Share This Page

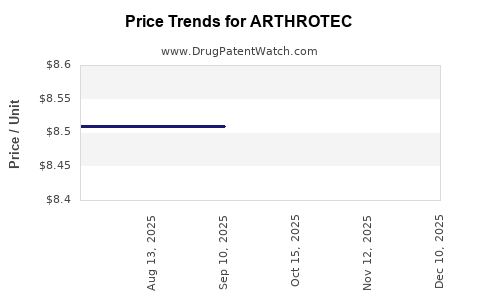

Drug Price Trends for ARTHROTEC

✉ Email this page to a colleague

Average Pharmacy Cost for ARTHROTEC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ARTHROTEC 75 MG-200 MCG TAB | 00025-1421-60 | 8.50946 | EACH | 2025-12-17 |

| ARTHROTEC 75 MG-200 MCG TAB | 00025-1421-60 | 8.50946 | EACH | 2025-11-19 |

| ARTHROTEC 75 MG-200 MCG TAB | 00025-1421-60 | 8.50946 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ARTHROTEC

Introduction

ARTHROTEC, a combined drug formulation comprising acetaminophen and non-steroidal anti-inflammatory drugs (NSAIDs), specifically diclofenac, is widely used for managing moderate to severe osteoarthritis and rheumatoid arthritis. Its market viability, pricing strategies, and potential trajectory are influenced by factors such as therapeutic efficacy, regulatory landscape, competitive positioning, and emerging alternatives. This analysis delves into the current market landscape, assesses key drivers shaping ARTHROTEC’s value, and provides forward-looking price projections rooted in industry data.

Market Overview

Therapeutic Demand and Usage Trends

ARTHROTEC caters primarily to a sizable global cohort afflicted with osteoarthritis (OA) and rheumatoid arthritis (RA). According to the Global Osteoarthritis Market report, the osteoarthritis therapeutics market is projected to reach USD 15.7 billion by 2026, expanding at a CAGR of approximately 4.2% from 2021 (1). The demand for combination NSAID formulations like ARTHROTEC is driven by the need to optimize pain relief while mitigating gastrointestinal side effects common with NSAID monotherapies.

Geographical Market Dynamics

The highest market consumption is observed in North America and Europe, driven by aging populations and high prevalence rates of chronic joint conditions (2). Emerging markets, notably Asia-Pacific, are witnessing accelerated growth due to increasing healthcare infrastructure and awareness. The regulatory frameworks in these regions influence commercialization and pricing.

Competitive Landscape

ARTHROTEC competes with single-entity NSAID and acetaminophen formulations, as well as other combination therapies. Major competitors include brands like Voltaren Emulgel (diclofenac), Tylenol (acetaminophen), and other generic combination drugs. Patent expirations of key molecules and the advent of biosimilars contribute to market commoditization, exerting downward pressure on prices.

Regulatory and Safety Considerations

Regulatory Approvals and Patent Status

ARTHROTEC's approval status varies across jurisdictions, often linked with proprietary formulations or delivery mechanisms. Patent expiries, especially for diclofenac formulations, open avenues for generics, affecting pricing dynamics globally (3).

Safety and Side Effect Profile

Growing awareness of NSAID-associated gastrointestinal and cardiovascular risks influences prescribing patterns. Prescription guidelines increasingly favor formulations with protective co-therapies, which may impact the demand and, consequently, the pricing structure.

Market Drivers Influencing Pricing

-

Efficacy and Patient Outcomes: Demonstrated superior pain management and tolerability enhance ARTHROTEC’s market appeal.

-

Cost of Production: Economies of scale, manufacturing efficiency, and patent status determine baseline costs.

-

Competitive Pricing Strategies: Manufacturers may adopt aggressive pricing in generic markets or premium pricing where clinical benefits justify higher prices.

-

Regulatory Pricing and Reimbursement Policies: Pricing adjustments are influenced by government policies, insurance coverage, and value-based reimbursement models.

-

Emerging Alternatives: The advent of biologics, novel NSAIDs, and non-pharmacological therapies can modulate demand and pricing.

Current Pricing Landscape

Pricing in Key Markets

-

United States: Brand-name ARTHROTEC tablets priced approximately USD 50-70 per package (30-60 tablets), reflecting brand premiums and patent protections. Generics, when available, are priced at USD 20-35, expanding access.

-

Europe: Prices vary by country, with premiums in nations with slower generic penetration. Overall, prices range between EUR 40-60 per pack for branded formulations.

-

Emerging Markets: Lower price points, often USD 5-15, driven by generic manufacturing and market competition.

Pricing Trends

The industry trend indicates a gradual decline in branded product prices with patent expiries, replaced by generics and biosimilars offering similar therapeutic benefits at lower costs. Additionally, value-based pricing models aim to align costs with clinical outcomes, potentially stabilizing prices in the long term.

Future Price Projections (2023-2030)

Factors Influencing Future Trends

-

Patent Expiry and Generic Entry: Expected between 2024-2026 for key formulations, likely causing significant price reductions—up to 50%–60% in mature markets.

-

Market Penetration of Biosimilars and Alternatives: Potential to further compress prices, especially in Europe, where biosimilars are gaining acceptance.

-

Regulatory Shifts and Pricing Policies: Emphasis on cost-effectiveness may favor lower pricing structures.

-

Manufacturing and Supply Chain Dynamics: While raw material costs for acetaminophen and diclofenac remain stable, disruptions could temporarily influence prices.

Projected Price Trends (USD per Package)

| Year | Price Range in Mature Markets | Expected Change | Notes |

|---|---|---|---|

| 2023 | 20–70 | Baseline | Depending on brand vs. generic status |

| 2025 | 15–50 | 20-30% decrease | Patent cliffs influence generic competition |

| 2027 | 10–40 | Continual decline | Increasing market saturation and biosimilar entry |

| 2030 | 8–30 | Stabilization at lower levels | Cost-effective generics dominate |

Note: These projections assume standard patent expiration timelines and no significant regulatory shifts.

Implications for Stakeholders

-

Pharmaceutical Companies: Need to strategize around patent lifecycle management, diversify formulations, and explore value-based pricing to sustain profitability.

-

Healthcare Providers: Must navigate balancing cost considerations with clinical efficacy, especially as cheaper generics flood the market.

-

Payers and Policymakers: Emphasize cost containment through formulary management, incentivizing bioseducials and generics.

-

Investors: Should monitor patent expiries, market penetration rates, and emerging competitors to inform valuation models.

Key Takeaways

-

Market Expansion: The increasing prevalence of osteoarthritis and rheumatoid arthritis sustains demand for ARTHROTEC, with growth expected in both developed and emerging markets.

-

Price Dynamics: Patent expiries and the proliferation of generics exert downward pressure, with prices projected to decline substantially over the next decade, particularly in mature markets.

-

Strategic Considerations: Companies should focus on differentiating through clinical benefits, optimizing manufacturing costs, and navigating regulatory landscapes to maintain competitive pricing.

-

Emerging Trends: Biosimilars, novel therapies, and value-based pricing models are shaping future market structures, with implications for ARTHROTEC’s pricing and market share.

-

Long-term Outlook: As commoditization progresses, ARTHROTEC's affordability and therapeutic positioning will be pivotal for sustained market relevance.

FAQs

1. What factors primarily influence ARTHROTEC’s pricing?

ARTHROTEC’s pricing is driven by patent status, manufacturing costs, competition from generics, regulatory reimbursement policies, and clinical efficacy perceptions.

2. How will patent expiries affect ARTHROTEC’s market price?

Patent expiries typically lead to generic entry, significantly reducing prices—by up to 60%—especially in markets with high generic penetration.

3. Are biosimilars impacting ARTHROTEC’s market?

While biosimilars are less relevant for small molecules like diclofenac and acetaminophen, their advent indicates a broader shift towards cost-effective therapies influencing overall pricing strategies.

4. What regions are likely to see the highest price reductions?

Europe and North America are poised for notable decreases post-patent expiry due to mature generic markets, whereas emerging markets may experience slower declines.

5. What pricing strategies should manufacturers consider for ARTHROTEC?

Innovative formulations, value-based pricing, prioritizing clinical differentiation, and market segmentation can optimize profitability amidst falling prices.

References

- Global Osteoarthritis Market – Industry Analysis and Forecast (2021–2026).

- WHO Global Health Observatory Data Repository.

- Patent expiration timelines for diclofenac formulations—Intellectual Property Outlook, 2022.

- Industry reports on NSAID formulations and market trends.

More… ↓