methylphenidate and amphetamines, but its differentiation as a non-stimulant makes it preferable in specific patient populations, including those with substance abuse concerns or cardiac issues.

Major manufacturers include Eli Lilly (original patent holder), with generic formulations rapidly entering markets post patent expiry, intensifying price competition.

Patent and Regulatory Dynamics

Eli Lilly's patent for Strattera expired in multiple jurisdictions between 2017 and 2020, catalyzing the entry of generics. The proliferation of authorized generics and biosimilars increases price competition and broadens access, especially in developed markets.

Regulatory approvals for new formulations—such as long-acting or combination therapies—could influence demand dynamics, although current growth largely hinges on existing formulations.

Drivers Influencing Market Trends

- Increased Diagnosis & Awareness: Improved screening protocols and social recognition of ADHD lead to higher prescription volumes.

- Preference for Non-Stimulants: Growing segment of patients and clinicians favoring non-stimulants due to safety profiles.

- Expanded Indications & Off-Label Uses: Emerging evidence supports broader applications, including in adult ADHD, which broadens the market.

- Healthcare Policy & Pricing Policies: Government initiatives to make ADHD medications more affordable influence pricing.

Pricing Dynamics & Projections

Current Pricing Landscape

- Brand-Name (Strattera): Average retail price per 40 mg capsule approximately USD 5.50–USD 7.00 in the U.S.

- Generics: Introduction of generics has driven prices down substantially; approximately USD 2.00–USD 3.50 per capsule.

- Market Variability: Prices fluctuate based on region, insurance reimbursement policies, and supply chain factors.

Future Price Trends

Based on current patent expirations and market competition, the following projections are made:

| Year | Expected Average Price per 40 mg Capsule | Rationale |

|---|---|---|

| 2023 | USD 2.50 – USD 3.00 | Dominance of generics, stabilized pricing post-expiry |

| 2024-2025 | USD 2.00 – USD 2.75 | Increased market penetration, price competition intensifies |

| 2026-2027 | USD 1.75 – USD 2.50 | Continued generic proliferation, potential biosimilar entry |

| 2028-2030 | USD 1.50 – USD 2.00 | Market saturation, price optimization, push for affordability |

Factors Affecting Pricing

- Generic Market Penetration: Accelerates price reductions.

- Regulatory Policies: Price controls or reimbursement incentives may stabilize or lower prices further.

- Manufacturing Costs: Economies of scale and manufacturing efficiency can reduce costs, further pressuring prices.

- New Formulations: Introduction of extended-release or novel delivery systems may command premium prices initially but tend to decrease over time with generic competition.

Market Outlook & Strategic Insights

The market for atomoxetine is poised for continued growth, albeit at a slower rate due to increasing generic competition. The shift towards value-based care and affordability initiatives will pressure pricing downward, especially in mature markets. Nonetheless, the drug’s unique therapeutic profile sustains a consistent demand, with innovation around formulations offering potential for premium pricing.

Pharmaceutical companies should leverage these insights to optimize portfolio strategies, balancing between leveraging existing formulations and investing in novel drug delivery systems.

Key Takeaways

-

Market Growth: The ADHD therapeutic market, including atomoxetine, is expected to grow at a CAGR of around 5-6%, with non-stimulants like atomoxetine maintaining a significant share.

-

Price Trajectory: Generic competition will continue to drive prices down, with projections indicating a decline to approximately USD 1.50–USD 2.00 per capsule by 2030 in mature markets.

-

Competitive Dynamics: Entry of biosimilars, regulatory hurdles, and pricing policies will shape future market valuations and pricing strategies.

-

Market Opportunities: Expansion into adult ADHD, combined formulations, and digital adherence tools represent avenues for growth and premium pricing.

FAQs

1. What factors influence the pricing of atomoxetine HCl globally?

Pricing is influenced by patent status, generic market entry, manufacturing costs, regulatory policies, insurance reimbursement schemes, and regional healthcare infrastructure.

2. How does patent expiration impact atomoxetine’s market and price?

Patent expiry allows generic manufacturers to enter the market, significantly reducing prices and increasing accessibility. This leads to increased market penetration but pressures brand-name pricing.

3. What are the key competitors to atomoxetine in ADHD treatment?

Stimulant medications like methylphenidate and amphetamines dominate due to their efficacy, but non-stimulants like guanfacine and clonidine are also competitors, especially in specific patient populations.

4. What is the market potential for novel formulations of atomoxetine?

Innovations such as extended-release or combination therapies could command higher prices initially and expand market share but will face pricing pressures over time as generics proliferate.

5. How will pricing trends affect pharmaceutical investment in ADHD therapies?

Trends toward lower prices necessitate strategic investment in value-added formulations, personalized medicine, and digital adherence to sustain profitability in a competitive environment.

References

[1] MarketWatch, "Global ADHD Drugs Market Size & Forecast," 2022.

More… ↓